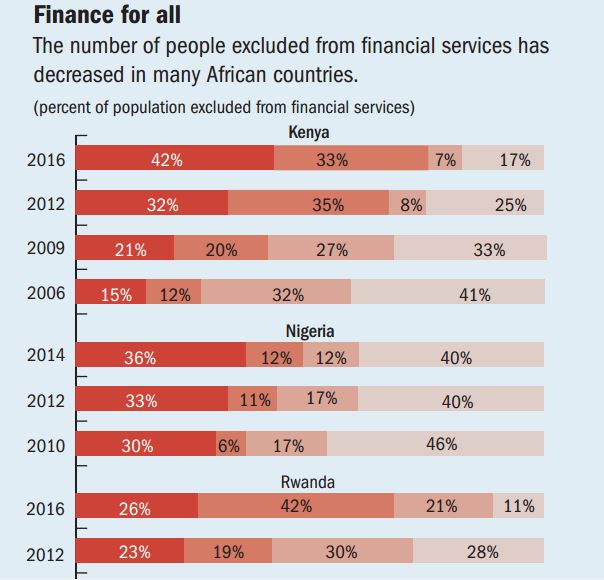

The International Monetary Fund (IMF) says 40 percent of Nigeria’s 180 million citizens are excluded from conventional banking, with only 36 percent covered by the formal banking sector.

IMF adds that another 12 percent of the population use informal banking modes to safe their monies, while another 12 percent use neither the semi-formal banks.

“It is the topic for policymakers in almost every developing economy—especially in sub-Saharan Africa,” IMF said in its Finance and Development magazine for June, 2016.

“Financial inclusion makes saving easier and enables accumulation and diversification of assets, boosting economic activity in the process.

Advertisement

“As its economies continue to grow, the region must take one crucial step if it wants to escape the poverty trap, and even more so now as commodity exporters face a downward terms-of-trade trend: deliver more financial services to people and institutions.

“Yet access to financial services for the poor has been limited. Minimum bank balance requirements, high ledger fees (costs for maintaining micro accounts), and the distance between poor people’s homes and bank outlets hinder their access to financial services and credit.

Advertisement

“Moreover, unaffordable collateral technology (the system of fixed assets required for loan approval) raises costs more than anything else, and the financial products available are often not suitable for customers with low and irregular income.”

IMF urged Nigerian banks to follow the Kenyan example, which has shown that “financial inclusion is more about opening financial services to the poor than just providing affordable financing”.

According to the Kenyan Central Bank, there are 2,400 Automated Teller Machines (ATMs) in the country and half of that are located in rural areas.

Advertisement