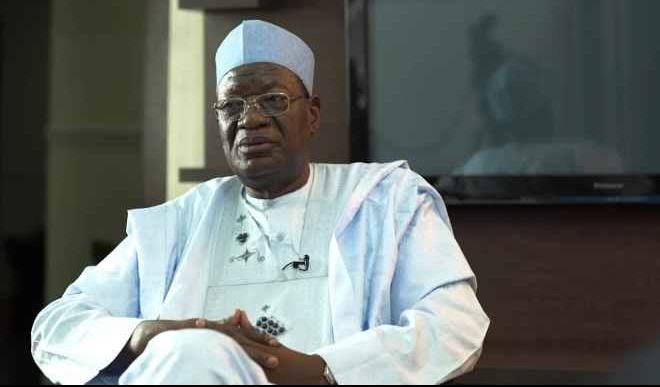

Kevin Amugo, director of financial policy and regulation at the Central Bank of Nigeria (CBN) said banks recovered N50.32 million bad loans from debtors within nine days of the commencement of the Global Standing Instruction (GSI).

Amugo was speaking on Tuesday at a webinar organised by the Chartered Institute of Bankers of Nigeria (CIBN) Dialogue Series 3.0.

NAN reports that the webinar was themed ‘Non-Performing Loans and Global Standing Instruction (GSI) Policy: Impact and Insights for Financial Stability’.

The GSI policy became operational from August 1, 2020, as part of efforts to reduce the rate of non-performing loans in the banking sector.

Advertisement

The GSI allows banks to debit the accounts of loan holders in other banks to settle defaults.

“The CBN had introduced the GSI as part of measures to curtail the rising non-performing loans (NPLs) in the Nigerian banks and its impacts on the industry,” he said.

“It was specifically introduced to support the banking industry in reducing the rate of unserviced loans, improve loan recovery and recovery efforts of banks.

Advertisement

“The amount recovered was, however, insignificant compared with the total of N1.66 billion worth of bad debts by 26,057 customers triggered by the lending banks.

“The size of the recovered NPLs was due to the fact that the CBN was still working on the GSI protocol for non-individual debtors, which means the recovery was made from individual loan defaulters.”

Amugo said that data from the CBN showed that NPLs in banks were higher during the economic downturn, and as the figure of NPLs rise, the instability in the sector worsens.

He said the level of non-performing loans rose from five percent to 15 percent between 2015 and 2017 when the country slipped into a recession.

Advertisement

“However, the CBN report showed that the NPLs ratio declined from 6.6 percent in April 2020 to 6.4 percent in June 2020; however the figure still remains above the 6 percent stipulated threshold by the CBN,” Amugo explained.

“Also, credit to the economy grew by N3.46 trillion, about 22 percent, of which new credit in June 2020 alone accounted for N773 billion, up from N412.7 billion in May 2020.

“The number of new borrowers similarly rose by about 42,000 to 93,578 from 51,700 in May.”

In his remarks, Adesola Adeduntan, managing director of First Bank Nigeria who was represented by Olusegun Alebiosu, the bank’s chief risk officer, commended CBN for the recovery made so far.

Advertisement

“N50 million recovered is excellent; I am sure after one year, the number of recoveries will increase,” Adeduntan said.

“GSI is what we have been looking forward to as a coordinated approach to addressing the NPL issue in the banking industry.

Advertisement

“You will agree with me that banks’ failure is not ordained, it’s just the behaviour of what we have. So, culture is a very big issue to credit; we need to address it.”

Bayo Olugbemi, the CIBN president, said bad loans have a long-standing issue in the Nigerian banking sector and the GSI will represent a new dawn in the debt recovery process.

Advertisement

Add a comment