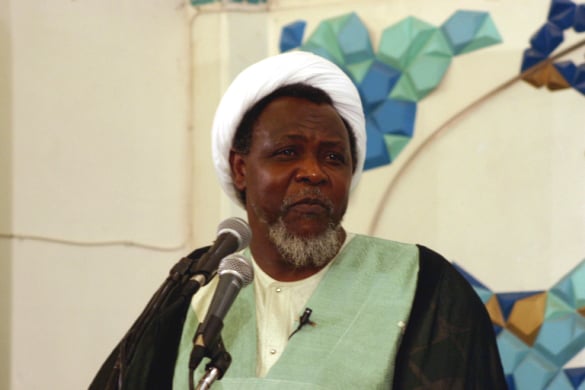

Pic.2. Vice President Yemi Osinbajo (L) presents the Presidential Enabling Business Environment Council (PEBEC) Impact Award to Mr Babatunde Fowler, Executive Chairman, Federal Inland Revenue Service (FIRS) in recognition of FIRS contributions to 2016-2017 Ease of Doing Business Reforms, during the PEBEC Impact Award ceremony at the State House in Abuja on Monday (11/12/17).

06726/12/12/2017/BJO/NAN

The Federal Inland Revenue Service (FIRS) says all companies must remit value-added tax and withholding tax by the 21st day of every month.

According to a statement signed by Babatunde Fowler, the FIRS chairman, some companies have been found not to deduct these taxes at source.

VAT is a consumption tax placed on a product whenever value is added at each stage of the supply chain – from production to the point of sale.

Withholding tax, however, is deducted at source by organisations or bodies making payments to suppliers of goods and services. They are required to remit the deducted sum to the tax authority as payments are being made to suppliers/vendors.

Advertisement

“It has come to the notice of the service that some companies do not deduct WHT/VAT from the compensation paid to their distributors contrary to provisions of the ‘Companies Income Tax (Rates, Etc. Deduction at Source (Withholding Tax) Regulations and Paragraph 3.8 of Federal Inland Revenue Service Information Circular No. 2006/02 of February 2006, which states that commission earned by distributors/dealers will be subjected to WHT and VAT,” he said.

“Following this discovery, the Service hereby puts all companies, particularly those in the fast-moving consumer goods sector on notice that compensation due to their distributors and customers in the form of commission, rebates etc and by whatever means of payments, whether by cash, credit note or even goods-in-trade must be subjected to WHT/VAT at the appropriate rates as applicable and remit same to the FIRS accordingly on or before the 21st of every month.”

Advertisement

Add a comment