At first, clawing Nigerian economy out from recession ditch was thought to be not only a Herculean task,but one that couldn’t be achieved so fast.

But at the rate at which the Naira/dollar exchange rate is converging, putting Nigerian economy back on even keel may be sooner than later.

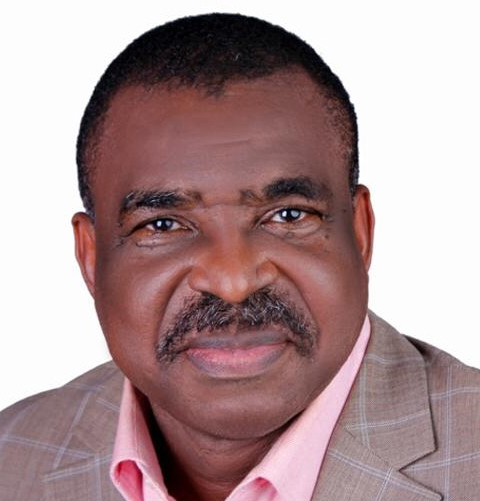

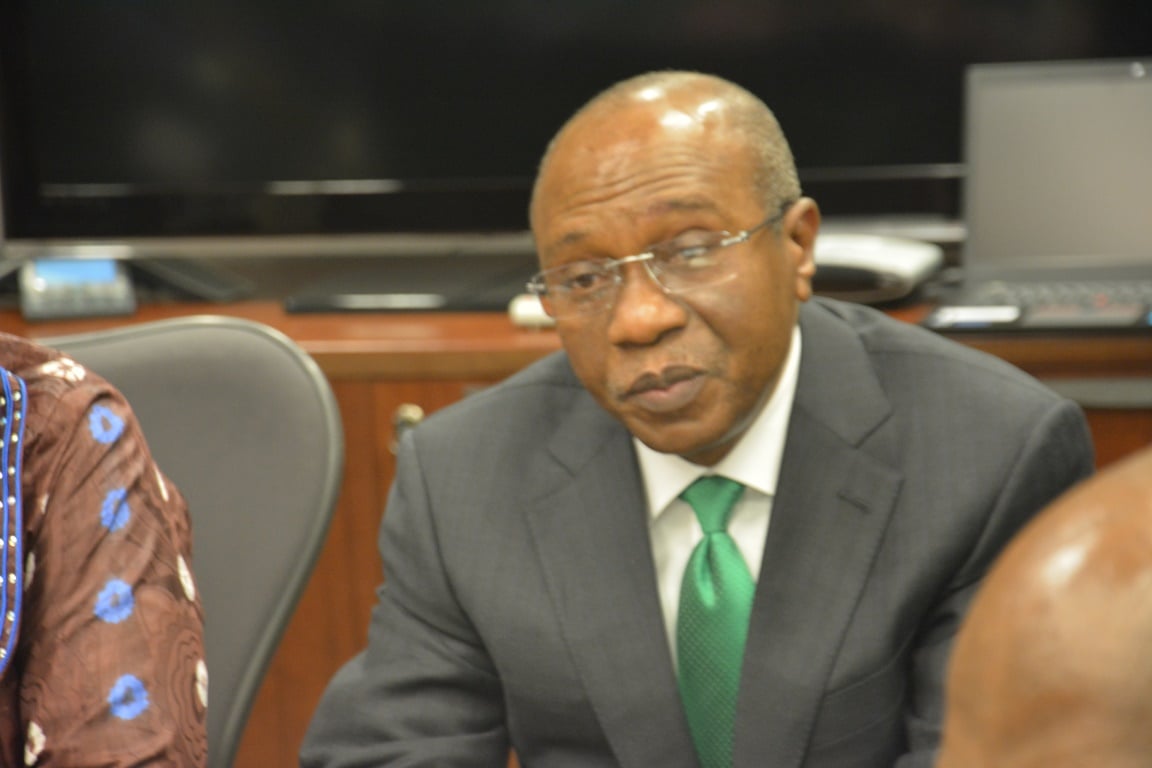

The analogy above may seem simplistic, but Godwin Emefiele, the governor of the Central Bank of Nigeria, CBN who is working assiduously towards the convergence of the official and the parallel markets foreign exchange, FX rates, appears to be on track to accomplishing the feat before the end of 2017.

Why is Emefiele becoming the legendary knight in a shining armor of Nigeria’s financial sector ,when his neck was literarily being put on the line for the guillotine as Naira/dollar exchange rate spiked to N500-$1 in the first few months of this year?

Advertisement

The reason is simple:

Based on data from Nigerian Bureau of Statistics, NBS, Nigeria’s trade volume is now N5.29 trillion with export being in excess of N3.0059 trillion, while import decreased to N2.286.

So for the first time in a long while, Nigeria is selling more than she is buying from the rest of the world.

Advertisement

And all these good news about trade improvement is attributable mainly to the significant growth being recorded in the agricultural sector which rose by a whopping 82%.

How could improvements in agricultural output be credited to the CBN’s Godwin Emefiele and not to Audu Ogbeh the minister of agriculture, you may be wondering?

Allow me walk you through the long road to recovery of Nigerian economy through fiscal measures conceived and implemented by Emefiele as CBN governor and you would see exactly why:

It may be recalled that in the bid to engender the positive results, the CBN under Emefiele’s watch banned 41 items from sourcing FX from the CBN for the importation- a.k.a Tooth Pick ban.

Advertisement

The justification for the prohibition was that most of the 41 items could be produced locally, hence they were cut off from receiving FX from the CBN with a view to encouraging importers to engage in a sort of backward integration through farming.

That policy generated a firestorm of condemnation from both local and international institutions including all the major policy wonks in Nigeria and attracted mocking comments from media outfits such as the highly influential Economist of UK and Time of USA amongst many other critics.

In fact the policy even triggered the delisting of Nigeria from the famous Jp Morgan index of emerging markets which accelerated the flight of private equity firms and their ‘hot money’ out of Nigeria leading to spike in FX rate.

Despite all the public reproach from even his colleagues in the bureaucracy, and call by local and international pundits for the pulling back of the 41 items ban policy that was dubbed ‘obnoxious’ as the Naira tumbled in value, Emefiele, apparently not wired to take the easy route,remained unyielding. Fortunately for him, his principal, president Muhamadu Buhari stood by him by shunning vicious calls for the CBN Gov’s sack.

Advertisement

Another policy that has facilitated the ramping up the value of Nigeria’s export compared to her import is the special interventions in the agricultural sector by the CBN.

Since Nigeria is believed to be spending 40% of its FX on food import, it was unsurprising that Emefiele targeted the sector funding intervention in order to cut down on the FX outflow.

Advertisement

Under the scheme, farmers in Jigawa state alone received over N15b Naira ( N300b was set aside) to support their cropping activities and that policy is yielding bountifully as impressive harvests has been recorded. It must be stated though, that the abundant crop yield was partly lifted by federal ministry of agriculture’s new fertilizer distribution policy which puts the products directly in the hands of farmers not middlemen which was previously the case.

The success story in Jigawa state is being replicated across the country and investments in the value chain of agricultural products is also being encouraged as evidenced by the collaboration between Jigawa and lagos states in the production and milling of rice.

Advertisement

Last Christmas, made in Nigeria rice flew off the shelves as if it was on auction resulting in a scramble like the pandemonium that takes place in major sales outlets in the USA, UK or Dubai whenever there is massive seasons discount.The demand for Nigerian rice is so high now that local rice farmers and millers are currently practically struggling to meet customers demand.

Arising from the public enlightenment made about locally grown rice being actually healthier than the imported brand,it is currently the preferred brand in my household, and my wife has been unable to meet my latest request that as part of my new year resolution , only made in Nigeria rice should be served. Owing to the scarcity of the commodity, she has been on queue on her supplier’s list in her quest to find locally grown and milled rice.

Advertisement

Going by agriculture and rural development minister , Audu Ogbeh’s account during the 41st National Council on Agriculture meeting held in Kano, Nigeria spends $20b on food imports annually.

In 2010 alone, former agriculture minister, now president of African Development bank, Akinwunmi Adesina reported that Nigeria spent N632b on wheat; N356b on Rice; and N217b on sugar and N97b on fish.

Without further equivocation,it is understandable that Emefiele would choose food import which consumes 40% of our foreign exchange outflow for major intervention by the CBN through backward integration or import substitution policy.

Through that vision, he literarily challenged the hitherto held assumption that farming is not financially viable hence it scarcely attracted bank funding; and debunked the notion that Nigerians don’t like consuming made in Nigerian goods and services; as well as provide justification for president Buhari’s vision of Nigerians producing more of what they consume.

And the best part of it is that what is fast becoming a sort of agricultural renaissance in Nigeria, does not just revolve around the leap in rice production and the craving of Nigerians for the locally produced staple. But following Emefiele’s farsightedness in CBN,the cash crop, sesame seed is increasingly looking like the new crude oil.

In fact the 82% increased value of export recorded in our country according to the latest NBS statistics is owed to sesame seed that has multiple uses in the Western world and therefore in high demand.

Admittedly, when the govt in authority took over the reins of power on 29th of May, 2015, Naira/dollar exchange rate was N160/$1, but today it hovers around N360/$1 and it is envisaged that it would crash further,probably until it finds equilibrium at half of today’s rate.

Given that the exchange rate had hit N500/$1 a few months back and critics of Emefiele’s policies had forecasted that it might ramped up to the N1000/$1 level, if he did not capitulate to their policy concepts of floating the Naira freely , it has put butterflies in the stomach of most entrepreneurs that the Naira is regaining its lost value.

Much as it is not yet Eldorado at the prevailing rate of N360/$1, the rates are slowly but surely coming down, and that’s assuming the massive infusion of dollars can be sustained,plus the rates have also become less volatile.

Now, the real icing on the cake is Emefiele’s policy of making available every quarter, $20,000 for each and every small and medium scale enterprises, SMEs in Nigeria to import basic inputs to keep their enterprise going. This unorthodox policy has been a massive game changer, as it has buoyed the hitherto sagging economy with a flurry of activities returning to market place.

The measure was a strategic response to the needs of the SMEs that were practically folding up in droves owing to lack of access, not only to credit, but also to FX as they were practically crowded out by the multinationals and behemoths whose insatiable appetite for FX was being met by banks at the expense of SMEs -the greatest employers of labour.

Today, spare parts dealers easily import and distribute their wares which oil the wheel of production in Nigeria factories and plants.

Prior to the CBN innovative relief, cars spare parts such as Tyres,batteries, and health care essentials like medicines plus other commodities like inputs in the manufacture of goods critical to human existence had become very scarce in Nigeria.

The lack of access to FX was so severe that living in Nigeria was becoming comparable to being in a Hobbesian state comparable to life in Zimbabwe when it was under global sanction after expelling white farmers and Venezuela currently suffering from resource curse.

But today, thanks to Emefiele, the story of Nigerian economy is changing fast.

Although, the prices of imported items have more or less doubled-reflecting the hyper inflation rate which is now said to be about 18% (NBS data)-the shelves are no more empty but prices are exorbitant.

One policy recently signed into law by acting president Yemi Osinbajo which would boost SMEs business in Nigeria is the law allowing them to use their movable assets like livestock-cattle, goats,chicken and fish as well as assets like vehicles, plants and machineries to secure loans. Hitherto banks accepted only fixed assets like houses and bare land as collateral and the CBN under Emefiele has been working hard to push the policy through legislation which it finally succeeded in doing recently.

Another unique approach to managing FX in Nigeria introduced by the CBN under Emefiele’s watch, is the third window (between official and black parallel market rates) from where school fees and overseas medical bills are funded. The policy has eased the discomfort hitherto suffered by parents over payments of their kids school fees and the infirm who were seeking medical attention abroad.

Prior to the introduction, parents that were unable to cope with the arduous task of sourcing funds from the parallel/black market, were compelled, at a point , to deprive their kids of high quality education obtainable abroad.

One monster in the financial services sector which has remained untamed even under Emefiele, is high interest rate which currently ranges between 25-30%.

Can the CBN under Emefiele slay the demon of exorbitant interest rates that has asphyxiated many enterprises through one of his esoteric or unconventional policies?

Time will tell.

Meanwhile, as the saying goes, necessity is the mother of invention,and hopefully the CBN working with Bankers Committee would step up to the plate.

So by and large, and from experience, Emefiele has been very inventive. The optimism is anchored on the fact that he has so far catered for all segments of the society through his very unusual, practical and effective initiatives that are now cooling the economy which had become incandescent owing to the voracious appetite of Nigerians for foreign made goods and services.

Arising from the accomplishments highlighted above, love him or loathe him, in a very uncanny way, Emefiele has become the accidental and unsung hero of this administration. This is underscored by the fact that he has proven pundits wrong with his Perculiar fiscal policy measures not taught in Harvard business school or London school of economics, which some of his biggest critics, The Time and The Economist magazines of New York and London respectively, espouse and which they expected him to copy and paste in Nigeria.

In appreciation of his uncommon financial management prowess, Emefiele was recently honored with the prestigious Ziks leadership award and for his special role in the effort to pull Nigeria out of recession, he has also not gone unnoticed by Africa’s richest man, Aliko Dangote ,who is fast becoming a major farmer, through the major stakes he is taking in the food basket zones of Nigeria.

According to Dangote, “Emefiele has contributed in saving the Nigerian economy from recession” Continuing , he said “The CBN has been very transparent in its policies and we are grateful for the contributions of the Bank in helping the economy come out of recession”.

All things being equal, many more accolades and garlands may be coming the way of Emefiele for his unique and efficacious economic sense in the period left of his five years tenure of which he spent the first year serving the previous govt that appointed him and now two years with the present regime.

Without much ado, from zero approval level at the inception of this administration, Emefiele is fast attaining a hero’s status in a space of 24 months.

Not many public servants can boast of such a phenomenal credentials in the current dispensation.

And it’s not too late for all other public servants to do better.

Onyibe, a development strategist, alumnus of the Fletcher School of Law and Diplomacy, Tufts university, Massachusetts, USA and former cabinet member of Delta state government, sent this piece from Lagos.

Add a comment