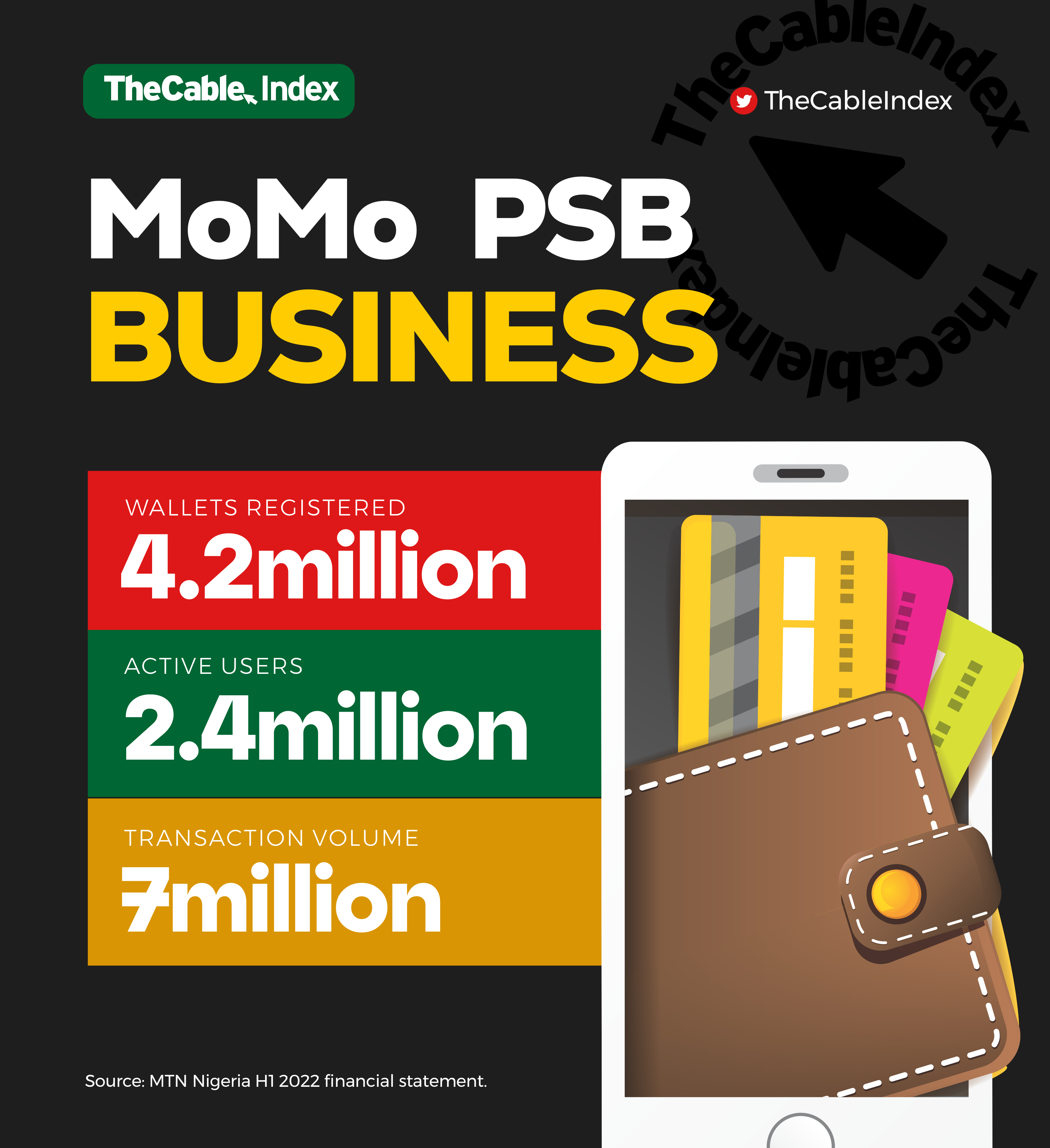

In the last three months, MTN Nigeria’s fintech subsidiary, Mobile Money Payment Service Bank (MoMo PSB), has gained traction and contributed to the country’s financial inclusion push. Within a few weeks of commencing operation, the PSB generated transaction volumes of approximately 7 million.

In May, MoMo PSB formally commenced operation following the final approval for a Payment Service Bank (PSB) granted by the Central Bank of Nigeria (CBN).

The key objective of issuing a PSB permit is to boost financial inclusion, especially in rural areas and facilitate transactions.

PSB operators are expected to function in rural regions and areas where Nigerians do not have bank accounts, with at least 50 per cent physical access points in rural areas.

Advertisement

MoMo PSB is a partner in facilitating the actualisation of the CBN’s financial inclusion strategy. It is also part of the overall 2025 strategic priorities of the MTN Group.

FINANCIAL INCLUSION – THE NUMBERS

According to the latest financial inclusion report by Enhancing Financial Innovation & Access (EFInA), about 36 per cent of the adult population (106 million), representing 38 million citizens, do not have access to financial services in Nigeria. The EFInA data showed that 64 per cent of Nigerian adults were financially served by the end of 2020 — up from 49 per cent in 2018.

Advertisement

Of the 64 per cent, EFInA said only 51 per cent of Nigerian adults have access to formal (regulated) financial services due to offerings from banking, microfinance bank institutions, mobile money, insurance, or pension accounts. By implication, 54 million of the adult population have access to banking services.

The report added that women are more financially excluded than men, with only 45 per cent of women using formal financial services, compared with 56 per cent of men.

Financial inclusion is achieved when adult Nigerians have easy access to a broad range of formal financial services that meet their needs at affordable costs, according to the CBN.

Advertisement

Despite successes recorded over the years, Nigeria failed to meet its 2020 target of 80 per cent financial inclusion and 70 per cent of Nigerians with formal financial services.

In 2019, Godwin Emefiele, CBN governor, said the country would continue to strive to improve financial inclusion and maintain financial system stability.

He had said the apex bank shifted its target for adult financial inclusion to reach 95 percent by 2024 — with a robust focus on PSBs and shared network expansion facilities.

THE MoMo STRATEGY FOR FINANCIAL INCLUSION

Advertisement

MoMo PSB brings one of the easiest and most convenient ways to bank in Nigeria. Some of its services include the collection of deposits and offering of digital accounts to banked and unbanked populations.

In essence, it is providing financial services to Nigerians who would otherwise not have access to them.

Advertisement

With MoMo, individuals and small businesses will be able to perform cross-border transfers through available methods in the future.

Advertisement

With easy-to-open and operate features, Nigerians can open a MoMo bank account by dialling *671# on any network, initiating fund transfers, and paying bills and remittances. Customers can also withdraw cash from their MoMo PSB wallets by visiting a MoMo agent or transferring to other banks.

MoMo PSB strengthens the CBN’s financial inclusion drive and ensures penetration among the unbanked and underserved in northern Nigeria and across the country. It promotes financial inclusion among women and youth through its agent banking channels and USSD.

Advertisement

Replicating success stories across African markets, MoMo removes the barriers to entry associated with financial services, including account opening, remittance services, and customer payments.

The numbers speak in 15 countries, with 56.8 million MoMo customers completing 10 billion transactions worth about $240 billion in 2021.

Benefits for individuals

With MoMo PSB, individuals and agents can accept deposits from customers and small businesses, hold funds in an electronic wallet, invest in interest-bearing federal government and CBN securities and offer saving products. They can also engage in different local payments, including merchant payments, bill payments, and person-to-person transfers. Agents running MoMo PSB business can provide POS and ATM services and build a network of physical banking agents for deposits, payments, and withdrawals.

Business owners

Businesses can also manage their finances and pay staff salaries with MoMo Bulk Disbursement. MoMo PSB offers a range of solutions to increase efficiency and decrease operating costs, driving faster growth of financial inclusion in Nigeria, especially for micro small and medium enterprises (MSMEs).

A BIG LEAP FOR MoMo PSB IN NIGERIA

Within six weeks of operations, MTN Nigeria MoMo registered 4.2 million wallets with about 2.4 million active users — generating transaction volumes of approximately 7 million. At the end of June 2022, it held N1.1 trillion for MoMo customers, according to the financial report of MTN Nigeria.

In a report, McKinsey said the potential economic benefits of digital financial services alone as an essential component of financial inclusion can boost the GDP of emerging economies by 12 per cent in 2025 and reduce leakages in government’s economic management by $2 billion annually.

EFiNA, on the other hand, said recent growth in digital financial services and agent banking such as the MoMo PSB “highlights opportunities to drive faster progress toward financial inclusion, particularly for excluded groups such as women, rural and Northern Nigerians”.

To accelerate the continent’s financial inclusion, MTN placed its “Ambition 2025” strategy on moves to lead the space in digital solutions for Africa’s progress by harnessing the power of its brand, footprint, connectivity infrastructure and technology platforms.

Add a comment