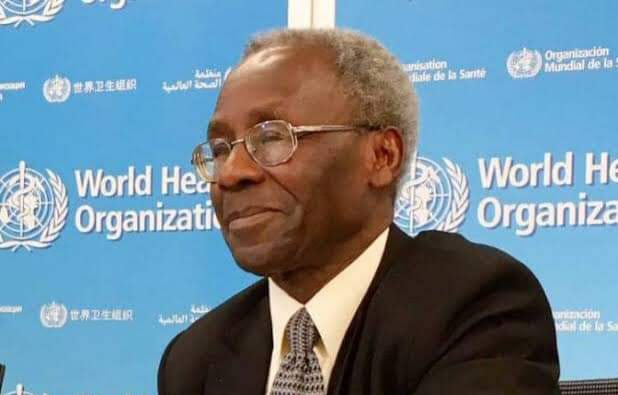

Muhammad Nami, executive chairman of the Federal Inland Revenue Service (FIRS), has asked state assemblies to give greater attention to tax matters.

This is as the FIRS boss advised governments at all tiers to ensure that tax-compliant citizens enjoy the value for the taxes they pay.

Nami said this in his goodwill message to the Nigeria Governors’ Forum’s 7th Internally Generated Revenue Learning Event in Abuja on Wednesday.

While calling for greater attention to tax-related matters, Nami said it is surprising that “no legislative assemblies have a tax committee”.

Advertisement

“Your Excellencies and Honourable Ministers, 22 years since Nigeria started this democratic dispensation, none of our legislative assemblies has a tax committee; it is surprising,” he said.

“We must see taxation in its proper context such that all arms of government (legislative, executive and judiciary) should accord it due attention.”

He also said that tax-compliant citizens legitimately expect their leaders to provide them with necessary amenities for good living.

Advertisement

“Tax compliant citizens can legitimately expect their leaders to provide necessary amenities for a ‘good life’,” Nami said.

“This expectation is confirmed by the Constitution of the Federal Republic of Nigeria (as amended) in section 16(b) where it provides that ‘the State shall, within the context of the ideals and objectives for which provisions are made in this Constitution, control the national economy in such manner as to secure the maximum welfare, freedom and happiness of every citizen on the basis of social justice and equality of status and opportunity”.

He added: “Governments at various tiers must, in view of the constitutional provisions, imbibe the culture of “value-for-money” or, put in proper perspective, “value-for tax-money”.

“The citizens should not just hear budget figures but must, within their immediate living quarters, feel, see and experience effects of tax revenue. This, going forward, should be the norm and not an exception.”

Advertisement

The FIRS chairman also encouraged state governors to look inwards and create alternative sources of revenue away from depending on revenue from oil sources.

“Your Excellencies, Nigeria, over the years, has been dependent on revenue from crude oil. This source of revenue is no longer sustainable as the market for fossil fuel continues to deplete due to complications arising from the impact of the COVID-19 pandemic, the shift from fossil fuel to other cleaner sources of energy, rising cost of exploration, banditry and oil theft, etc,” he added.

“In plain truth, the future of crude oil as a major revenue earner is very bleak. Going forward, taxation remains the only sustainable source of revenue anywhere in the world — Nigeria is not an exception.

“To this end, Your Excellencies need to adopt right tax policies that will ensure adequate funding for the much needed social-economic infrastructures. Equally, it is important for governments, at all levels, to come together to fight tax evasion, touting, etc., which are negatively impacting tax revenue.”

Advertisement

FIRS and some state governments are currently engaging in a legal tussle over the collection of value-added tax.

Advertisement

Add a comment