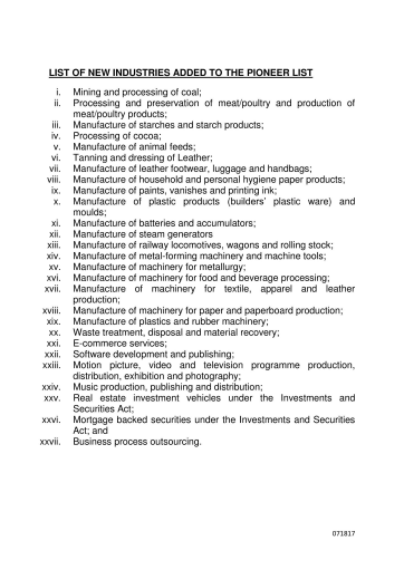

Companies involved in the manufacture of poultry products, leather, mining and processing of coal are part of the 27 industries that have been granted a three-year tax holiday by the federal government.

Okechukwu Enelamah, minister of industry, trade and investment, made this known in a statement released by the ministry on Monday.

According to the statement, the industry has also released new guidelines for pioneer status industries.

“In line with the reform provisions, all additions will be added to the list immediately, and all deletions will be removed from the list in 3 years,” the statement read.

Advertisement

“The federal government is committed to encouraging and attracting investments into critical sectors of the economy which will significantly impact development and deliver key benefits to the country,” Enelamah said.

“These benefits include economic growth and diversification; industrial and sectoral development; employment; skills and technology transfer; export development; and import substitution.”

Advertisement

According to the statement, an industry is eligible for pioneer status if “it is not being carried on in Nigeria on a scale suitable to the economic requirements of the country or not at all; or where there are favourable prospects for further development; or if it is expedient in the public interest to encourage the development and establishment of an industry in Nigeria.”

The pioneer status industries are given a tax holiday from the payment of company income tax for an initial period of three years with the possibility of an extension for one or two years.

Add a comment