Foreign investors snubbed 27 states as the value of capital importation into Nigeria fell by 34 percent to $2.82 billion in the first nine months of 2023, from $4.27 billion in the same period last year.

The National Bureau of Statistics (NBS) disclosed this in its latest capital importation report for the third quarter (Q3) of 2023 released on Friday.

Capital importation can be explained as bringing in capital from abroad to fuel investment, trade, and manufacturing within a country.

Nigeria’s capital imports for the first nine months of 2023, comprising Q1 – Q3 totalled $2.82 billion, with $1.13 billion imported in Q1, $1.03 billion in Q2 and $654.65m in Q3 2023.

Advertisement

The number of states that did not record investments dropped from 28 states in the first half of 2023 to 27 in the first nine months after Abia attracted a remarkable $150.09 million in Q3 – the only state to witness such a dramatic turnaround within three months.

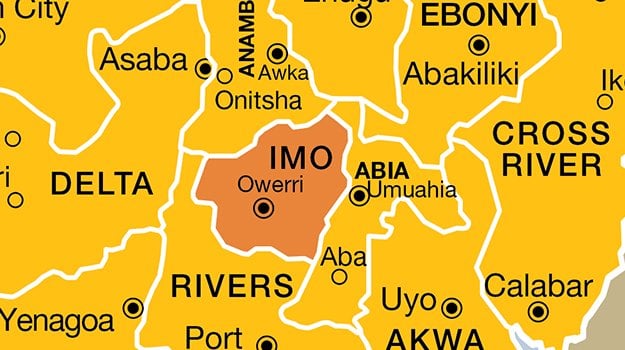

According to the NBS report, the 27 states that failed to attract foreign investment in the first nine months of 2023 include:

- Bauchi

- Bayelsa

- Benue

- Borno

- Cross River

- Delta

- Ebonyi

- Edo

- Enugu

- Gombe

- Imo

- Jigawa

- Kaduna

- Kano

- Katsina

- Kebbi

- Kogi

- Kwara

- Nasarawa

- Osun

- Oyo

- Plateau

- Rivers

- Sokoto

- Taraba

- Yobe

- Zamfara

LAGOS CONTINUES TO DRAW CAPITAL EVEN AS OTHERS FALTER

Advertisement

In the review period, Lagos took the lead, outshining others — including the federal capital territory (FCT) — to top the list of states that attracted the most investments.

Analysis by TheCable Index shows that the country’s major commercial city attracted $1.79 billion, representing 64 percent of the total capital inflow into Nigeria.

In April, Babajide Sanwo-Olu, governor of Lagos, assured investors that the state is the right place for investments and “the crown subnational jewel of the African economy”.

He said Lagos was ripe for investments in financial technology, education technology, health technology, business process outsourcing (BPO), talent training and placement, or physical infrastructure like data centres, among others

Advertisement

According to the NBS report, FCT emerged as the second top investment destination with $799.21 million — representing 28 percent of the total capital inflow in the country in the first nine months of the year.

Other states that attracted foreign investments in the nine months are Abia ($150.09 million), Akwa Ibom ($39.13 million), Ogun (27.09), and Adamawa ($4.5 million).

Anambra attracted $4 million, Niger $1.50 million, $200,000 and Ekiti $38,250.

Advertisement

Add a comment