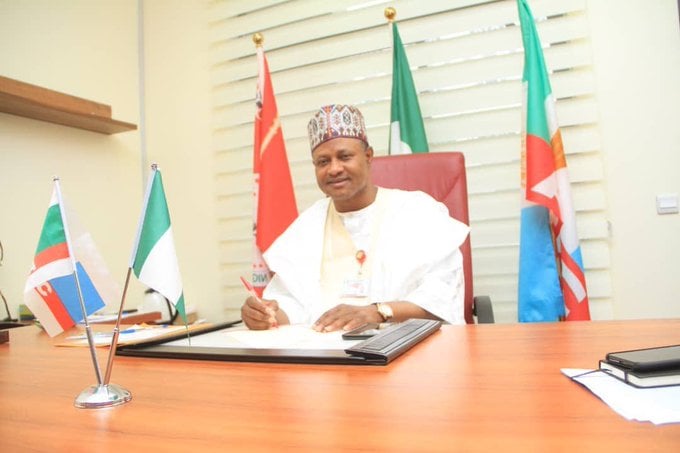

Given the persistent outcry by Tinubu’s administration about how Buhari left the country bankrupt and hopeless, it was surprising to see Mele Kyari’s appointment renewed. Now, we are left with an inevitable disaster waiting to happen.

The beginning of the inevitable is Kyari’s participation in short-changing Nigeria in a loan triangle between the NNPCin Nigeria, an SPV in the Bahamas and the African Export–Import Bank (Afreximbank) in Egypt.

From the onset, Kyari stepped into the position of the CBN Governor to provide forex liquidity in the country. I do not have to go into details about how Nigeria got into this mess, but the forex market is driven by high demand for dollars to buy imported goods and due to harsh economic conditions, the dollar is in short supply.

Let’s be clear: providing forex liquidity is the sole responsibility of the CBN Governor, not Kyari. But given that these are unprecedented times, we want to continue our import dependency, desperate measures were needed. This is why the Tinubu administration allowed Kyari to conduct a business he was either inexperienced with or decided to deliberately use this avenue to short-change the country. Either way, he is complicit.

Advertisement

One key point before we start breaking down the process is that those who facilitated the loan will earn a 2% commission, which is $ 66 million. Similarly, Nigeria will pay a 2% penalty per annum in the event of a default. This means the lender will always win, and Nigeria will be on the back foot, regardless.

The deal, as reported by The Cable, is against the Fiscal Responsibility Act of 2007. It will see Nigeria pay an interest rate of 11.85% on the $3.3 billion loan. For clarity, I refer to FRA’s Framework for Debt Management, Section 41, Subsection 1(a):

Government at all tiers shall only borrow for capital expenditure and human development, provided that such borrowing shall be on concessional terms with low-interest rate and with a reasonable long amortisation period subject to the approval of the appropriate legislative body where necessary.

Advertisement

This law clearly specifies that the government cannot borrow to relieve the Naira or stabilise the volatile exchange rate market, as Kyari announced in August. The law also stipulates that the government can only borrow on concessional terms with low-interest rates. For context, the lending rate at the World Bank, IMF and other multilateral agencies is less than3%. Similarly, the law stipulates that it should be a long-term loan, but Kyari’s loan is expected to last for only five years.

The repayment will be through an SPV called Project Gazelle Funding Ltd, which is incorporated in the Bahamas. In the process of this agreement, Kyari has pledged almost 40% of NNPC’s five-year oil revenue to secure the loan. Given that NNPC is a Federal Agency, the loan agreement is against FRA’s Section 47(3):

In the case of foreign currency borrowing, Federal Government guarantee shall be a requirement and no State, Local Government or Federal Agency shall, on its own borrow externally.

However, in this case, the SPV, Project Gazelle, is the borrower and the NNPC is termed as the sponsor. Kyari is expected to supply crude oil to the SPV to liquidate the loan.Specifically, the NNPC will have to supply 90,000 barrels of Nigeria’s for the next five years to pay off this unsolicited loan.

Advertisement

The last bit is that the law clearly stipulates that no loan should be collected without proper research conducted. Specifically, the FRA’s Section 44(1):

Conditions of Borrowing and Verification of Compliance,limits any Government in the Federation or its agencies and corporations desirous of borrowing shall, specify the purpose for which the borrowing is intended and present a cost-benefit analysis, detailing the economic and social benefits of the purpose to which the intended borrowing is to be applied.

This means that Kyari and his accomplices ought to have presented a detailed overall impact of the project to stabilise the volatile exchange rate market in a term the public can all understand: Money. They failed to do that. But I will not hold it against him because he does not have the financial expertise to understand the fundamentals of the forex market, nor does he have the mandate to intervene in the forex market. But this is a Renewed Nigeria, under Tinubu’s rubber-stamp National Assembly, where laws are made as they get along.

If not for the violation of the law, the NNPC would not be engaged in a loan triangle with an SPV in the Bahamas to pay Afrexim Bank in Egypt just to solve a problem they do not understand while using the powers outside their remit. To make matters worse, the objective has not been achieved–the Naira is not relieved, and the volatility in the forex market is still ongoing.

Advertisement

Dr Aminu sent this article from Cardiff, Wales.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.