BY IRENE DAVID-ARINZE AND LINCOLN TOWINDO

The COVID-19 pandemic decimated highly vulnerable African economies which had already been on a lifeline. Jobs were lost and incomes were affected, due to the lockdowns. Restrictions on movement and face-to-face interactions sped up the pace of digitalisation of financial services and the infiltration of some unscrupulous unregulated financial service operators. In a bid to survive, some vulnerable people got trapped in the web of fraudulent loan apps hosted on Google Play store.

These predatory lending apps are disguised as platforms where you can access quick loans with no collateral except provision of bank verification number (BVN), request to permit picture, contact, and files on the device. Victims are expected to repay loans at astronomical interest rates within 3-7 days as against the 91 to 365 days claim on Google Play store. We found that this flouts the rule of Google Play store as updated in August 2019.

The policy reads: “We do not allow apps that promote personal loans which require repayment in full in 60 days or less from the date the loan is issued.”

Some of these loan apps operate with no regulation by government, expired licenses and in some cases, no licensing. Further investigation shows that the Google Play store has an 83.07% market share in Nigeria, 84.61% market share in Zimbabwe, and 90.63% market share in Kenya.

Advertisement

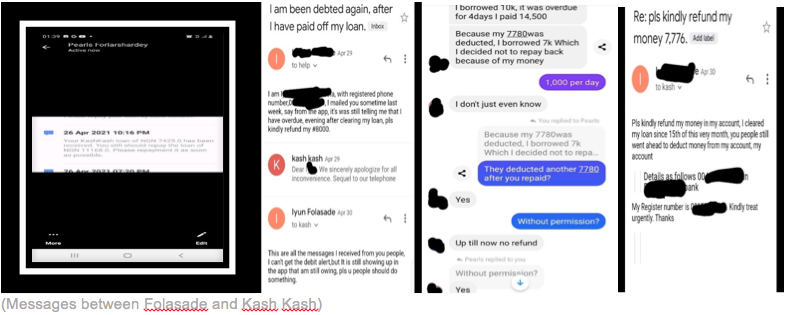

We spoke with Pearl Folasade from Nigeria who was utterly frustrated that despite the fact she had cleared her debt, the loan app she used, called “Kash Kash,” had not cleared her, hence an accumulation of late repayment debt. She showed a string of threatening messages she had received from the company.

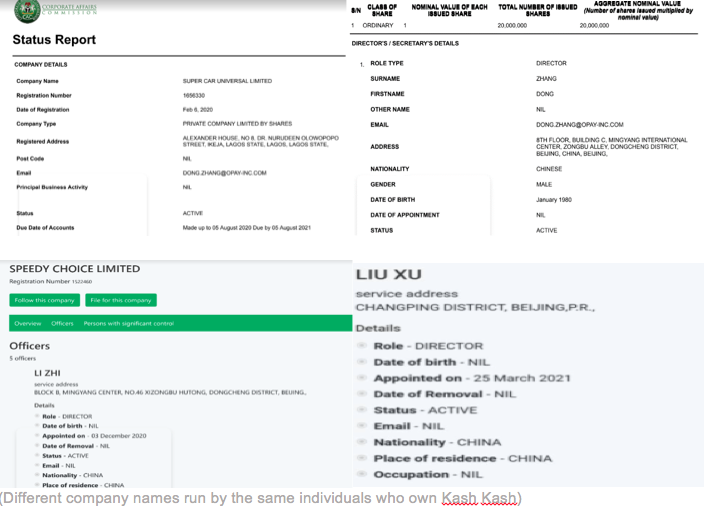

We assessed registration documents of three such loan apps and the documents retrieved from the Corporate Affairs Commission (CAC) in Nigeria showed that the founding directors were Chinese nationals. While Nigeria does not discriminate against foreign nationals doing business in the country, the business should be legal and have the required license to operate. However, for the volume of financial transactions these companies did, they were not licensed, hence illegally operating in the country.

Advertisement

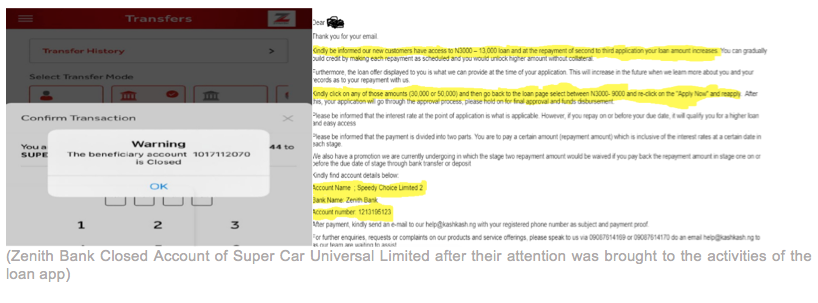

We looked into the operations of Kash Kash and discovered some red flags. We asked a source at Zenith Bank, a commercial bank in Nigeria where Kash Kash hosted its operating account under the name Super Car Universal Limited, about the activities of the loan app, such as the exorbitant interest rates they collected from customers and defamatory messages sent to contacts of their customers when they missed their repayment date. After our inquiries, the bank conducted an internal investigation and it was discovered that the account holder did not have the required license to operate as a money lender, according to the source who spoke on condition of anonymity. This led Zenith Bank to close the first account, however, their operations were moved to another account named Speedy Choice which is still operational and managed by the same people who managed the previous account. We sent emails to Kash Kash to further explain the interest rates formula, but we never got a response.

We spoke with a former loan collector who declined to be identified. He said the loan company he worked for, LCredit, had a similar business model as Kash Kash and was operating under the CAC company name Cashigo and disbursing loans to customers with no collateral and defaulters were sent threatening messages. These customers seldom read these policies out of desperation and are unable to keep up with the payment date. According to him, the loan app (LCredit) tested the idea of sending threatening messages as a way of retrieving loan repayment and it worked, hence it was adopted by the entire organisation. He said he did not agree with the unethical practice of sending such messages to contacts. We reached out to one of the people listed as a deponent on the company’s registration document, Kelechi Obi, who declined to comment as he simply replied via email saying “I have no dealing with them since the company was incorporated. I don’t know where they are”.

Advertisement

Babatunde Irukera, the CEO of the Federal Competition and Consumer Protection Commission in Nigeria (FCCPC), said they have taken steps towards regulating loan apps. “We have investigated and closed down 6 major ones and are now looking for the smaller ones,” he said.

“We are working with the Central Bank of Nigeria and other stakeholders to develop guidelines on how they do business and also guide them on how to calculate interest and what kind of information they are able to download from consumers. Money lenders are an important part of society. We are not sending them away; we are trying to regulate.”

In Nigeria, short-term borrowing through registered channels such as microfinance banks is restricted to those who have a steady stream of income, leading to the surge of loan seekers patronising these loan sharks in a country.

Loan apps and other fintech products can be used for money-laundering and other forms of illicit financial flows (IFF). According to the Economic Development in Africa Report 2020 by the UN Conference on Trade and Development (UNCTAD), Africa loses about US$88,6 billion, annually in IFF.

Advertisement

LESSONS FROM ZIMBABWE

Loan apps such as those in Nigeria are prevalent in some other African countries such as Kenya, however, the mode of lending in a country like Zimbabwe seems to vary a bit.

Advertisement

One such operator sends out text messages on WhatsApp offering “instant” loans as seen below.

“We consider the following: cars, machinery, TVs, fridges, freezers, and generators as collateral. We have secure parking and storage for the assets,” one of their advertisements reads, before promising the best deal on bridging finance. Patience Murai, a civil servant from Bulawayo, Zimbabwe’s second capital, used the platform to supplement her income in 2021. The loans on offer ranged from ZW$1000, with an unlimited maximum amount (determined by one’s creditworthiness).

Advertisement

“The loan was a godsend,” she said. Her small side business of selling skincare products to her colleagues at work was no longer bringing in supplementary income because government offices had been not so busy. “Paying back the loan was something else, I had not realised that these short-term loans, are extortionate.”

After she missed her initial repayment deadline, the lender threatened to confiscate her television set, which she had offered as collateral. She had to borrow from a friend to save her property being confiscated.

Advertisement

Patience’s case does not seem to be as common in Zimbabwe as in Nigeria, however, and we discovered that measures have been put in place by government and regulatory agencies to avoid the penetration of these unregulated loan apps.

Over time, Zimbabwe has seen an increase in non-bank mobile money providers which are largely operated by mobile network operators (MNOs). These include Kashagi, which is owned by Zimbabwe’s largest MNO- Econet Wireless.

Informed by this growth, the government amended the Microfinance Act in 2019 to allow for only two classes of Micro Finance Instruments, namely deposit-taking and credit-only. Authorities have tightened regulation of this sector to curtail the emergence of predatory operators. According to Jenfan Muswere, minister of information communication technology for postal and courier service, to protect the integrity of the system, mobile money system operators are required to partner with established financial institutions.

He said the Central Bank monitors MNOs and financial institutions’ cash balances in real-time.

“Banking institutions, in turn, are required to seek regulatory approval before introducing mobile financial services. The Reserve Bank subjects mobile financial services to ongoing supervision through on-site inspections and off-site examinations which has proven very effective.”

In 2019, the Reserve Bank of Zimbabwe (RBZ) established the National Fintech Steering Committee to provide strategic policy direction that promotes financial technology innovation and entrepreneurship. The committee was also tasked to assess the “risks, challenges and opportunities arising from digitalization and use of financial technology”.

According to Harare-based banker Tawanda Kaminza, “poor regulation of micro-lenders poses a huge risk for the sector. When poorly regulated, the sector faces risks that include licensing of predatory lenders including criminals involved in Illicit Financial Flows”.

As of December 2021, there were 168 credit-only microfinance institutions registered with the RBZ.

Nigeria has more than 850 licensed microfinance banks. Judith Onyishi, managing director, Peace Micro Finance Bank, said MFBs are heavily regulated by the Central Bank.

“Initially MFBs were not allowed to ask for collateral before they give loans due to bad loans, but they are now forced to ask for collateral,” she said. “Most of our clients are pensioners.” According to Onyishi, loan apps can work closely with the MFBs such that the MFBs do the due diligence and creditworthiness checks on loan seekers, while the apps disburse the loans and a profit-sharing plan is reached.

Albert Makochekanwa, a professor and lecturer in the department of economics at the University of Zimbabwe, said properly regulated microfinance institutions are crucial.

“Microfinance institutions assist the vulnerable in society who cannot provide collateral for bank loans,” he said. “In addition, properly registered microfinance institutions operate legally as compared to loan sharks. This means that they can be regulated, reducing the chances of borrowers being defrauded.”

This report was produced courtesy of Wealth of Nations, a media skills development programme run by the Thomson Reuters Foundation. More information at www.wealth-of-nations.org. The content is the sole responsibility of the author and the publisher.

Add a comment