The Renewable Energy Association of Nigeria (REAN), a private sector group, says the Nigeria Customs Service is forcing its members to pay between five percent and 10 percent import duty on solar panels.

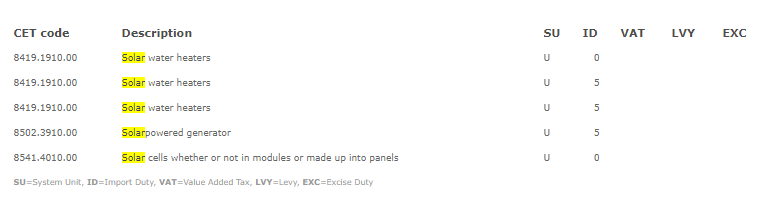

In a statement on Wednesday, REAN said CET code 8541.4010.00 – a classification for import duty tariff, states that import duty on solar panels should be zero percent.

“Consequently, discharge of goods from the ports has been slowed down immensely and demurrage charges have risen for our members since the start of the year,” the statement read.

“This has grave implications for Nigeria’s quest to improve the ease of doing business and deepen energy access for over 70 million people with inadequate access to power.”

Advertisement

The group said the duty being forced on them is counterproductive to the successes recorded by the presidential enabling business environment council (PEBEC).

“As concerned Nigerians and sector participants, members of REAN have answered the national call by providing solutions to the country’s epileptic power situation and our members currently provide over 10,000 direct and indirect jobs to the Nigerian economy,” it said.

“All over the world, the cost of solar panels is falling, leading to increased adoption of the renewable.

Advertisement

“Nigeria currently does not have the capacity to manufacture solar panels but does limited assembly in volumes that cannot meet market demand, hence our recourse to importation while growing capacity locally.

“This tariff will increase acquisition cost of solar panels in Nigeria, which are currently heavily deplored in rural areas where purchasing power is low.”

When contacted by TheCable, Joseph Attah, Customs PRO, said only solar panels attract zero percent tariff.

“Government in a bid to support the power sector brought a policy that says solar panels which are under HS code 8541 attract zero percent duty but when you bring solar panels that have other systems they have components when it becomes a set having the electrons, the diodes. It will no longer be under 8541, it will be under 8502 and 8502 attracts five percent. This is what some of them don’t appear to understand,” he said.

Advertisement

“We are not saying if today you bring only solar panel, it will not be zero percent, it will still be zero percent in accordance with government policy. When you now bring other components by our tariff classification, it’s no longer under 8541.

“If they want a complete set with all other components to be zero percent, they have to make a presentation to the federal government to take a look at the intention behind the fiscal policy to see if they can bring 8501 under the fiscal policy so that it can attract zero percent.”

Add a comment