It has been stories of frustration and anger since the N200, N500 and N1,000 naira notes became scarce commodities following the redesigning of the currency by the Central Bank of Nigeria (CBN). For people that depend on cash to run their daily business activities, the naira scarcity has taken a toll on their finances while point of sale (PoS) merchants have taken advantage of the situation. TheCable’s SAMAD UTHMAN reports.

Hassana Aliyu was browsing through news feeds on her phone in her office, when she came across a headline detailing how the Central Bank of Nigeria (CBN) had redesigned the N200, N500 and N1000 notes.

Aliyu said she was delighted that the new naira notes would not only stop the rising inflation but also help curtail vote buying and douse terrorism financing in the country.

The 32-year-old Aliyu did not foresee any iota of frustration in the phase-out of the old naira notes until she was strapped for cash for four days after the stipulated deadline.

Advertisement

Aliyu said she had roamed different automated teller machines (ATMs) stands around her area in Bwari, Abuja, but she met long queues.

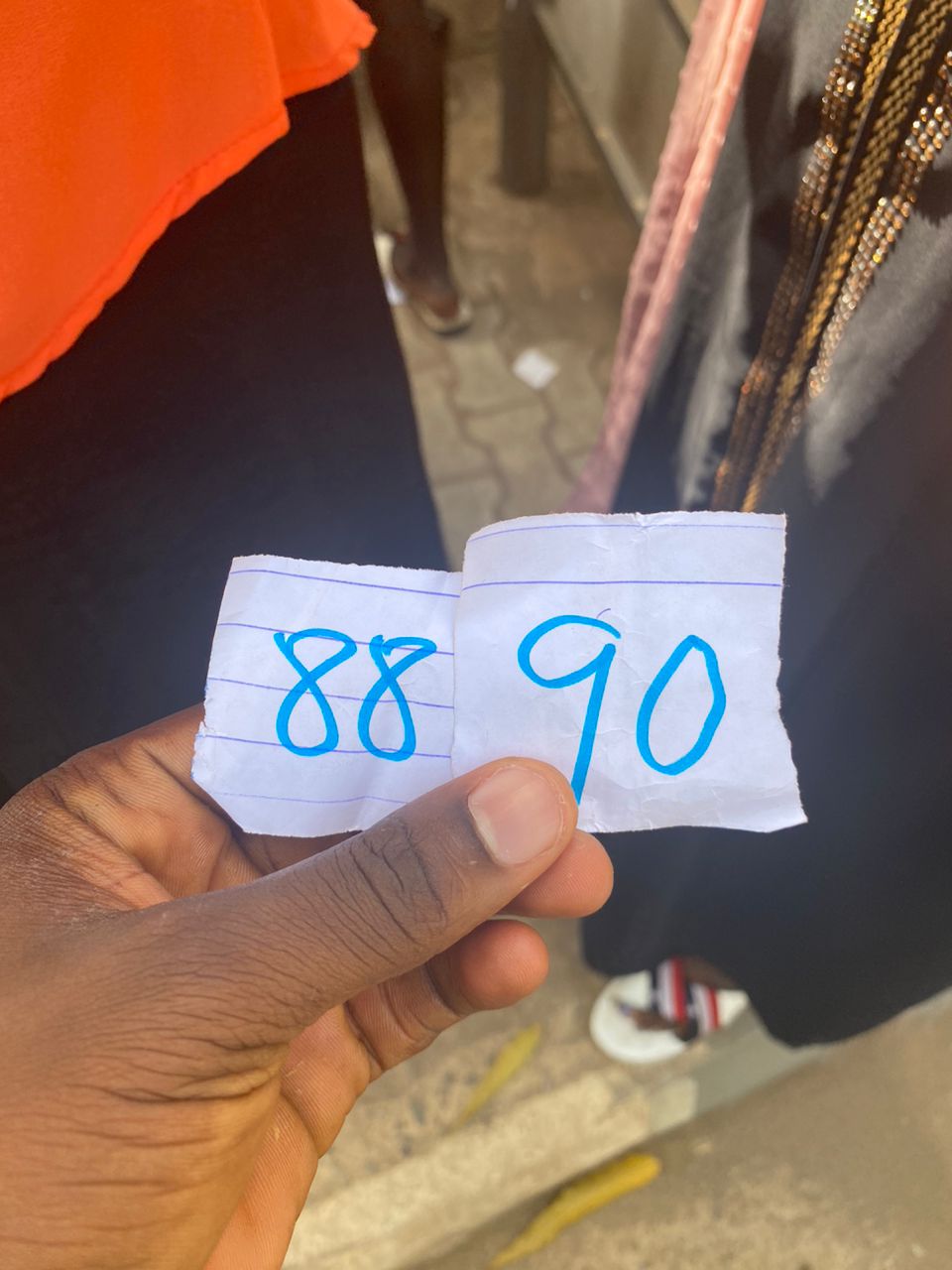

“I am so frustrated about everything in Nigeria. I have missed work for the fourth day. Thank God my colleagues and supervisors are understanding. There is no single cash on me for the fourth day. They kept fighting and beating each other at the ATM stands. I have money but I can’t withdraw it. I have been here since 6 am, yet I was number 88th in the queue,” Aliyu said, her face wet with perspiration.

“I went to join another queue at the First Bank over there as number 90. I hope you can understand my frustration. I can’t feed myself and my child. We have been feeding on the little food we have at home since. It is past 10 am, I haven’t eaten. No money at PoS stands either. The ones with money want me to pay N200 to get N1,000. Is that not extortion?”

Advertisement

Aliyu added that she has been unable to pay for her transport fare to work while her six-year-old child has been surviving on leftover food.

THE SCRAMBLE FOR CASH

Aliyu is one of the millions of Nigerians finding it hard to cope with the challenges posed by the scarcity of the new naira notes.

With about 1.6 million PoS machines in Nigeria, the merchants that could have served as the last resort of many Nigerians have also added to the problem.

Advertisement

The Central Bank of Nigeria (CBN) has continued to advise Nigerians to use PoS terminals — a critical aspect of its cashless policy — as alternative means for transactions.

The apex bank had given a deadline of January 31 for the validity of old notes — but it was recently extended to February 10.

And as the scramble for cash persists in banks and ATM galleries across the country, the PoS merchants are making quick cash by charging outrageous withdrawal fees.

Before the currency redesign policy began, a withdrawal of N1,000 to N9,000 attracts a N100 fee while N10,000 to 20,000 attracts N150 to N200.

Advertisement

Checks by TheCable across the FCT and Nasarawa revealed that as Nigerians are scrambling to obtain the new naira notes, PoS merchants are heavily profiting.

PoS merchants with the new naira notes now charge a N100 commission per N1,000 withdrawal. This means if Aliyu eventually gets cash through any PoS terminal, she would pay N1000 to withdraw N10,000

Advertisement

In some parts of Keffi, Nasarawa state capital, some PoS merchants are now charging as high as N150 per N1000 — and N1500 for N10,000.

The 10% and 15% PoS withdrawal fees are coming at a time Nigerians are grappling with various economic challenges including a hike in the cost of premium motor spirit (PMS) and rising inflation.

Advertisement

As of Monday, February 5, the commission rate had been hiked to 20% per transaction in Kaduna and some parts of Abuja.

In Kuje, a satellite town in Abuja, residents said the struggle for new naira notes has resulted in PoS merchants charging N600 on every N3,000 withdrawn.

Advertisement

‘WE MAY NOT SURVIVE THIS’

Haruna Cynthia, a plantain seller in Utako market, lamented that she is starved of customers.

Madam Cynthia, as she is fondly called, said her plantains are perishing as customers are only willing to pay through bank transfers — but she doesn’t have a bank account.

“See my goods perishing. We are here now for the fourth day. I don’t use a bank account. We eat from hand to mouth. People are asking for my bank account. I am sure the federal government didn’t put us into account before phasing out the old naira in two months,” she told TheCable reporter on Tuesday.

Madam Cynthia said many of the traders in the market are running at a loss as their sales have dropped.

Some of the PoS merchants interviewed by TheCable said the stress incurred before withdrawing cash from banks is the main reason behind the increment in commission rates.

In Keffi, a popular PoS merchant known as HopeWell, told TheCable that following the cancellation of over-the-counter withdrawal of new naira notes — which has now been reversed — operators had to seek any means possible to get the required cash for their business.

HopeWell said she would join queues at bank ATMs as early as 6 am after transferring N20,000 to five of her bank accounts with ATM cards.

She said the strategy has helped her circumvent the CBN’s policy of N20,000 daily withdrawal limit over the counter.

HopeWell added that most PoS operators resolve to buy at higher prices from cash holders which implies that their own commission rates also have to be increased.

“You can’t blame us. Everyone is feeling the heat. Since banks have refused to dispense cash, we also are buying from private citizens holding the cash. We need to calculate our gains too. It is a messed up cycle at the moment,” she said.

TheCable also observed that many PoS operators have shut down their services owing to a lack of cash.

The Association of Mobile Money and Bank Agents in Nigeria (AMMBAN) said over 80 percent of its members have shut down their operations due to the cash crunch in the country.

Hussein Olanrewaju, national chief aggregating officer of AMMBAN, told TheCable that the cash shortage has affected the means of livelihood of PoS operators nationwide.

‘ECONOMIC ACTIVITIES WILL BEAR THE BRUNT’

The increment in commission rates by PoS merchants is not limited to Abuja, Nasarawa and Kaduna alone. It is currently widespread across the country as economic pundits argue that the situation may be worse in far-flung communities that are home to most of Nigeria’s unbanked.

TheCable had reported that PoS merchants charge as high as N500 for N2,000 in some parts of Lagos, N300 for N1000 in Anambra and N1000 per N5000 in some parts of Ogun state.

Leo Ukpong, a professor of financial economics at the American University of Nigeria (AUN), said if the scarcity lingers for long, the country may witness an exponential decrease in the volume of economic activities.

“From an economic point of view, it is bad for consumers as well as for supplies of goods and services. This action will result in higher inflation and a decline in economic growth,” Ukpong said.

This is a special investigative project by Cable Newspaper Journalism Foundation (CNJF) in partnership with TheCable, supported by the MacArthur Foundation. Published materials are not views of the MacArthur Foundation.

Add a comment