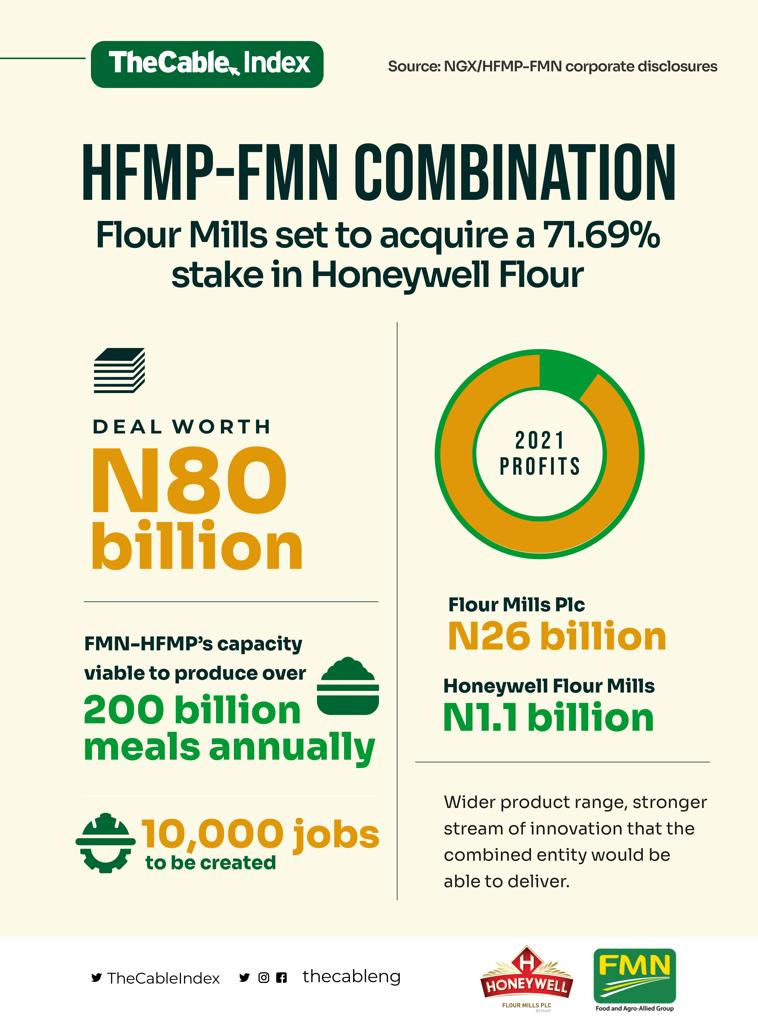

On November 22, 2021, when the Honeywell Flour Mills (HFMP) and Flour Mills of Nigeria (FMN) transaction was announced, investor excitement led to a bullish run seeing HFMP’s share price shoot up by 9.73 percent. It was an indication of a strong move in the flour milling industry, especially after Olam International’s deal with Dangote Flour Mills in 2019. The current HFMP-FMN deal will see a combined business operation with Flour Mills acquiring a 71.69 percent stake in Honeywell Flour.

Worth an estimated N80 billion, the transaction will combine the strengths of the two food products manufacturers to become a strong national food champion in the country. Though still under regulatory approvals, industry players had said the transaction is an indication of good things to come in Nigeria’s fast-moving consumer goods (FMCG) market.

Omoboyede Olusanya, the group managing director of FMN, said that it aligns with the company’s goal to be a national leader in the food and agro-allied industries.

“The proposed transaction is part of our global growth strategy; which is aligned with our vision to not only be an industry leader but also, a national champion for Nigeria in the Food and Agro-allied industries,” Olusanya said.

Advertisement

Honeywell Group (HGL), a family-owned investment holding company of Nigerian heritage with a nearly 50-year vision of creating value that transcends generations, has supported HFMP for over two decades. HGL has assisted HFMP in building a strong business, processing wheat and converting it into a range of staples including baking flours, semolina, noodles and pasta. According to the company’s managing director, Obafemi Otudeko, HFMP has grown from a 200-metric tonne business to a publicly quoted company with a production capacity of 835,000 metric tonnes of food per annum.

WHY THE DEAL IS TIMELY

Despite Nigeria’s slowing inflation, food prices continue to rise, hitting 18.34 percent in October 2021, according to data from the National Bureau of Statistics (NBS). Apart from the COVID-19 disruption, experts also attributed the lack of adequate investment in the food sector as one major reason for the hike in food prices.

Advertisement

The HFMP-FMN business investment is one of such opportunities needed to help the country to tame rising food inflation. This will help the companies expand capacity, create a more resilient national champion in the Nigerian food industry, and ensure long-term job creation and preservation.

The coming together of two industry leaders will create a strong brand, not only in product pricing but also in terms of quality, while giving Nigerians and shareholders the much-needed value for their money.

The combination is also coming at a time when the federal government is planning to create 21 million jobs and lift 35 million people out of poverty through the new National Development Plan (2021-2025).

The NDP focuses on the prioritisation and implementation of critical and strategic infrastructure projects that will directly boost production and productivity, an approach HFMP-FMN is taking with its business combination as its contribution to the National plan. A business combination of this magnitude, comes with a strong team, technical know-how, and infrastructure, leading to an increase in production, profit, and invariable staff strength.

Advertisement

Also, with a strong investment combination like this deal, Nigeria may be looking ahead to jettison the status of an import-dependent economy in the short term. In 2020, the country recorded its first annual trade deficit since 2016, after imports exceeded exports by N7.37 trillion.

HFMP-FMN STRENGTHS

HFMP is now one of a small number of food & beverage businesses to report revenue in excess of N100 billion. Through its operations, the company employs more than 2,000 individuals. In its 2021 full-year report, it surpassed its turnover target by posting an impressive 36 percent jump in revenue for the full year ended March 31, 2021.

Precisely, it recorded N109.5 billion in revenue for the period while its operating profit grew to N7.6 billion from N5.5 billion, under the condition of a pandemic, which battered the global economy and disrupted supply chains of most consumer goods companies.

Advertisement

The profit after tax (PAT) increased by 73 percent, growing from N650 million in the full year 2020 to N1.1 billion in 2021.

On the other hand, Flour Mills Plc reported a 126 percent leap in after tax profit to roughly N26 billion despite the economic turbulence of COVID-19 and lockdown. It was the second straight year in which the food and agro-allied company jerked up profit by triple-digit. Its profit had soared by 184 percent in 2020.

Advertisement

The company’s revenue came from three broad market segments — food, agro-allied, and sugar – with strong growth recorded in each segment. Revenue growth was led by the company’s main revenue line, which is the food products segment. It contributed roughly 62 percent of group sales revenue at the end of the financial year.

The company’s backward integration programme helped it achieve cost moderation leading to strong growth in sales to extend profit capacity.

Advertisement

With the strong financial positions, the combined business is expected to complement the synergies and cement the earnings uptick in the long run. Little wonder that market pundits believe that the transaction will create a long-term competitive advantage for the two companies when the deal is finally sealed.

Analysts at FBNQuest Capital Research speaking about the deal have said ‘Based on Honeywell Flour Mills 2022 half-year numbers, we would expect the acquisition price to be well above N3.39, perhaps above N5 per share. We believe that Flour Mills of Nigeria can comfortably finance the deal, using its robust cash balance of N52.7 billion as at 2022 half-year financial statement and would not have to use new debt,’

Advertisement

Looking forward, and building on these incredibly strong foundations, HGL’s leadership believes that the combination of HFMP with FMN will maximise the future potential of HFMP for its employees, customers and investors. The proposed combinations can share the goals of making affordable food available to Nigeria’s 200 million population and meeting the UN’s 2030 goal of Zero Hunger in Nigeria

BUSINESS COMBINATION

Through the business combination, FMN and HFMP’s capacity is viable to produce over 200 billion meals annually. With strong support for the overall development of Nigeria’s industrial capability, ensuring sustainable practices, commercial agriculture development, logistics, and corporate accountability.

It will also ensure access to safe, nutritious, and sufficient food, attend to the ever-growing population of Nigeria, and help the country achieve Goal 2 “Zero hunger” of the United Nations Sustainable Development Goals by 2030.

END GOAL

In the future, continued investment in the business will enable the combined entity to be a critical provider of the continent’s food needs.

HFMP has a solid 10-year-plan to increase investment in innovative product development and advanced technology infrastructure, with a “continued focus on functional proficiency and local content development as the key strategic drivers for expanding shareholder value and growing market share”.

According to the corporate disclosure, FMN had said it is committed to building on HFMP’s rich heritage and culture of the company; the two companies have shared values and a commitment to the betterment of the industry and the high demand for carbohydrates in Africa’s populous economy.

The business deal delivers the following impacts:

WIDE RANGE OF PRODUCTS FOR CONSUMERS

The transaction will give access to a wider product range, and an even stronger stream of innovation that the combined entity would be able to deliver.

STRONG WORKFORCE

Employees will have access to broader opportunities within the combined entity and continue to be a part of a company that plays a critical role in Nigeria’s food production and security. In a joint statement, the two companies noted that the transaction is about creating a stronger combined business with enhanced growth prospects and potential future job creation; there is not expected to be a material impact on the workforce or operations of the two companies.

MASSIVE INVESTMENT IN BACKWARD INTEGRATION

The Nigerian economy will enjoy a massive backward integration programme as a result of the combination. The backward integration programme is one of the laudable policies of the Godwin Emefiele-led Central Bank of Nigeria (CBN). The policy seeks to improve and revive local production capacity and create employment for teeming youths.

Nigeria will also benefit from both companies focusing on developing the agricultural value chain and backward integration of the food industry ultimately improving food security.

1 comments

This is very commendable. Hoping other companies in other industries can take a cue from what is happening in the food space.