The Nigerian Communications Commission (NCC) approved the request of telecommunications companies (telcos) to increase tariffs by 50 percent on January 20, placing the sector on a strong footing for survival amid reforms which have severely impacted Nigerians and businesses.

The move, deemed the first hike since 2013, was achieved after a relentless push by stakeholders, specifically Karl Toriola, MTN Nigeria’s chief executive officer (CEO), and one of the prominent voices behind the campaign.

In August 2024, Toriola painted a grim scenario of the country’s telecoms sector when he spoke at an industry investment forum in Lagos.

His submissions, partly woven around drying investments in the industry, addressed the sector’s challenges.

Advertisement

The CEO said the sector is “in a deep crisis” and “in an intensive care unit”, pointing out the severe sustainability straits rocking telecoms operators in Nigeria.

He said despite growth in the last two decades of liberalisation, the sector is no longer attractive to investors — warning that without swift changes, the flow of new investments could dry up completely.

WHAT DATA SAYS ON THE MATTER

Advertisement

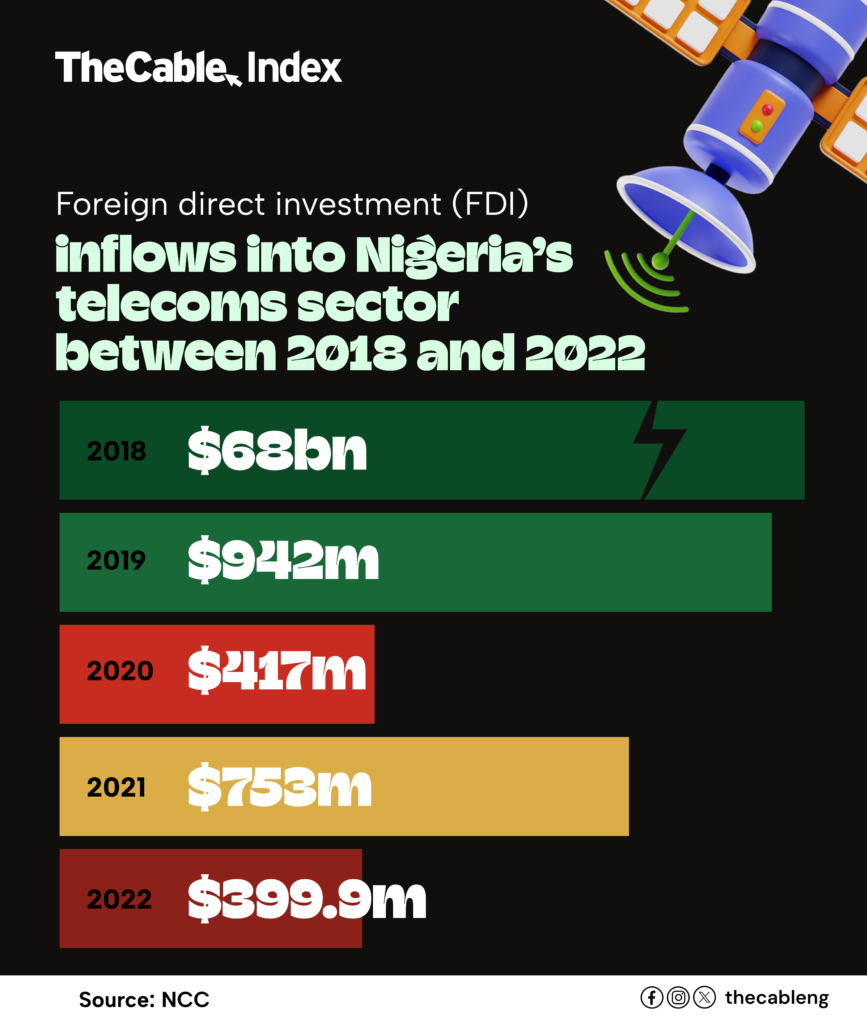

Examined by TheCable Index, data on investment inflows between 2018 and 2022 provided justification for the CEO’s outburst — and ultimately the recent tariff increase.

Before ex-President Muhammadu Buhari’s eight-year tenure ended, foreign direct investment (FDI) into the country’s telecoms industry fell by 99.4 percent in the period reviewed, according to the Nigerian Communications Commission’s (NCC) subscriber and network data annual report.

The report is an annual publication that provides data on the industry’s performance.

The NCC said the sector attracted $399.9 million in FDI in 2022, the latest report to date.

Advertisement

While the amount may appear quite impressive, it is a tremendous slump in a five-year trend reviewed from 2018 when foreign capital inflows into the sector peaked.

In 2018, the sector recorded capital inflows of $68 billion, the NCC said. The figure fell to $942,863,833 in 2019, slashing off $67,057,136,167 (about 98.6 percent).

The sector recorded a further drop in foreign investment to $417,481,615 in 2020, the report said. Soon after COVID-19, there was a significant increase by $334,562,831 to $753 million in 2021 before the huge fall in 2022 as mentioned above.

Advertisement

…BEYOND FDIs

Apart from drying FDIs, a review of Nigeria’s economic indicators shows that the operating environment has become more challenging.

Advertisement

This, experts say, has exacerbated the woes of mobile network operators (MNOs) as the sector is now threatened by rising operational costs.

For instance, Nigeria’s inflation rate is 24.48 percent as of January, when juxtaposed with the 9 percent recorded in 2013, according to data from the central bank. Energy costs have also surged, with a litre of diesel increasing from N200 12 years ago to N1,200 currently, based on available data. Similarly, a litre of petrol, which was N97 in 2013 now goes for about N900.

Advertisement

Nigeria’s foreign exchange rate has seen a significant increase from N157 to the dollar in 2013 to about N1,500. Businesses across diverse sectors have been forced to increase prices in response to inflation, FX volatility, and other macroeconomic factors.

In 2024, companies such as Nigerian Breweries Plc and Netflix adjusted prices multiple times. There have also been tariff hikes in other sectors, including the recent 15 percent port charges, 4 percent charge on the free-on-board (FOB) value of imports (though suspended), automated teller machine transaction fees, and electricity tariffs.

Advertisement

Last year, Nigerian bakers protested multiple times over the rising cost of production, with bread prices surging exponentially.

Industry analysts said the telecoms sector has not been immune to the macroeconomic issues. Airtel Africa had posted an $89 million net loss in the financial year 2023/2024 as the naira devaluation took its toll. MTN Nigeria also recorded a N514.9 billion FX loss in nine months of 2024.

It is also understood that the industry faces frequent fibre optic cable cuts due to road construction and vandalism, multiple taxations, and challenges in acquiring rights-of-way. Nigeria recorded about 50,000 telecoms cable cuts last year, according to Aminu Maida, NCC’s executive vice-chairman (EVC) and chief executive officer. MTN Nigeria alone reportedly spent at least N11 billion on cable repairs, a development that hints at the huge costs MNOs bear.

DATA RATES IN KEY AFRICAN ECONOMIES

TheCable Index’s analysis of global reports shows that Nigeria is one of the countries with the cheapest data rates.

A report by the cable.co.uk ranked Nigeria as one of the countries with the cheapest price for 1GB of data in the world in 2023. Nigeria was ranked 31 out of 237 countries, with an average cost of $0.39 for 1GB of data — the cheapest in West Africa.

Israel was ranked as number one at $0.02 for 1GB of data, according to the report.

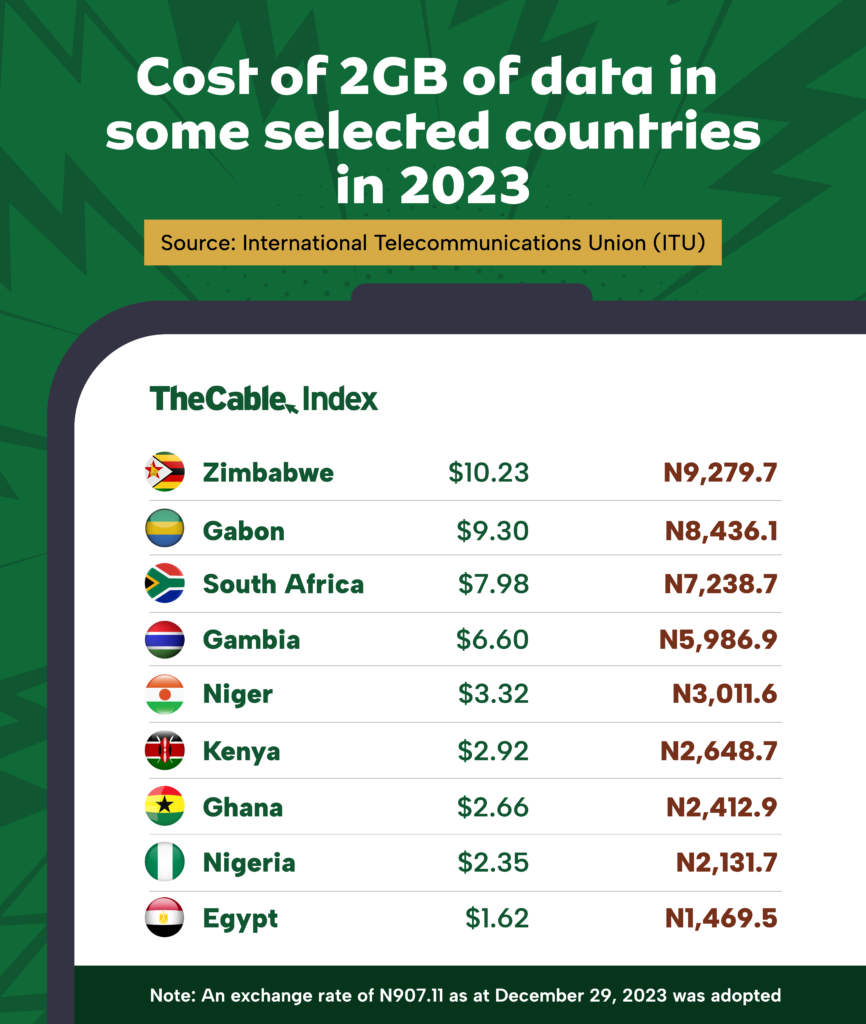

In addition, the International Telecommunications Union ITU, in its 2023 ICT services affordability report, said Nigeria has one of the lowest data rates in the world.

An examination of the cost of 2GB in select African economies showed that Nigerians paid $2.35 (N2,131.7 using the official FX rate of N907.11 as at December 29, 2023) for the aforementioned amount of data.

According to the report, the same 2GB costs about $7.98 or N7,238.7 in South Africa, $2.92 (N2,648.7) in Kenya, $2.66 (N2,412.9) in Ghana, $1.62 (N1,469.5) in Egypt, $3.32 (N3,011.6) in Niger, $9.3 (N8,436.1) in Gabon, $6.6 (N5,968.9) in Gambia, $1.84 (N1.669) in Ethiopia, and $10.23 (N9,279.7) in Zimbabwe.

TELECOMS GDP CONTRIBUTION IN SEVEN YEARS

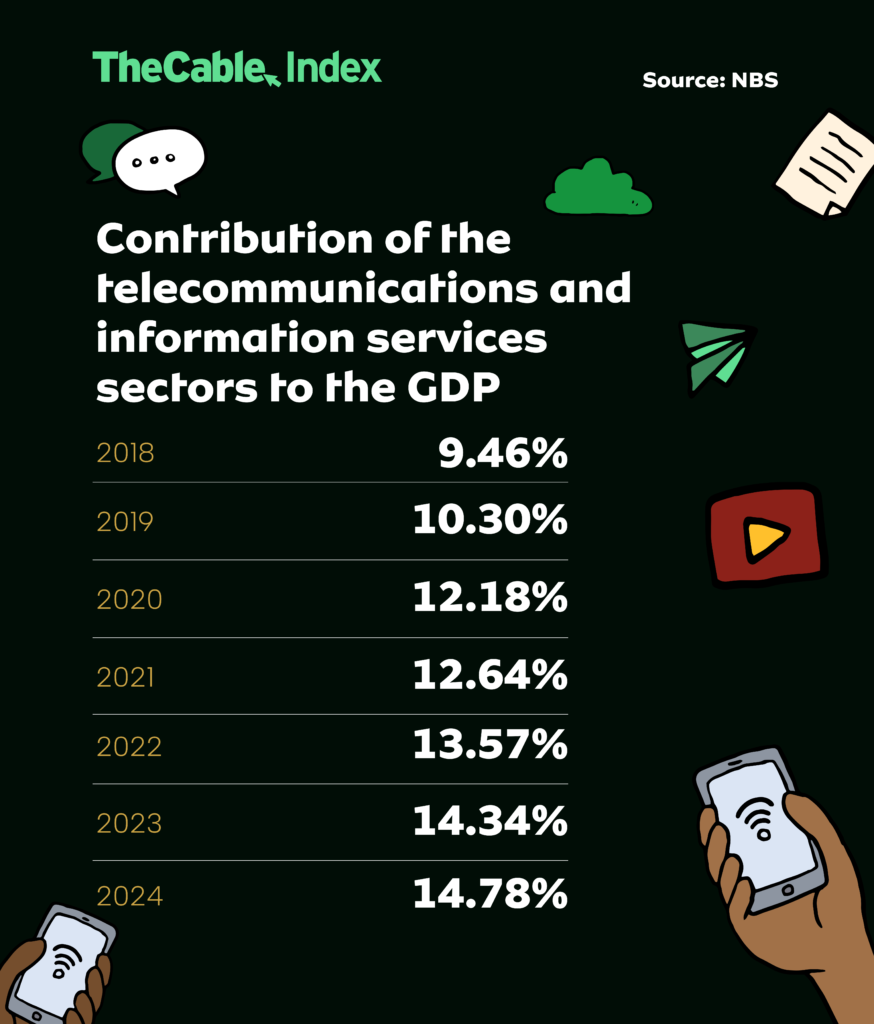

Despite this, the telecoms sector has consistently increased its contribution to Nigeria’s gross domestic product (GDP), positioning it as a major driver of the country’s economy.

According to a sectorial analysis of the National Bureau of Statistics (NBS) GDP report, the telecommunications and information services sectors recorded about 9.46 percent contribution to the economy in 2018.

The bureau said the sector’s contribution continued to rise, hitting 10.30 percent in 2019, 12.18 percent in 2020, and 12.64 percent in 2021. It further grew to 13.57 percent in 2022, 14.34 percent in 2023, and 14.78 percent in 2024.

‘TARIFF HIKE PREVENTED SHUTDOWN OF TELCOS’

According to stakeholders, the tariff increase by telcos was an act of survival, given the prevailing economic situation.

When the NCC approved the 50 percent tariffs increase (lower than the 100 percent sought by telcos), the agency said the aim was to address the significant gap between operational costs and current tariffs while ensuring that the delivery of services to consumers is not compromised.

“…the adjustment will enable telcos to invest in infrastructure and innovation, ultimately benefiting consumers through improved services and connectivity, including better network quality, enhanced customer service, and greater coverage,” the commission had said.

Various stakeholders had previously warned that unsustainable pricing could mean dire consequences for the sector.

Further rationalising the increase on February 27, Bosun Tijani, the minister of communications, innovation and digital economy, said companies were at risk of shutting down if tariffs were not raised.

Jobs would have been lost, Tijani added, reiterating a similar warning by Gbenga Adebayo, chairman of the Association of Licensed Telecommunications Operators of Nigeria (ALTON), that FX challenges could impact job creation since the industry heavily depends on dollars to import critical technology and infrastructure required to run telecoms networks.

WHAT TO EXPECT FROM IMPLEMENTATION

Following the regulator’s approval, telcos began implementing the 50 percent increase on February 17.

This means that telcos can increase prices to as high as 50 percent for their various bundles. In some cases, new bundles may be released and old ones scrapped.

“For example, MTN, which has over 100 different individual products (giving consumers and enterprises numerous data plan options), cancelled its 15GB data packaged priced at N2,000,” a source said.

“So, customers should not interpret them as ‘increased prices’, when they are totally new products.”

TheCable also understands that the government, through NCC, Federal Consumer Competition Protection Commission (FCCPC) and other relevant agencies, will enforce quality of service (QoS) standards and monitor investment fulfilment, especially since operators are expected to invest in network upgrades and service improvements following the hike.

OPPOSITION STILL PERSISTS

However, since the regulator’s nod and implementation commencement, telecoms have faced stiff opposition from various groups, particularly the Nigeria Labour Congress (NLC) and the house of representatives, which asked the ministry of communications, innovation and digital economy to suspend the approval granted to telcos to raise tariffs.

On its part, the NLC, on February 12, called on workers and the public to boycott the services of MTN, Airtel, and Globacom over the matter, described as “arbitrary” and demanding an immediate reversal.

The congress, which also threatened to protest the hike on March 1, temporarily suspended the industrial action after an agreement with the federal government to reduce the tariff increase to 35 percent.

Speaking in a communique on March 2, Joe Ajaero, president of the NLC, warned that the congress would protest if the 35 percent agreed upon is not implemented.

Add a comment