I did explore the idea of Nigeria’s economy growing in double digits when I ran for president in 2019. From the get-go, the idea sounded egregious to establishment people, some of whom ventured that Nigeria should not think of more than a 4% to 6% growth rate. In other words, we must continue along the lines of mediocrity. My research – which I made open – to the effect that the developed nations of today grew in leaps and bounds as they made their way up, did little to convince anyone. Not even the fact that matured economies – pre-Covid were growing faster than us and are very likely to grow faster post-Covid as everyone generally reorganizes to put that terrible past behind them.

Why should Nigeria be satisfied with growing at 2% or 3%? Why should 4% GDP growth be a big deal for us? Why should 6% make us ecstatic and braggadocious? We need to remember where we are coming from. They say someone who does not know where he is going will be led in another direction by someone who takes him to another location. We must be able to determine our own destiny and setting a robust growth target is also a way of challenging ourselves to achieve more. I am however not just pulling figures from the skies by speaking of these numbers. My hope is based on empirical projections from several sectors of the economy as we may see shortly.

My ideas are not meant to be perfect though and are therefore subject to critique. Even the idea of measuring economic performance by GDP (Gross Domestic Product) growth is itself flawed. Simon Kuznets in the 1930s invented the idea of GDP and put a caveat on it based on its inadequacy. But in spite of its inadequacy – measurement issues in informal economies, skewness to a few or singular sectors, and non-measurement of inequality and other metrics of human capital development – the GDP as a general tool is useful for those who are true to themselves. As much as GDP measurements do not equate to economic development, we also know that growth must accompany any process of real development.

I base my optimism that Nigeria’s economy should be able to grow by double digits in 2023 and beyond – an optimism that is shared by no less than Bola Tinubu, the APC’s presidential flagbearer – on several factors and sectoral developments such as:

Advertisement

- The Buhari Government has made some good investments which Nigeria should now reap, going forward. Developments like the Dangote Refinery, Lekki Ports, Second Niger Bridge, Calabar Ports redevelopment, and so on, are meant to add to economic activities and thus add to GDP growth in 2023 and beyond.

- A reduction in the activities of terrorists and bandits and other marauders in the north of Nigeria should be able to get people back to the farms and allow the region to breathe again. If the north, being the food basket of Nigeria and indeed West Africa and the region with the vastest arable land in Nigeria should find peace, this will create a good boost for the Nigerian GDP. I kind of believe that the worst is over for Nigeria and we should only grow from here.

- If we view the economy through the neoliberal concept of boom and bust, the Covid era represents a bust for Nigeria and the world as we entered another round of economic depression – which we pulled out of in record time. After the bust comes the boom. After a slump comes growth. So, I say why not we grow at double digits? Base effect is what it is called.

- The Buhari government seems to be getting a better handle on our petroleum sector as it winds up. The NNPC has been commercialised and is currently being streamlined. This means that there will be less waste and better accountability as some private sector standards are infused into that company. With our pipelines now being better secured using the help of local players (read Tompolo and company), and with the Kolmani Oil Field in the Bauchi/Gombe axis projected to add another 120,000 barrels per day alongside gas to the kitty, the petroleum sector in Nigeria is likely to witness a major leap in 2023 and beyond. A December 7, 2022, report in the PUNCH has it that Nigeria’s oil production has increased to 1.6 million barrels already, up from 970,000 in September of the same year. This is a 70% increase in productivity if we are to believe the words of Bala Wunti, the head of former NAPIMS, now NNPC Upstream Investment Company. A 70% growth in the oil sector means a lot for the entire economy as it links with many other industries from oil servicing, to real estate, to our foreign exchange. A 70% growth in that industry could translate itself to a modest 7% growth in GDP if well harnessed. If we add the fact that Nigeria is actually a gas country with a bit of oil, and our NLNG is doing great with demand for gas on the increase worldwide, we could actually do better in the oil and gas sector.

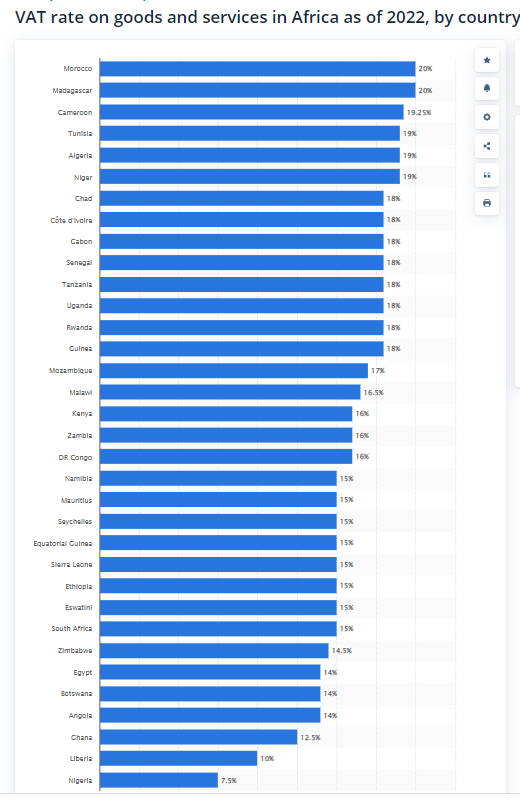

- The current cashless policy of the Central Bank of Nigeria will also contribute something significant. This is because it will enhance transparency. People will eventually comply. With the lesser ability to operate in cash and avoid accountability, the federal, state and local governments, will certainly be able to track transactions more and obtain revenue from source, along the lines of its taxes, rents, rates, duties, fees, fines, levies, and what have you. Hopefully, too, corruption will be curbed howbeit marginally, freeing up funds for the development of the country and investment in public goods. President Buhari wants this to be his legacy and I hope he succeeds. The success of the cashless policy could lead to a doubling and tripling of government revenue, putting Nigeria under less pressure to borrow for recurrent expenditure. Hopefully, we are talking about revenues raised from productive activities, and in a progressive manner, not from the poor and vulnerable. At present, the federal government has given a total tax holiday to companies with less than N25 million in yearly turnover, in response to the COVID-19 problem. This is commendable but may not continue forever. A review of this policy will also boost government revenue greatly. I will suggest a rollback of this policy. It’s not being done in any other country I know around the world. In fact, UAE and Saudi Arabia, which never had any company taxes are now introducing some. Nigeria has the lowest VAT in Africa (see figure). I believe low-income companies should be returned to 15% and maximum taxes pegged at 22% for large companies. Whereas the textbook says tax cuts are a way of increasing GDP, for a country like ours tax enforcement is more important. The failure of VAIDS was something I predicted. We jumped the gun. Also asking companies with N25 million turnover and below to stop paying VAT or CIT is a very reckless idea. Before we start declaring these freebies we should understand that tax discipline and compliance are prime in a country like ours. The cashless policy is also in tandem with the now ubiquitous reliance on technology to drive every process – especially revenue collection, project management, budgeting and what have you. We may be looking at a time of economic renaissance indeed if we could keep our heads.

- Big ideas could also lead to a leap in GDP. The good thing is that nothing stops different sectors from chipping in at their own paces. If Nigeria could have a consumer credit revolution around goods and services produced in Nigeria, and our banks could get more adventurous in advancing credit to Nigerians for mortgages, household appliances, other assets like cars, even education (student loans for universities), a lot will change in Nigeria and GDP will take flight. I know a Professor Richard Werner who believes that such consumer credits are central to the leap in development witnessed in Europe, Japan and the USA. This is because it leads to rapid money creation by banks, and by extension value creation. Such credits must however not be directed at importation. Nigeria needs a big idea around the housing sector too, which could begin to totally transform the face of our cities from massive slums to something a bit more organised. In China and Morocco, among other places, the private sector got involved in the provision of mass housing. Nigeria has made the mistake of thinking of elite houses instead of the more profitable investment in mass housing. There has to be a way to work this out, and our banks must look at creating massive value by expanding their balance sheet in this regard. However, they must be ready to make a modest profit. This idea alone will add 10% to Nigeria’s GDP.

- Another factor that can add to our GDP in 2023 and beyond is the import substitution policies of the present administration – including some of the initiatives of institutions like the CBN. I am decidedly on the side of a little protection for the economy, not the full opening up of the economy to the vagaries of brutal global competition. To that extent, where I believe it should be tenured, I see sense in the non-support of 43 items for import such as toothpicks, milk, fish, vegetables, rice, furniture and others. As things stand, some local industries have developed on the back of this protection. This is what every developed country has done in their time. Alexander Hamilton, the first US secretary of finance, was adamant about protecting the US economy from dumping by the superpower of that time – Britain. Hamilton, who was killed senselessly in a duel by Aaron Burr, a sitting vice president in 1804, is considered one of the best personalities in public finance there ever was. Our misreading of economics – and the indoctrination and brainwashing of many – is one of our biggest problems in Nigeria. No matter what, what we call the non-oil sector (a term I hate to use because it continues to elevate crude oil as our mainstay), is likely to contribute even more to economic growth as we forge ahead. Initiatives like the CBN’s RT200, which incentivizes exporters, have begun to lay emphasis on value-added export as well. Nigeria may witness a renaissance in the manufacturing sector. I believe we have suffered enough and turned the corner. But we must stay on course. I however propose that those 43 items be put on very heavy tariff regimes so as to not give traducers of the concept any excuses that the CBN is sending importers of the products to the same black market. Further use of IT at our ports will increase collections by customs naturally.

- The coming on board of Dangote and hopefully, Air Nigeria, will help conserve foreign exchange. Second to sundry technology imports, the import of refined petroleum gulps most of Nigeria’s scarce forex resources. Local production will mean that we do not have to import any more. Ditto, having a national carrier will mean that the pains Nigerians bear with airlines presently will reduce and so also will the current gridlock arising from FX obligations to foreign airlines. Less pressure on our FX reserves will lead to accretion (increases), thus improving our national balance sheet and making Nigeria attractive to foreign investors again. This may however take longer than a year or two but the effects will be profound and salutary.

We must recall that our GDP had once hit $510 billion before two recessions came and sent us reeling (2016 and 2020). By moving from the current $440 billion, in two years we will be back to where we were in 2014 essentially. We should view this as a minimum and not an achievement. Whatever happens after two years of double-digit growth should then be seen as a real achievement. With better accountability, focus, clear heads, cleaner statistics, and a little bit of luck, we should be targeting a trillion-dollar economy in about six to seven years, given the geometric projection.

We should defy the World Bank and IMF who keep projecting economic growth rates that barely cover our population growth rate of 2.6%, much less our inflation of 21.47% for us. What I see in their statements, year in, year out, is that they are telling us that we don’t think, will not think, and will never reorganise ourselves out of the rathole we find ourselves today. We are under obligation to prove that we are not rats.

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment