The Federal Inland Revenue Service (FIRS) and the Institute of Chartered Accountants of Nigeria (ICAN) are not on the same page about the proposed 10-year tax holiday for new companies in the country.

While FIRS wants the retention of the current provision in company income tax act (CITA), which gives a five-year tax holiday to new companies, ICAN wants it to be reviewed upward.

At a public hearing in Abuja, Babatunde Fowler, FIRS chairman, argued in favour of a continuation of the status quo.

He said the five-year term “is more than sufficient” for investors to recoup their profit.

Advertisement

“When one looks at the telecommunications companies that were given incentives a lot of them actually did make profit before the pioneer status of the incentives even expired,” he said.

“So, I wouldn’t like us to grant such incentives for a period of 10 years. We believe that 10 years is a very long time for any business not to generate profit. And I believe investors would have taken due recognition of their investments and the time that they expect for profit to be made.”

Section 34 (a) of the proposed act states that “A new company going into business where infrastructures such as electricity, water or tarred road are not provided by the government shall be exempt from tax for the first ten years of its operation”.

Advertisement

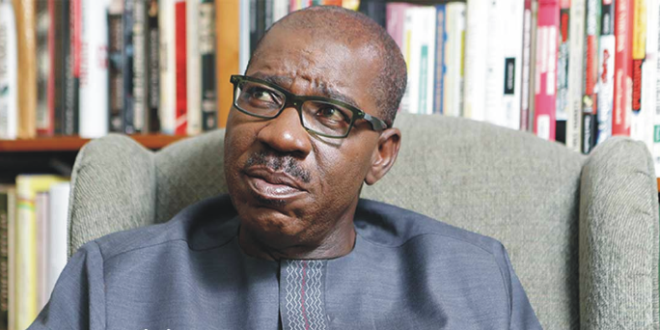

However, Isma’ila Zakari, ICAN president, said he was in support of 10 years because it would encourage entrepreneurs and existing companies to expand their operations.

“This is a welcome development that will encourage entrepreneurs to invest and expand their operations. However, this section should be amended to include existing companies,” he said.

“This would encourage existing companies to expand their operations so as to benefit from the incentives when they invest in such locations.

“We recommend that the new section should read as follows: ‘A new or existing company going into business where infrastructures such as electricity, water or tarred road are not provided by the government shall be exempted from tax on its operation for the first five (5) years for existing company and ten (10) years for a new company’.”

Advertisement

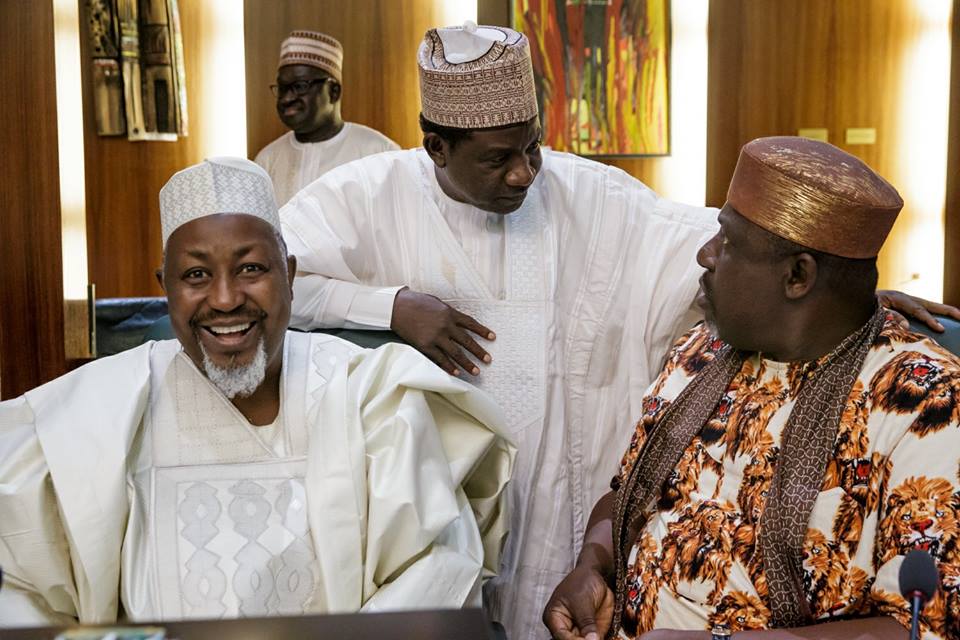

Senate President Bukola Saraki, who inaugurated the public hearing, said when passed into law, the CITA bill would provide employment opportunities for the unemployed youth.

“The proposed amendments will encourage investments in the industrial and mining sectors of the economy; especially in the rural areas where ordinarily it would have been unattractive to invest,” he said.

“It is expected that when the CITA bill is passed into law, economic activities that would be generated through tax moratorium assured by this bill, will pilot the much-canvassed employment opportunities for our qualified youths; and open up communities where these companies are sited.”

Advertisement

Add a comment