Oando Plc has entered into a “definitive agreement” to sell 60% of its economic rights in the downstream sector to HV Investments II B.V.

The Nigerian company on Tuesday announced the $276 million agreement, which is subject to regulatory approvals and other formalities.

HVI, a joint venture owned by a fund advised by Helios Investment Partners and the Vitol Group, will also acquire 51% voting rights in Oando Downstream when the deal is finalised.

A special purpose vehicle will hold 100% of the economic interests and 49% of the voting rights of Oando Downstream, the oil and gas company said in a press statement.

Advertisement

The total consideration of US$461.3 million is to be funded by a US$276.8 million cash contribution from HVI and US$184.5 million in preference shares issued to Oando Plc.

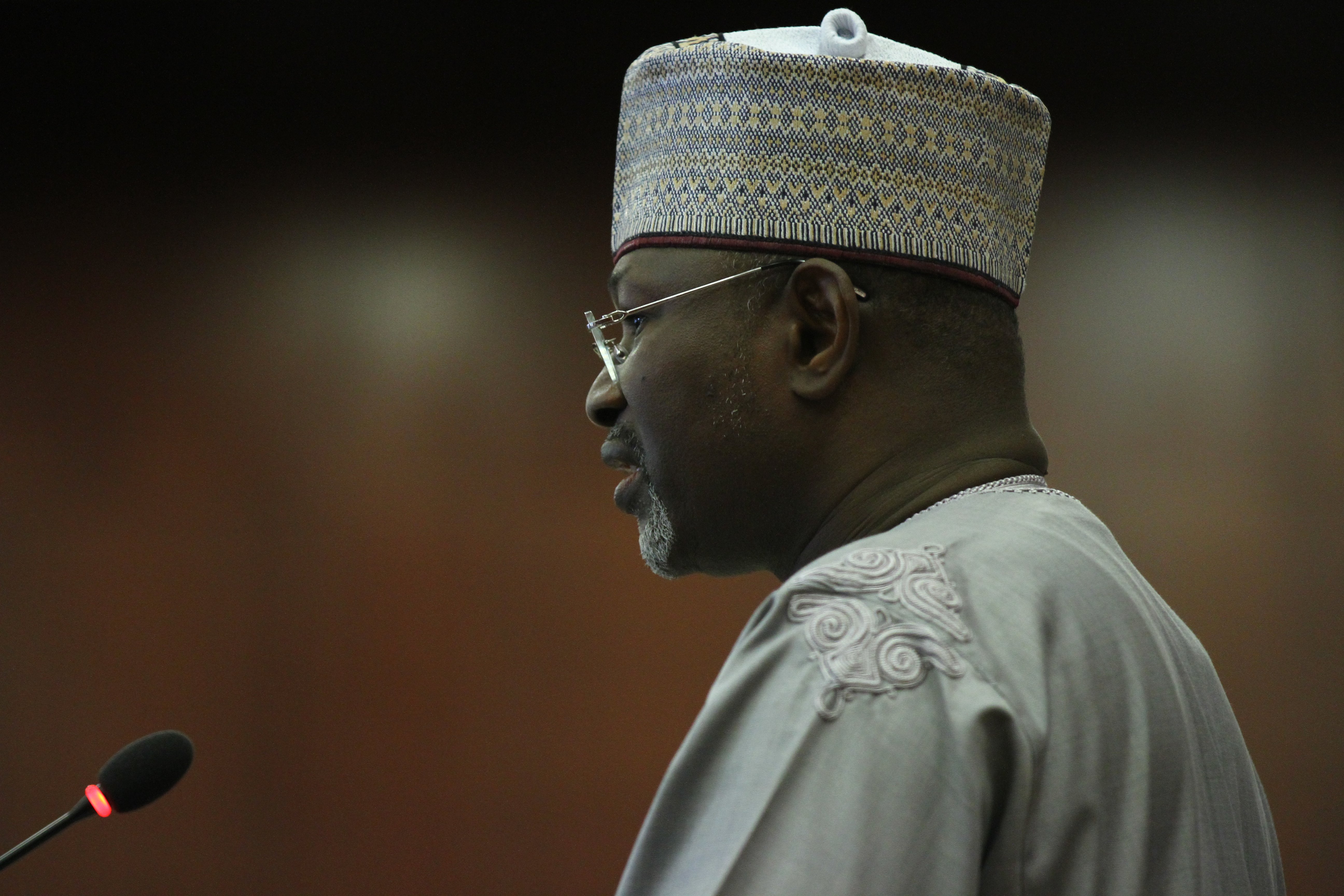

Commenting on the transaction, Wale Tinubu (pictured), CEO of Oando Plc, said: “This transaction is an exciting development in downstream West Africa. By working with Vitol, a global energy and commodities company and the largest independent trader of energy products, and Helios, a premier Africa-focused private investment firm, Oando Plc has repositioned Oando Downstream for a new era of investment growth and profitability.

“Importantly, the divestment enables Oando Plc to focus on its upstream and midstream businesses. Even as proceeds of the sale will be applied almost entirely to reducing Oando’s leverage, we underscore the portfolio rationalization achieved alongside the balance sheet optimisation.”

Advertisement

Ian Taylor, president and CEO of Vitol, said his company has a long history of working in Nigeria and is proud to have served our customers here over many years.

“This investment is a further reflection of our confidence in the Nigerian economy, and will be independent of the services we provide to our long standing Nigerian customers. We are looking forward to building this new downstream business, alongside our many other business activities in Nigeria,” he said.

Tope Lawani, co-founder and Managing Partner of Helios Investment Partners, said: “This is a market leading downstream energy business with a strong brand and exciting growth potential. Given our successful partnership with Vitol to create Vivo Energy, a leading downstream business which distributes and markets Shell-branded fuels and lubricants in 16 countries across Africa, we are confident that our expertise and regional presence will support the management team in capitalising on its strong market position and the compelling growth opportunities in Nigeria.”

The Oando downstream businesses are made up of Oando Marketing Plc, a petroleum product retailing and distribution company with over 400 retail outlets in Nigeria, Ghana and Togo; Oando Supply & Trading Limited, a physical trader of petroleum products in the sub-Saharan region, supplying and trading crude oil and refined petroleum products and Oando Trading Limited (Bermuda), which trades crude oil and refined petroleum products in international markets.

Advertisement

Others are Apapa SPM Limited, the marina jetty and subsea pipeline system capable of berthing large vessels, and Ebony Oil & Gas Limited, the Ghanaian supply and trading entity with a provisional bulk distribution company licence supplying white products.

Helios Investment Partners describes itself as “an Africa-focused investment firm” managing funds totalling over $3 billion.

Helios’ diverse LP base comprises a broad range of the world’s leading investors, including sovereign wealth funds, corporate and public pension funds, endowments and foundations, funds of funds, family offices and development finance institutions across the US, Europe, Asia and Africa.

The Vitol Group was founded in 1966 in Rotterdam, the Netherlands, and has grown to become a major participant in world commodity markets.

Advertisement

It is now the world’s largest independent energy trader, with trading portfolio including crude oil, oil products, LPG, LNG, natural gas, coal, electricity, agricultural products, metals and carbon emissions. Vitol trades with all the major national oil companies, the integrated oil majors and the independent refiners and traders.

Globally, Vitol trades over 5 million barrels of crude oil and oil products per day and revenues in 2014 were $270 billion.

Advertisement

Add a comment