Today, owning a car has become an essential part of daily life for many people. Whether it’s for commuting to work, running errands, or embarking on road trips, having reliable transportation is invaluable. However, along with the privilege of car ownership comes the responsibility of ensuring its protection with the right Auto insurance. With numerous options available in the market, choosing the right motor insurance for your car in 2024 requires careful consideration and informed decision-making.

Assess Your Coverage Needs

Before diving into the specifics of Auto insurance policies, it’s essential to assess your coverage needs based on factors such as your driving habits, budget, and risk tolerance. Ask yourself the following questions: How frequently do you use your car? What is the value of your vehicle? Are you concerned about potential risks such as accidents, theft, or natural disasters? Do you have any specific coverage requirements mandated by law or financing agreements?

By understanding your coverage needs, you’ll be better equipped to narrow down your options and select an Auto insurance policy that aligns with your priorities.

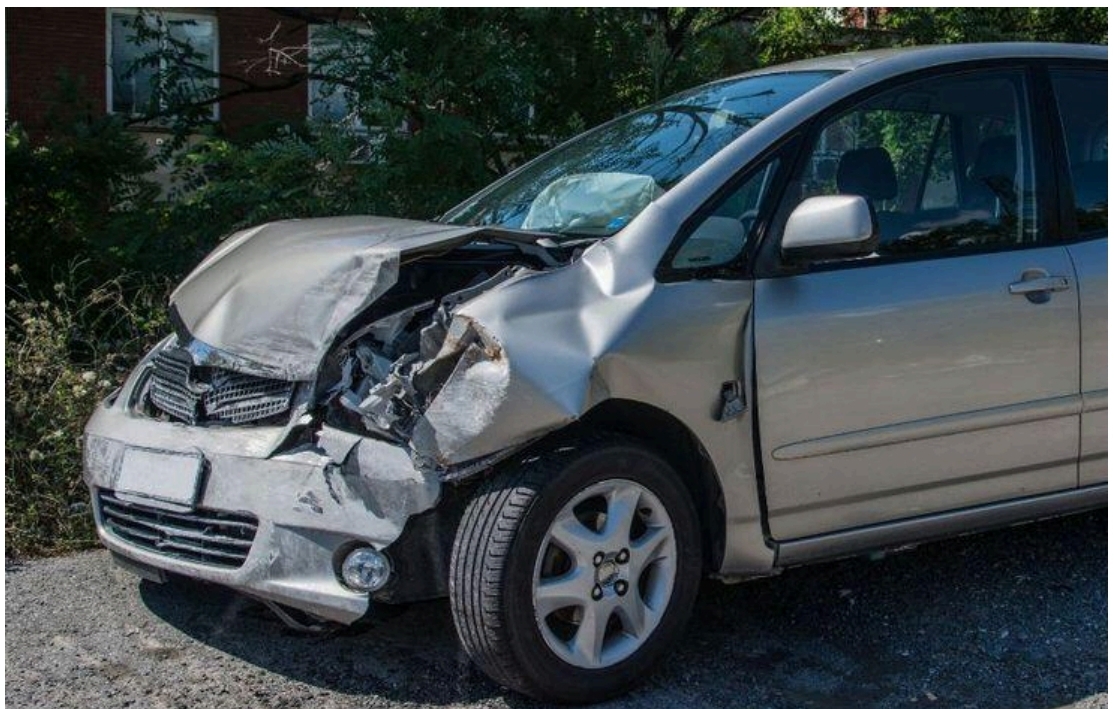

The Importance of Auto Insurance:

Owning a vehicle comes with responsibilities, and one of the most crucial is having adequate Auto Insurance. Here are some reasons why Auto Insurance is essential.

Financial Protection: Insurance covers the costs of repairs or replacement in case of accidents, theft, or vandalism, sparing you from significant financial burdens. Legal Compliance: It’s mandatory in Nigeria to have at least Third-party Auto Insurance to drive legally, avoiding fines and legal repercussions.

Peace of Mind: Knowing you’re covered allows you to focus on driving safely without worrying about potential financial consequences.

Liability Protection: Insurance shields you from legal liabilities for damages or injuries to third parties, covering medical expenses and property damage.

Asset Protection: Your vehicle is a valuable asset, and insurance protects it against accidents, theft, and natural disasters.

Understanding Different Types of Auto Insurance

Auto Insurance typically comes in various forms, each offering different levels of coverage and protection. The main types of motor insurance include:

Third-Party Auto Insurance: This basic form of coverage protects you against legal liabilities for damages or injuries caused to third parties while driving your vehicle. It’s usually mandatory in most countries and provides financial protection for third-party property damage and bodily injury.

Comprehensive Auto Insurance: Comprehensive insurance offers broader coverage than Third-party Insurance. In addition to Third-party liabilities, it also covers damages to your vehicle caused by accidents, theft, vandalism, fire, and natural disasters. While Comprehensive Auto Insurance may be more expensive, it provides comprehensive protection for your vehicle against a wide range of risks.

Compare Insurance Providers and Policies

Once you’ve determined your coverage needs and understood the types of Auto Insurance available, it’s time to compare insurance providers and policies. Consider the following factors when evaluating insurance options:

Reputation and Reliability: Research insurance providers’ reputations, financial stability, and customer reviews to ensure reliability and trustworthiness.

Coverage Limits and Exclusions: Review policy terms and conditions, including coverage limits, exclusions, deductibles, and claim procedures, to understand what

is and isn’t covered.

Premium Costs: Compare premium rates from multiple insurance providers to find competitive pricing that fits within your budget. Be sure to inquire about any available discounts or incentives that may lower your premiums.

Additional Benefits and Services: Consider additional benefits or add-on coverage options offered by insurance providers, such as roadside assistance, rental car reimbursement, or personal accident coverage.

Introducing Leadway Auto Insurance

When it comes to protecting your car and your peace of mind, Leadway Assurance is your trusted partner. With over 50 years of experience in the Nigerian insurance industry, Leadway Assurance is committed to providing comprehensive Auto Insurance coverage tailored to your needs.

Leadway offers different Auto Insurance options with benefits such as;

Customizable Coverage Options: Choose from Third-party Auto Insurance, Third-party Auto Base or Comprehensive Insurance coverage options to suit your

preferences and budget.

Competitive Premium Rates: Benefit from competitive premium rates and customizable coverage options designed to provide maximum value for your investment.

24/7 Customer Support: Access dedicated customer support services round the clock to address any queries or concerns regarding your motor insurance policy.

Digital Tools and Services: Enjoy convenient account access, policy management, and claims processing through cutting-edge technology and digital platforms like the Leadway VehiScanner AI

Don’t leave the protection of your car and your financial future to chance. Take action today by choosing any of The Leadway Auto Insurance options. With our expertise, commitment, and personalized approach, we’ll help you navigate the complexities of Auto Insurance and secure peace of mind on the road. To learn more about the different Auto Insurance options available at Leadway Assurance and how we can help you choose the right Auto Insurance cover for your car in 2024, contact us today or visit our website for more information.

Add a comment