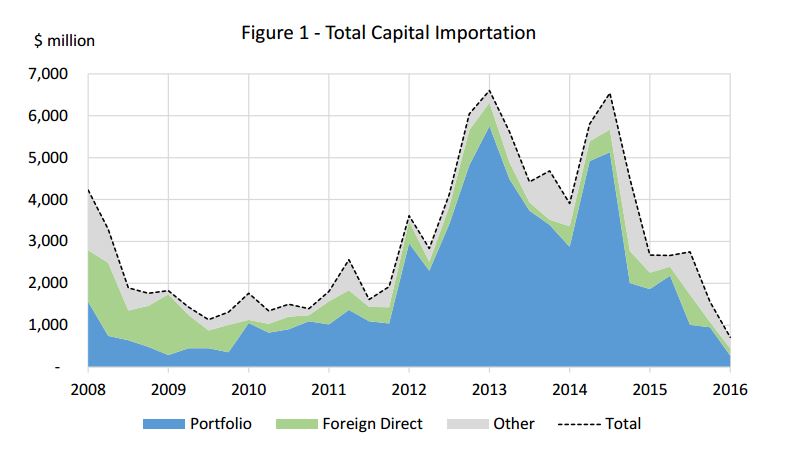

The inflow of foreign investments or capital importation in Nigeria has sunk to its lowest level since 2007, hitting $710 million in the first quarter of 2016.

In the executive summary of its Nigerian capital importation report, the Nigerian Bureau of Statistics said there was a decline of 73.79 percent in capital inflow in the first quarter of 2016, when compared to the same time in 2015.

“The total value of capital imported into Nigeria in the first quarter of 2016 was $710.97 million, the lowest level since the series began in 2007,” the report read in part.

“This represents a decline of 54.34% since the final quarter of 2015, and a year on year decline of 73.79%. Both the quarterly and year on year declines were also the lowest recorded since the series began.

Advertisement

“As a result of these changes, total capital importation has fallen by 89.13% since its peak level in the third quarter of 2014.”

FOREX POLICY, JP MORGAN EXCLUSION HURTING INVESTMENT

The report further revealed that the JP Morgan exclusion of Nigeria from its bond indexes and current foreign exchange regime have been areas of concern, driving investors to keep their money out of the economy.

Advertisement

“The scale of the decline in capital importation in the first quarter of 2016 is symptomatic of the challenging period that the Nigerian economy is going through following the fall in crude oil prices.

“Although there are a number of reasons why the amount of capital imported in recent years may have been higher than usual (such as the inclusion of Nigerian in the JP Morgan Bond Index, and globally low interest rates triggering a search for higher yields over this period) the fact that the amount of capital imported has dropped to a record low suggests that there are further reasons why Nigeria has attracted less foreign investment in recent quarters.

“Investors may be concerned about whether or not they will be able to repatriate the earnings from their investments, given the current controls on the exchange rate.”

The Nigerian economy can be said to be officially experiencing its lowest growth in about two decades, with every economic indicator giving off red signals.

Advertisement

Inflation is at new high, investments at new lows, GDP growth at 16-year low, with the IMF predicting a new low in 2016.

Add a comment