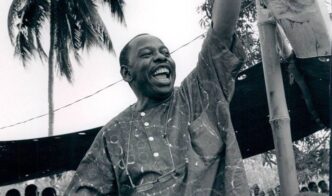

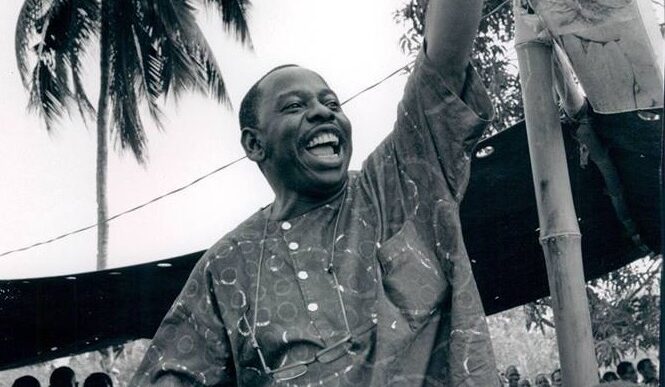

Festus Osifo, president of the Trade Union Congress (TUC)

The Trade Union Congress (TUC) has rejected the provision of the tax reform bill proposing an increase in the value-added tax (VAT) from 7.5 percent to 15 percent.

According to the proposed legislation, VAT will be increased to 12.5 percent by 2026, 2027, 2028, and 2029, and 15 percent by 2030.

VAT refers to a consumption tax on goods and services levied at each stage of the supply chain where value is added.

Speaking on Wednesday during the public hearing on tax reform bills organised by the house of representatives committee, Festus Osifo, the TUC national president, said the proposed increase will worsen the economic hardship faced by workers.

Advertisement

Represented by Nuhu Toro, TUC secretary-general, Osifo said the VAT should rather remain at 7.5 percent in the “best interest of the nation”.

“The TUC rejects the gradual increment of VAT from 7.5 percent to 15 percent,” he said.

“Increasing it will place an additional burden on Nigerians, many of whom are already struggling with the economic challenges and realities at a time when inflation is on the rise.

Advertisement

“It will further strain households and businesses, which eventually might slow down the economy. We are strongly of the opinion that VAT should remain at 7.5 percent.”

Osifo also proposed an increase in the tax exemption bracket to N2.5 million.

“The threshold for tax exemption should be increased from the current N800,000 as proposed in the bill to N2.5 million per annum,” he said.

“This will provide relief for struggling Nigerians within that income bracket, easing the economic realities and increasing their disposable income.

Advertisement

“Our third concern is on TETFund and the National Agency for Science and Engineering Infrastructure (NASENI), which is due to be scrapped and defunded.

“The TUC is of the opinion that both TETFund and NASENI should remain. These institutions have greatly impacted the country through their respective mandates.

“Both have been respectively instrumental in improving our tertiary education and adopting a homegrown technology to enhance national productivity and self-reliance.

“Their continued existence is vital for sustaining progress in education, technology, and economic development across the length and breadth of this country.

Advertisement

“The laws setting up these institutions can be reexamined to make it more transparent and repositioned for optimal performance.

“Our fourth concern is the Nigeria Revenue Service taking over the role of NUPRC in the collection of royalties and other revenues in the oil and gas sector.

Advertisement

“Our affiliate, PENGASSAN, has already submitted a position paper on this, and the TUC aligns fully with the position of PENGASSAN.”

Also, the Supreme Council for Shari’ah in Nigeria (SCSN) rejected the proposed VAT increase, calling for it to be reduced to five percent or kept at the current rate of 7.5 percent.

Advertisement

Adewale Adeniyi, the comptroller-general of the Nigeria Customs Service (NCS), also expressed concerns about “jurisdictional conflicts” in sections 23 and 29 of the joint revenue board bill, as well as section 41a of the joint revenue bill, which he said could impact the service’s mandate.

Advertisement

Add a comment