The new foreign exchange regime implemented by the Central Bank of Nigeria (CBN) saw the naira “effectively devalued” from 197 to about 283 against the dollar on the official side.

The naira has lost over 30 percent of its value to the dollar since the start of the new regime, but many foreign investors are not convinced, and they are seeking more devaluation of the local currency.

Prior to the start of the new regime, investors have always asked that the CBN devalues the naira to reflect market realities.

Renaissance Capital (RenCap), a Russian investment banking firm with a base in Victoria Island, Lagos, said in January that the fair value of the naira was 305 against the dollar, urging the CBN to devalue to 240,250 at the time.

Advertisement

Now that the CBN has let go of its 16-month old peg on the naira, the naira has depreciated below RenCap’s requested 240,250, but other investors want more depreciation.

Christine Phillpotts, a stocks analyst at AllianceBernstein, says the fair value of the naira is 320/$1.

“It’s hard to tell what the central bank has in mind, it’s probably driven equally by economics and politics,” she said. “It comes down to Buhari and his comfort level with the new regime.”

Advertisement

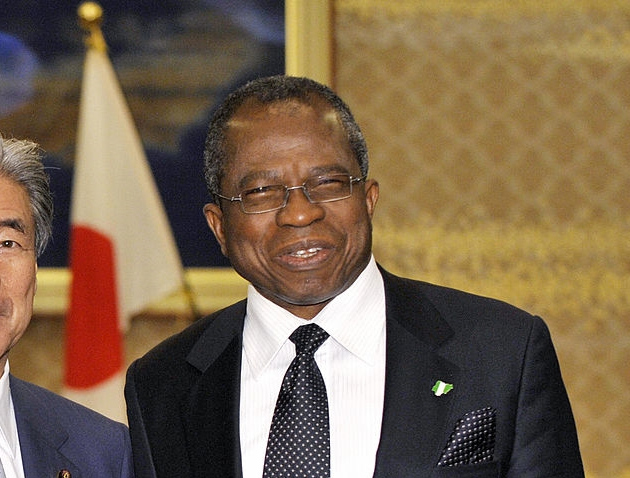

President Muhammadu Buhari has insisted that he is opposed to devaluation, driving investors to presume a naira peg in the not-too-distant future.

AllianceBernstein LP and Loomis Sayles & Co., which are currently among investors navigating post-Brexit global market turmoil, say CBN is not letting the naira weaken enough.

“The central bank is probably wondering why investors haven’t moved back in following the devaluation,” Rick Harrell, an analyst in Boston for Loomis Sayles, which oversees $229 billion of assets, told Bloomberg.

He said investors were “being cautious and the main reason why is the state of the economy. The fundamental backdrop isn’t positive.”

Advertisement

Bloomberg says trading in the Nigerian interbank foreign exchange market is yet to pick up, partly because the central bank cleared a backlog of dollar demand by selling more than $4 billion in the spot and forward markets on the first day without the peg.

“That the currency’s been so stable since the devaluation tells me that the central bank is still heavily managing it,” Harrell said.

“If we saw gradual depreciation to 300 or above, investors might feel more comfortable coming back.”

Despite floating the local currency, the CBN says it will intervene in the market from time to time to ensure proper regulation, assuring the nation that the naira would settle at 250/$1.

Advertisement

1 comments

Who are the investors or you mean Speculators.

We need Industries have enough land and Educated labors with biggest consumer market.We need industrialization.not the speculators.