Listed fast moving consumer goods (FMCG) companies suffered a 27.89 percent decline in profit in the first half of the year.

The sharp drop in bottom line rode on the back of COVID-19 pandemic and restriction of movement in major cities in the country, which further exacerbated the already pressured bottom line of players in the industry.

Interestingly, most companies recorded an impressive performance in the first three months of the year.

However, impact of the pandemic eroded the gains in the second quarter (April-June) following rising number of covid-19 cases in the country, forcing a restriction on interstate movements and disrupting supply chains.

Advertisement

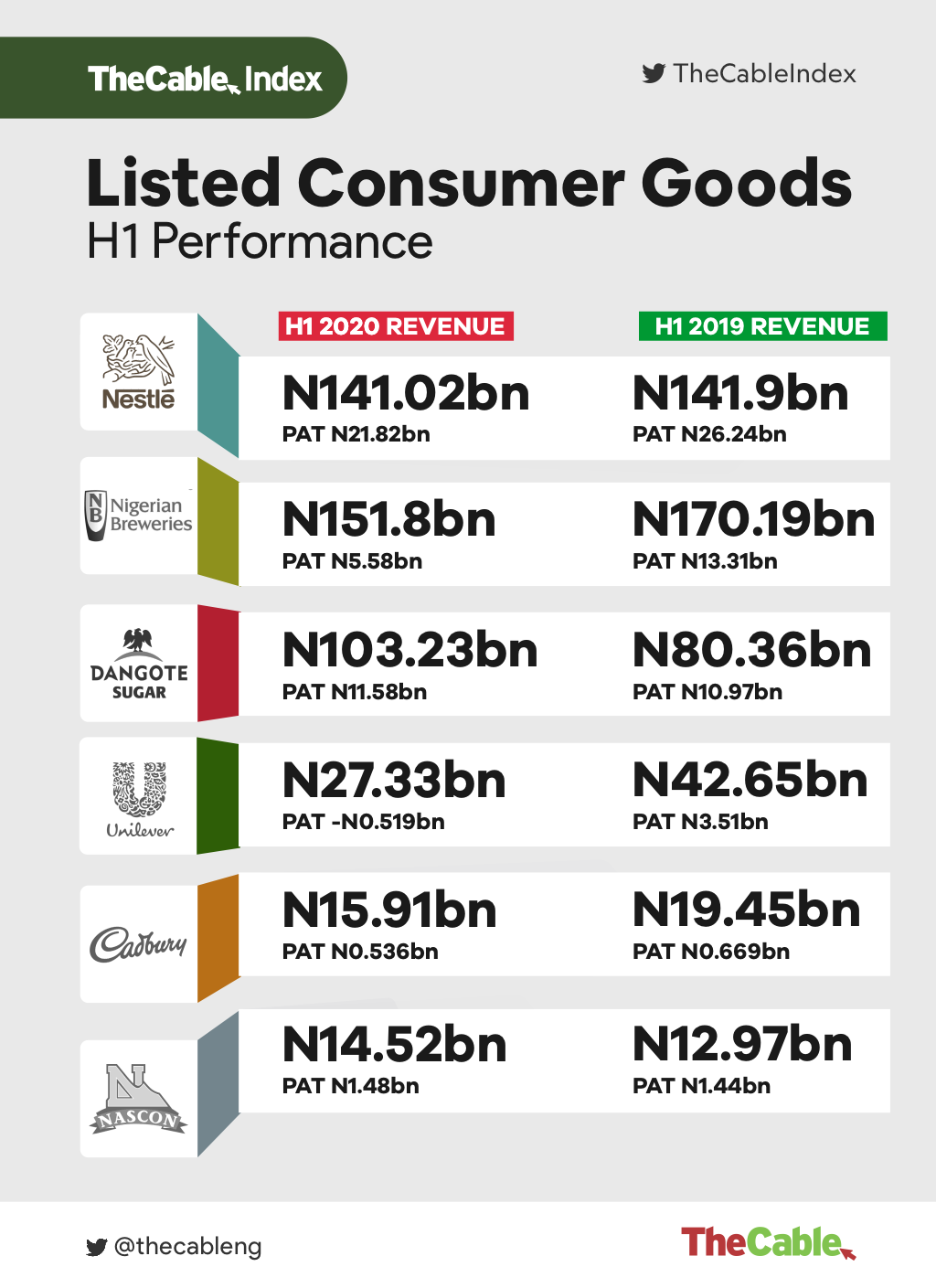

Analysis by TheCable shows that six of the biggest listed consumer goods posted a net profit of N40.4 billion at half year ended June 30 — compared to N56.13 billion recorded same period in 2019.

Revenue also dropped slightly at 2.9 percent, totaling N453.81 billion from N467.52 billion in same period in 2019.

Specifically, while four of the companies recorded a decline in revenue and profit, the remaining two printed a slight improvement in both top lines and bottom lines.

Advertisement

Nestle, the biggest in the consumer goods sector by market capitalisation, reported 0.3 percent decline in revenue in second quarter and 0.6 percent in the first half of the year.

In the first half of 2020, Nestle’s net profit moderated at 16.8 percent year-on-year to N21.8 billion owing to constraint on revenue growth.

The food segment was most impacted by the COVID-19 shock as revenue declined by 8.7 percent in the first quarter.

There was a 4.1 percent year-on-ear recovery in second quarter but the growth was not enough to offset the previous quarter’s decline.

Advertisement

The beverages segment benefited from a 3.0 percent year-on-year price increase, and increased consumption during the lock down, with first quarter revenue increasing at 13.1 percent year-on-year.

The makers of Milo beverage drink saw cost to sales margin worsened to 56.9 percent in the first half of the year as a result of pressures from higher raw materials costs amid weaker revenue drive.

Cadbury’s half year revenue dropped to 18 percent to 15.91 billion from N19.45 billion recorded same period in 2019.

Its cost of sales, which includes the cost of materials and labor directly used to create the goods, 17 percent dropped to N12.6 billion from N15.31 in the same period in 2019.

Advertisement

Net profit for the half year period stood at N536 million from N669 million in same period in 2019.

Advertisement

The woes of home care and personal care (HPC) giant Unilever Nigeria were further worsened during the first half of the year.

The makers of Omo detergent revenue tanked 35.9 percent at N27.33 billion from N42.65 billion in 2019. It also recorded a post-tax loss of N0.5bn from N3.51 billion recorded same period in 2019, due to intense competition which has seen price sensitive consumer shift loyalty to cheaper alternatives.

Advertisement

For Nigerian Breweries, the biggest brewer in the country by market size, the half-year is one that the makers of Star will not forget very soon.

The first half saw a slowdown in revenue by 10 percent to N151.8 billion from N170.19 billion recorded in same period in 2019, with a 21 percent decline in the second quarter, the largest decline on record, as volumes were negatively impacted as on-trade sales channels (hotels, bars, restaurants, clubs, etc), which account for an estimated 64 percent of beer industry sales, were effectively cut off as these businesses shut down operations during the quarter.

Advertisement

Net profit in the half year stood at a meager N5.58 billion from N13.31 billion recorded in same period in 2019.

Dangote Sugar, the largest sugar refiner with a market share of over 70 percent of the Nigerian sugar industry and the largest refinery in Sub-Saharan Africa, benefiting from its economies of scale saw revenue surge 28 percent at N103.23 billion from N80.36 billion in same period in 2019.

The positive performance mirrors higher growth in volumes from 581,504 MT to an estimated 660.000 MT as local sugar prices per 50kg bag declined 8.5 percent year-on-year to N13,485 from N14,741 in 2018.

Also, the turnaround in volumes reflects the impact of increased local market share as smuggling activities have moderated following the land border closures in August last year.

The sweetener’s net profit at half year stood at N11.58 billion from N13.32 billion in same period in 2019.

NASCON, a major player in the salt refining and seasoning industry, saw revenue increased to N14.52 billion from N12.97 billion.

To grow market share, the company aggressively advertised its products while increased capacity drove higher personnel and depreciation costs. Net profit increased marginally to N1.48 billion from N1.44 billion in same period in 2019.

According to consumer goods analyst, Chinedu Obi, the Nigerian growing middle income class and steady economic growth has positioned the country as an attractive investment destination for FMCG players globally.

However, the sluggish economic recovery, tight consumer spending and widening income inequality have slowed the growth in the consumer goods sector since the 2016 recession.

“Players will have to focus more on backward integration to reduce their exposure to foreign exchange volatility and also reduce their cost of production,” he said.

Add a comment