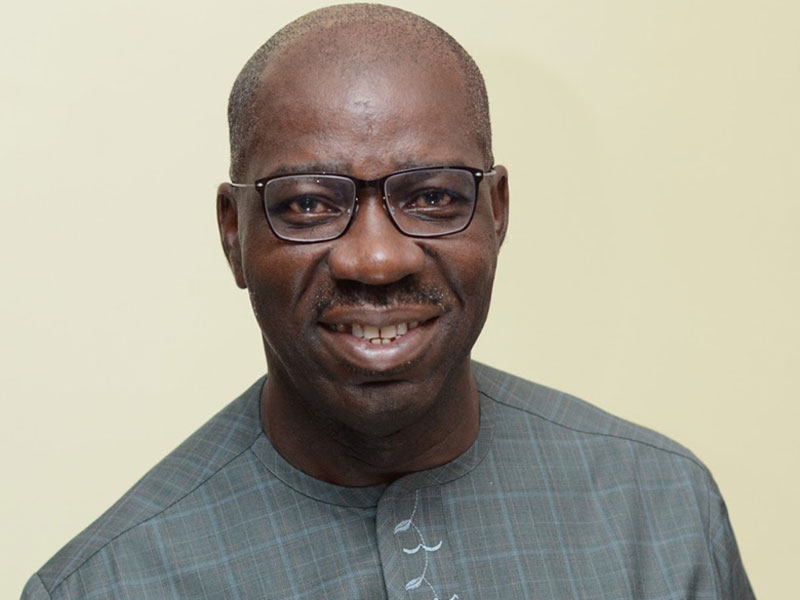

Brokers and dealers hail the President during his visit to the Nigerian Stock Exchange in Lagos, March 12

The new foreign exchange policy adopted by the Central Bank of Nigeria (CBN) appears to be impacting positively on the Nigerian Stock Exchange (NSE) as stocks hit a 2016 high.

In the past two trading days, investors have voted N760 billion into the Nigerian capital market, pushing the NSE market capitalisation from N9.28 trillion at the close of business on Tuesday to N10.05 trillion on Friday.

This is the first time the NSE market cap will cross the N10 trillion mark in 2016, having opened the year at N9.757 trillion.

When the CBN announced its initial forex policy in January, halting the sales of forex to bureau de change operators, the market lost N1.2 trillion in eight days, falling to its lowest point in 2016.

Advertisement

The market began to recover, moving inch-by-inch above the N7 trillion mark, until the new forex policy was recommended by the CBN money policy committee (MPC).

After the MPC decision to adopt a flexible foreign exchange policy, Nigerian stock rose to a five-month high of N9.35 trillion.

With new policy, NSE all share index also rose to a 2016 high of 29,247 points, from 28,902 points as at the close of business in May, 2016.

Advertisement

Lukman Otunuga, FXTM research analyst versed in market operations, said earlier that the new policy has restored optimism in the Nigerian capital market.

The new forex policy will take its full swing on June 20, 2016, when it eventually takes effect.

Add a comment