Kayode Egbetokun, inspector-general of police (IGP), says the enforcement of third-party insurance for vehicles will commence on February 1.

Egbetokun spoke in Abuja on Friday when the National Insurance Commission (NAICOM) officials visited him at the force headquarters.

Olusegun Ayo Omosehin, the commissioner for insurance at NAICOM, led the team to the IGP’s office.

In a statement, Muyiwa Adejobi, force spokesperson, said Omosehin sought the support of the Nigeria Police Force (NPF) for “nationwide enforcement of compulsory third-party insurance, which provides substantial benefits to all road users”.

Advertisement

Adejobi said the IGP stressed the need for vehicle owners to have third-party insurance.

“In his remarks, the IGP affirmed the importance of third-party insurance and announced February 1, 2025, as the commencement date for the enforcement of the relevant laws,” the statement reads.

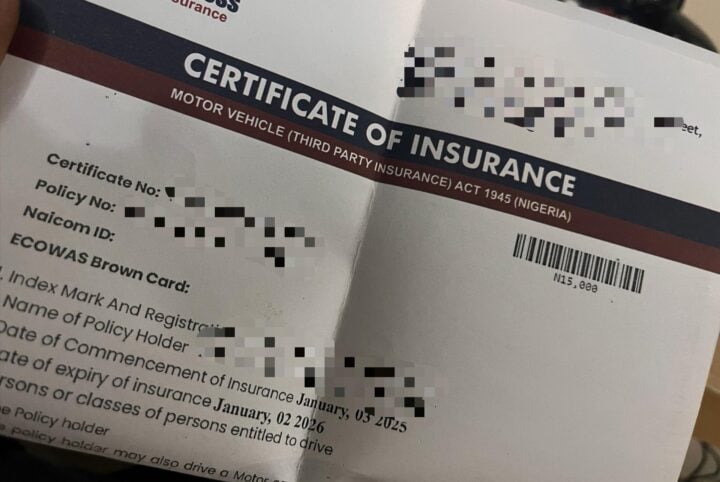

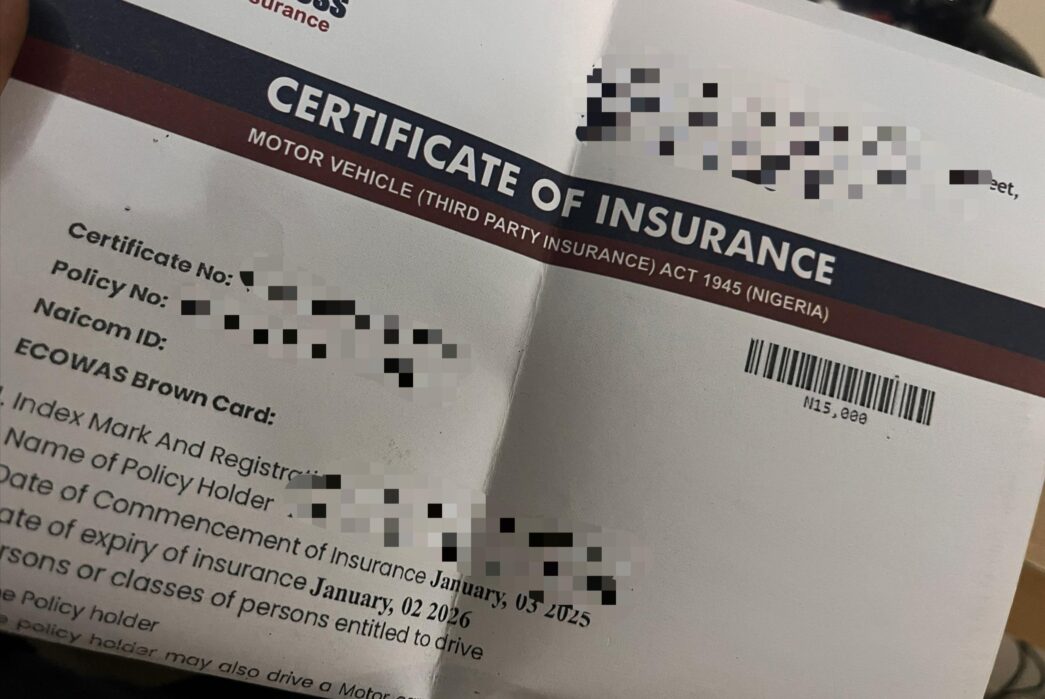

“The IGP further stated that section 68 of the Insurance Act and Section 312 of the 1945 Motor Vehicle (Third Party Insurance) Act mandate that all vehicle owners possess third-party insurance before operating their vehicles on public roads.

Advertisement

“He urged Nigerians to comply with these laws, as violations are punishable by imprisonment, fines, or both.

“The NPF remains steadfast in collaborating with all MDAs and companies in ensuring that the protection of lives and property of all citizens of the Federal Republic of Nigeria remains paramount.”

Third-party motor insurance is a type of coverage where the insurance company agrees to compensate the insured if they are sued or held legally responsible for injuries or damage caused to a third party.

Section 68 of the Insurance Act of 2003 states that “Insurance of third-party property damage: (1) No person shall use or cause or permit any other person to use a motor vehicle on a road unless a liability which he may thereby incur in respect of damage to the property of third parties is insured with an insurer registered under this Act.

Advertisement

“(2) The insurance taken out pursuant to subsection (1) of this section shall cover liability of not less than N1 million.

“(3) The insurance under this section shall be in addition to the liabilities required to be insured under the Motor Vehicle (Third Party) Insurance Act, 1950, and shall be regulated mutatis mutandis by the provisions of the Act.

“(4) A person who contravenes the provisions of this section commits an offence and is liable on conviction to a fine of N250,000 or imprisonment for one year or both.”

Advertisement

Add a comment