Geregu Power Plc, on Wednesday, listed N2.5 billion shares on the main board of the Nigerian Exchange Limited (NGX).

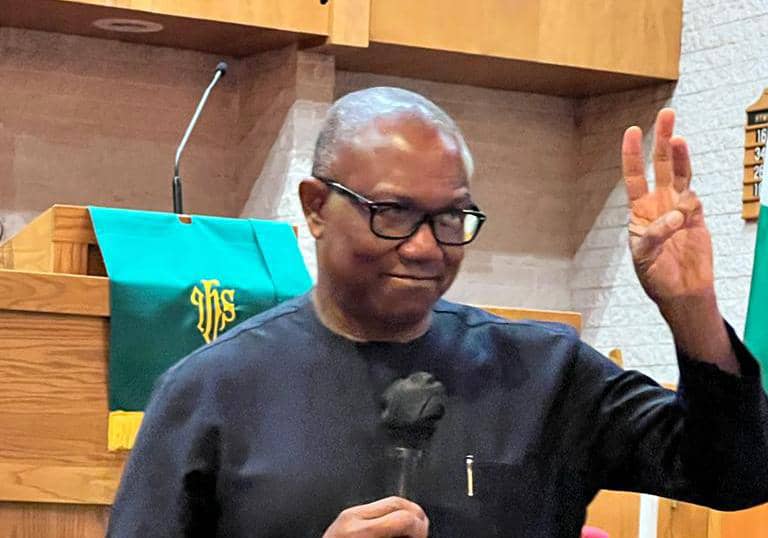

With this development, Geregu Power, chaired by Femi Otedola, the billionaire businessman, becomes the first electricity generation company (GenCo) to be listed on the NGX main board.

NGX, in a statement, said the listing of Geregu’s shares has added N250 billion to the market capitalisation of the exchange.

The exchange explained that the GenCo undertook the listing by introduction in order to promote better liquidity of its shares in the secondary market and be better positioned to access long-term capital from a wide range of local and international investors when required.

Advertisement

‘Listing by introduction’ means the company is not raising capital (through IPO) immediately.

Speaking on the development, Femi Otedola, chairman, Geregu Power, said it was the actualisation of the company’s vision to bring world-class standards in governance, sustainability, and business processes to the company and the Nigerian electricity sector.

Otedola said the listing on NGX’s main board would ensure that the long-term growth of the company is assured and its benefits would be passed on to their shareholders.

Advertisement

On his part, Temi Popoola, chief executive officer, NGX, said the listing was a promising development in the country’s power sector.

“We are delighted to welcome Geregu Power Plc to the exchange,” he said.

“Having Geregu listed in our market is proof of NGX’s commitment to building a robust and inclusive market and creating avenues for sustainable investment.

“This listing will enhance liquidity for Geregu, increase its visibility among global investors, elevate its value and boost transparency, as our marketplace is a sterling platform for raising capital and enabling sustainable growth for national development.”

Advertisement

Meeanwhile, at the close of trading on the floor of the exchange on Wednesday, investor sentiment was bullish as the share price of Geregu rose by 10 percent, driving up its market cap to N275 billion.

“Investors are quite optimistic about the value proposition of the company. The trajectory of its share price will be positive once the company has a good dividend yield and maximises value for investors,” an industry analyst who did not want to be named, was quoted to have said.

Add a comment