When WACOT Rice Limited (WRL) inaugurated a state-of-the-art facility in Kebbi state in August 2017, its main purpose was to produce premium household brands of parboiled rice for Nigerians. Today, the company has revolutionised the rice industry, processing 120,000 metric tonnes of paddy per annum at the Kebbi facility. The two main household brands of parboiled rice — Big Bull and Patriot — are also at quality par with foreign rice in the market.

WRL, a subsidiary of Tropical General Investments Group, is a Nigerian rice processing company operating one of the largest rice mills in Africa and sources paddy from various rice-producing states across Nigeria.

WACOT uses outgrower farming programmes with paddy farmers to boost their yields and guarantees off-take through a buyback arrangement.

In the space of five years, the company said it has created more than 3,000 direct and indirect employment in the state. It is also leveraging its networks to create enabling environment for farmers and onboard them into the financial inclusion space.

Advertisement

According to the latest financial inclusion report by Enhancing Financial Innovation & Access (EFInA), about 36 percent of the adult population (106 million), representing 38 million citizens, do not have access to financial services in Nigeria. Most people in this category are from the northern part of the country.

Farouk Gumel, chairman of WACOT Rice, said the organisation’s plan is to ensure farmers have adequate identification to transact seamlessly and not shortchanged for lack of financial records.

“What we are doing with financial inclusion is for people to get identified by the system and the system identify them as eligible citizens to get NIN, BVN and eventually open bank accounts,” he told TheCable in Kebbi.

Advertisement

“We will continue to make sure we capture people, most farmers, into the banking platform.”

HELPING THOUSANDS OF FARMERS, FEEDING MILLIONS OF NIGERIANS

In Kebbi, WACOT Rice Mill processes 120,000MT of paddy per annum through procurement of paddy from over 30,000 farmers in the state and other paddy-producing states.

Advertisement

Annually, the company said its total procurement is worth about N27 billion. Using a structured outgrower programme, it engages tens of thousands of rice farmers who are provided with quality agri-inputs, capacity building and technical support in addition to guaranteed offtake at harvest. The programme ensures an adequate supply of agricultural products and empowers farmers’ livelihood.

STRATEGIC PARTNERSHIP WITH USAID

In December 2020, WRL partnered with USAID’s West African Trade and Investment Hub on a $10 million outgrower expansion project in Kebbi.

The 3-year project allows WACOT to register an additional 5,143 farmers to complement its already existing outgrower network in the state. The new farmers also cultivate over 5,000 additional hectares of land, thereby producing over 20,000 tons of paddy for the Kebbi rice mill.

Advertisement

The smallholder farmers benefitting from the deal include those from Argungu, Augie, Suru and Dandi LGA’s of Kebbi through the implementation of dry season cycles to encourage increased dry season cultivation as most initiatives tend to focus only on wet season farming.

On its own, the project is expected to create 2,000 jobs and ensure youth and women inclusion as well as yield improvement by 50 percent from baseline through capacity building to enhance better farming techniques.

Advertisement

THE AUDACIOUS MOVE ON FINANCIAL INCLUSION

The remote location of most communities in Kebbi hinders accessibility to banks, POS or automated teller machines (ATMs). As a result, farmers have been averse to opening bank accounts for cooperatives and receipts of paddy payments. This affected the volumes of paddy bought back in the first year of the USAID project, the company said.

Advertisement

As part of efforts to ensure financial inclusion, the parent company, TGI, recently acquired the majority stakes in Union Bank Plc. The audacious move forms part of efforts to ensure farmers get paid through financial institutions.

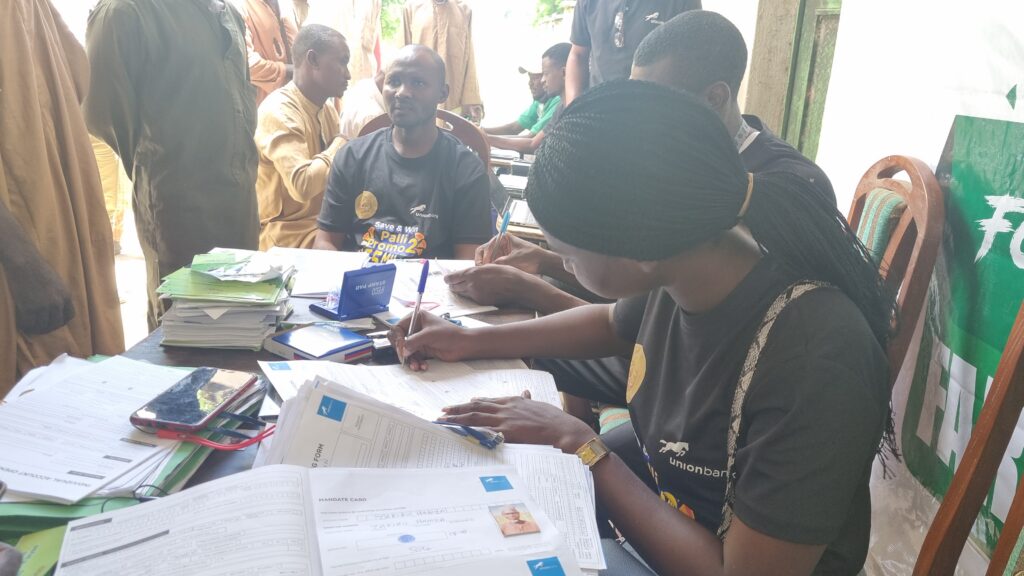

Through Kebbi Financial Inclusion Drive (KFID), WACOT, in collaboration with Union Bank, embarked on a bold attempt to financially include over 7,000 farmers across Argungu, Augie, Suru and Dandi ahead of the farming cycle.

Advertisement

When TheCable visited the registration point in the Augie LGA area of Kebbi, thousand of villagers flocked to the centre to register for national identity cards, bank verification numbers (BVN) and account openings.

Abubakar Musa, a farmer in Tiggi village in Augie, said apart from supporting farmers with fertiliser, the company has helped him and others to open bank accounts without stress.

“We are gathered here to celebrate WACOT. Honestly, we knew nothing about the company until it came into this community of ours, that was when we realised that this company is a blessing to the people of this country,” Musa told TheCable.

“WACOT has helped farmers in different ways, especially in irrigation farming. They support us with fertiliser and pesticides and also have personnel who we associate with and enquire about how our farming is going or ask if there is any issue so that they’ll provide solutions for us.

“It’s through this way that we will also show our appreciation to the company. Farmers are really enjoying this programme (outgrower expansion project) because it is benefiting.

“WACOT gives farmers fertiliser and won’t even ask for it until you’re done farming. It’s after you’re done farming you’ll return what was given to you and when you do so, the company would show their interest in buying what you produced and pay you. Therefore, this is something to celebrate.”

Musa said the financial inclusion drive is a welcome idea for them in the community.

“I now have a secret account. I can use put my money and use it during rainy times,” he said.

“They’ll open an account for you for free, including BVN registration, which when in banks takes time. You’ll be told to come back tomorrow or on a certain day.”

Speaking at the centre, Gumel said financial inclusion for smallholder farmers is central to a long-term transformation of their livelihoods.

Gumel, who also doubles as chairman of Union Bank Plc, said KFID is designed to simulate a one-stop shop account-opening platform, especially for smallholders without any formal identification document or requisite support.

“To engender ease of access to financial services, 50 mobile banking hubs/agents will be stationed across farmer communities in the four LGAs to provide primary banking services,” he said.

“In addition, two smart banking hubs will be established with a wider range of services in selected cities.

“It is centred on a multi-stakeholder alliance across the traditional leadership, the courts, the National Identity Management Commission and most importantly — our farmers.”

He added that the ultimate goal is to ensure that farmers can receive payments seamlessly at harvest while being empowered to make crucial financial and investment decisions for their households.

ANOTHER RICE MILL UNDERWAY IN KEBBI

By 2023, the company plans to expand its milling capacity to 240,000 MT per annum as it moves to conclude the construction of another rice mill facility.

When completed, the $50 million rice mill, located beside the current factory in Argungun, Kebbi, will have a production capacity of 120,000MT per annum and a power plant like the current one. It would also double the staff strength and empower more local farmers.

Atiku Bagudu, governor of Kebbi, said the second rice mill in Argungu was a testimony that Nigeria has attained self-sufficiency in rice production.

“WACOT has really demonstrated that this is real, and we can feed our immediate neighbours and other parts of the world, especially with rice,” he said.

“The farmers are doubling their capacity, and work is in progress. They have promised to commission the project before May 29, 2023, and from what I saw, it will be real.

“Nigeria is a big market for rice and that efforts of WACOT in the state had boosted financial inclusion.”

Bagudu thanked WACOT for supporting farmers with improved rice seeds and expressed happiness that the company has demonstrated that Nigeria is an investment destination.

Add a comment