Tax evasion is a crime under Nigerian laws, but the government appears to have little or no morality to punish it. After all, it cannot claim to have been faithful with the use of taxes paid — in the opinion of citizens. In this special report, MAYOWA TIJANI attempts to find out why over 49 million Nigerians do not pay taxes, what can change their minds and how the citizens can voluntarily come into the tax net.

STORY HIGHLIGHTS

- One keke rider in Lagos pays N511,000 in taxes and levies every year

- Okada and keke riders relocate to Kano, Kaduna, Zaria after Lagos ban

- About 86 percent of ‘Instagram vendors’ do not pay taxes

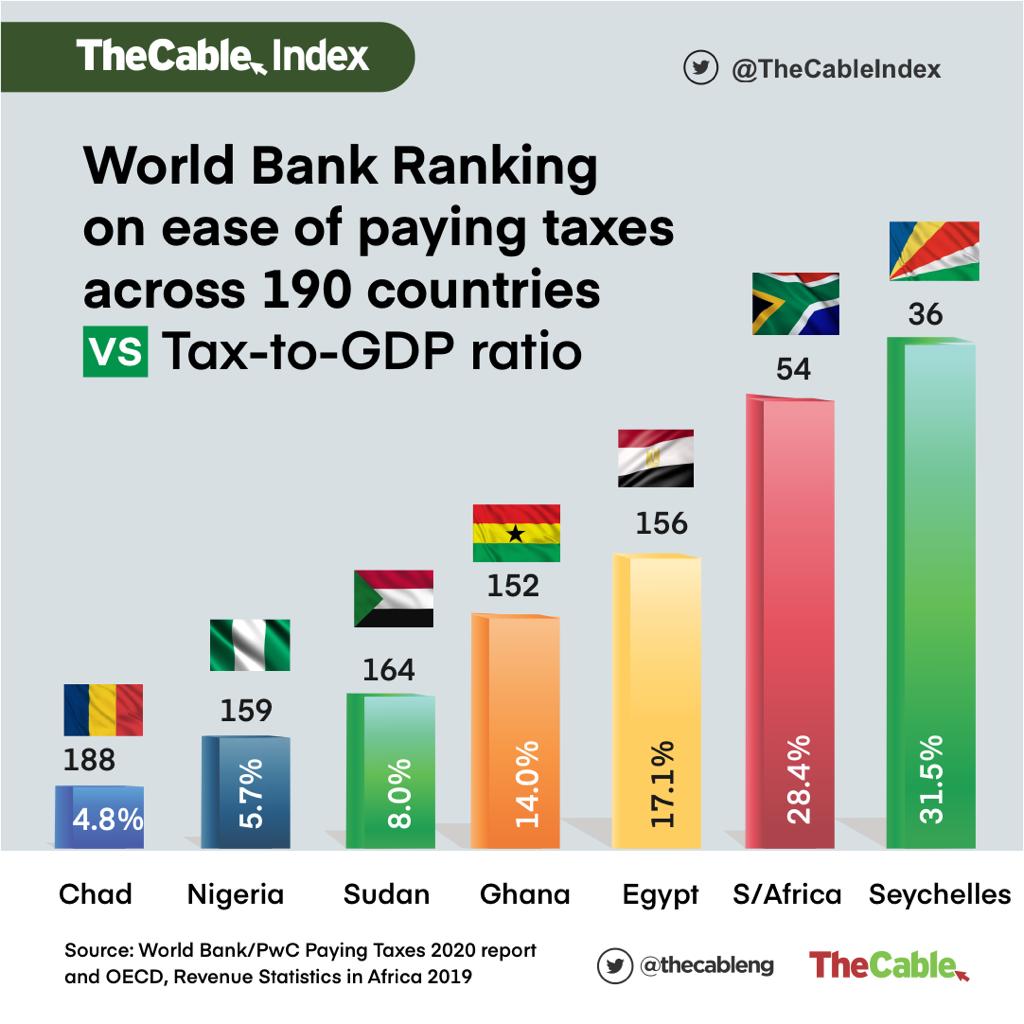

- Nigeria ranks 159 on World Bank-PwC ease of paying taxes report

- Possible tax solutions

“I paid N20,000 to get my keke (tricycle) from Lagos to Kaduna on a trailer. I also had to transport myself; everything I spent was N25,000,” Adamu Amodu tells TheCable as he fiddles with his little cellphone. He had travelled nearly 800 kilometres on the back of a trailer, like thousands of his colleagues, friends and family members who had to leave Nigeria’s most populated city, Lagos, after a flip-flop in government policy suddenly rendered them jobless.

Only a month ago, Adamu was fortunate to be called “employed”; he was not one of 23.1 million Nigerians the National Bureau of Statistics (NBS) refers to as unemployed. He made his livelihood by riding tricycle, popularly known as “Keke NAPEP” — named after a 2001 National Poverty Eradication Programme (NAPEP). Not only was he employed, but he was also a taxpayer who contributed to the purse of what is regarded as the fifth biggest economy in Africa — the Lagos economy.

Driving passengers across Victoria Island, Adeola Odeku, New Market, Obalende, Idejo, Ligali Ayorinde, Marwa and Lekki, Amodu had to pay taxes and levies to the state authorities and the National Union of Road Transport Workers (NURTW) to the tune of N511,000 if he worked every day of the year.

Advertisement

“We buy tickets N700, we pay booking N500, we pay the security levy N200 — in a day we pay N1,400,” he said, adding that this did not include how much money they had to pay to police officers by way of extortion. Adamu, who has been driving the tricycle for nearly six years, had been paying the taxes and levies for as long as he had worked here.

We ran an estimate, taking out two weeks every year when he usually travelled home to see his family. Adamu has paid at least N2.45 million in levies and taxes to the authorities in Lagos state (350 days per year x N1,400 x 5 years). For him, all his taxes and commitment to the state came to nothing when he was told he could no longer ply his trade in Lagos.

“When they wanted us to vote them in, they were begging us. They promised us they would not ban Keke Marwa (the original name for the tricycle when it was introduced into Lagos under Mohammed Buba Marwa as military administrator of Lagos state between 1996 and 1999), they would not ban okada. Before Sanwo-Olu won the election, he said we could work, okada can work, he’d not ban us. But after he won, he banned us,” Adamu laments.

Advertisement

Adamu is one of the numerous working Nigerians who told TheCable the main reason they would not pay taxes if they can avoid it — owing to the lack of trust in government, policy flip-flop and mismanagement of funds being their underlying reasons.

THE OILY PROBLEM WITH TAXES IN NIGERIA

According to the Federal Inland Revenue Service (FIRS) and the Joint Tax Board (JTB), only 20 million Nigerians paid taxes as of the second quarter of 2019. Based on its most recent labour force report, the National Bureau of Statistics (NBS) estimates that there are 69.5 million employed Nigerians who earn taxable incomes, with very few of them tax-exempt. This means at least 49 million gainfully employed Nigerians are avoiding or evading taxes.

Historically, non-oil taxes make a very small portion of government revenue in Nigeria. This has been due to the fact that most of the government’s income has been from massive oil earnings — in sale, royalties, and taxes. But the times have changed, oil prices have fallen drastically over the years, and the population has increased by no small measure over the course of time. The oil income is no longer enough to run the affairs of the state.

Advertisement

In 2019, Muhammad Sanusi II, the emir of Kano and former governor of the Central Bank of Nigeria (CBN), lamented how 70 percent of government revenue was for debt servicing, with the country simply managing 30 percent of revenue and acquiring more debts.

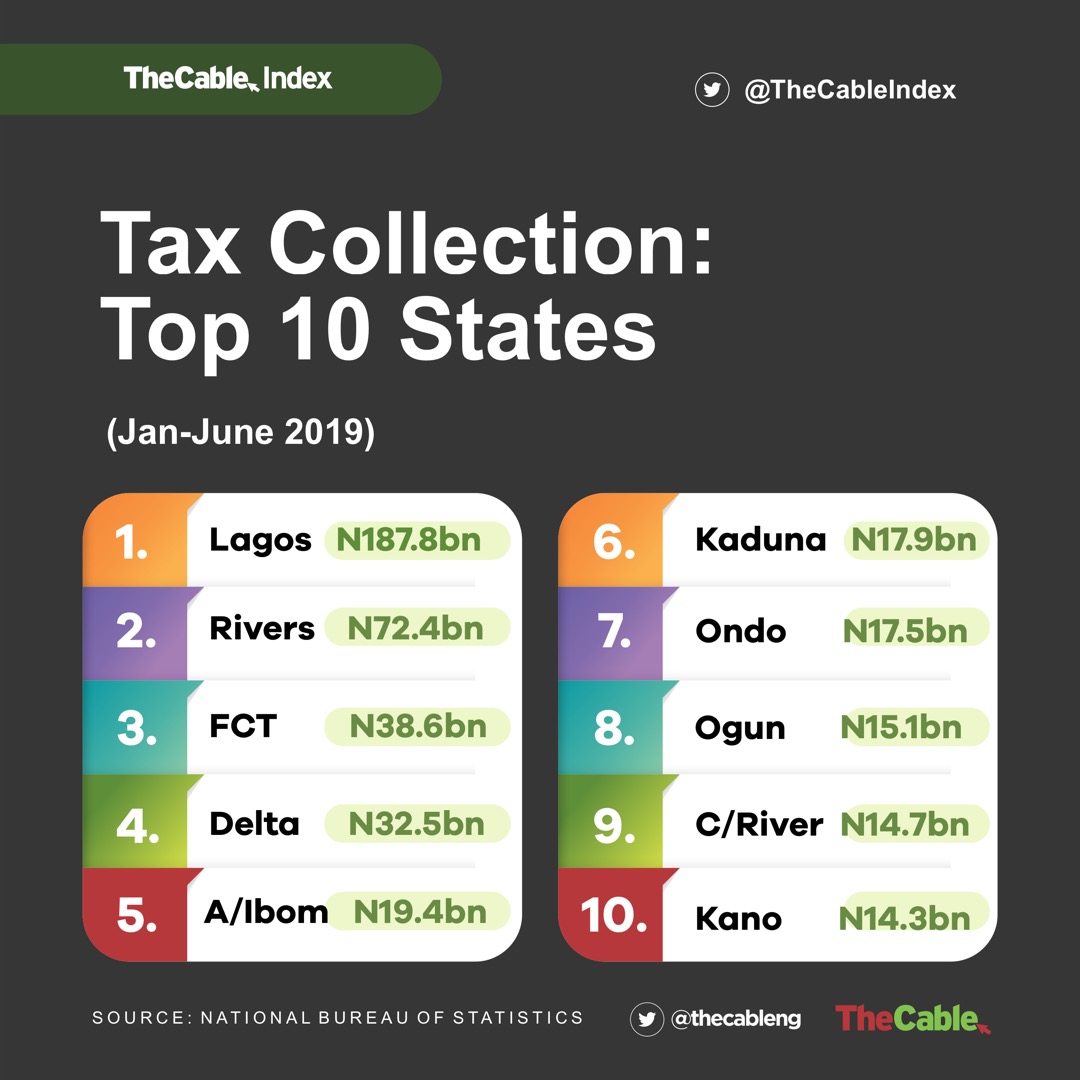

Following the fall in oil prices post-2014, the government has turned on the searchlight on taxes, especially non-oil taxes. This has raised the country’s federal revenue to a record N5.3 trillion in 2018 and N5 trillion in 2019. Despite the increase in revenue in naira terms, 49 million Nigerians still dodge taxes. To find the solutions, TheCable explored data from the NBS to find out the states who are the best performers with revenue generation via taxes and draw what lessons other states and the federal government can learn from the bright spots.

KADUNA AS A BRIGHT SPOT WHERE VULCANISERS PAY TAXES

In northern Nigeria, Kaduna was the top performer in the year 2019, growing its revenue by 67 percent by H1 2019 versus H1 2018 — and by the end of the year, the state Inland Revenue Service had generated N14.88 billion more than it generated the previous year. TheCable visited Kaduna to glean from what it had done to grow revenue at such a rate within a very short period of time.

Advertisement

In 2019, Nasir el-Rufai, governor of Kaduna state, appointed 35-year-old Zaid Abubakar as the chairman of Kaduna Inland Revenue Service (KADIRS). Abubakar, who holds a PhD in accounting from Al-Madina International University, Malaysia, is said to be one of the major forces behind Kaduna’s tax improvement.

Speaking to TheCable in Kaduna, Abubakar said the most important thing in revenue generation is identifying the revenue lines that a government wants to work on and improve the morale of the staff of the revenue-generating agencies.

Advertisement

He said research revealed that taxpayers’ perception was poor in Kaduna state, and all his team did was to leverage on that to educate the people and make them see that what is being paid is what is used for developmental projects in the state.

“We let them know that it is what they pay that we use for developmental projects. What we have done in the course of six month, I can assure you that taxpayers are well informed on what they need to do,” he told TheCable.

Advertisement

“Nobody wants to pay taxes, but what is actually working for us is that the state government is putting the resources into use. The taxpayers are seeing it on the ground, and that is what is actually incentivising the taxpayers to come forward.”

He said about 50 percent of the private sector is still out of the tax net. He highlighted that the informal sector has been doing well — paying what he called “presumptive tax”, where the sector is categorised into A, B, C and expected to pay a certain amount of money to the government monthly.

Advertisement

TheCable visited vulcanisers, shoemakers, traders, mechanics, noodles makers popularly known as Maishayi, among others, and found that virtually all of them pay taxes to the state government.

“Every time tax collectors come here, we pay our taxes because we know the benefits of paying taxes. Together with the government, we are all developing, we can see schools, hospitals, roads,” Ibrahim Garba, a vulcaniser at Rabah road, central Kaduna, who pays N1,000 per month in presumptive taxes, told TheCable.

INSTAGRAM, E-COMMERCE AS A POTENTIAL CHALLENGE

“[For] income received online, hardly can revenue-generating agencies track them, and that is the way to go,” Abubakar, thought to be the youngest state inland revenue chairman in Nigeria, said.

He added that his vision is to “ensure that those e-commerce businesses, those businesses that go online which are underground economy” can be tracked and taxed. “It is an area that [we] need to study and bring dexterity to,” he said.

TheCable ran a survey of 100 “Instagram businesses” and found that only 14 businesses pay any form of taxes — personal income tax, company income tax — especially the obvious value-added tax (VAT). This means 86 percent of the vendors surveyed did not pay VAT in the last year.

Using google forms, we also asked Nigerians if they ever had to pay VAT on items such as wigs, cosmetic products, shoes, clothing, jewelry, and various VAT-able items bought via Instagram. The responses showed that less than five percent of the 156 responses received indicated VAT payment, while 95 percent paid no VAT.

Virtually all the vendors who responded to our queries had different reasons for not paying taxes. Some claimed they were not aware of the need to pay taxes, stating that their businesses were not registered with the government.

Registered vendors also said they were not open to paying taxes because the government “would embezzle the taxes”. “My business is registered with CAC, I am aware I need to pay taxes, but I have not been paying,” a registered vendor told TheCable asking not to be named.

“For us, Instagram is a tax haven. Make your money, avoid the taxes.”

Emmanuel Adewale, a software developer, who spoke to TheCable in Lagos, said he was just switching jobs and now earns about N1 million from his new remote job but has no idea how to pay taxes, even though he is willing to.

“I have spoken to a few friends in the industry, they say I have to learn this and that. They say I have to pay personal income tax for now, and when I set up my remote gig company, I may have to pay company income tax. I think paying my money shouldn’t be this hard.”

IT’S STILL DIFFICULT TO PAY TAXES IN NIGERIA

The World Bank and PwC 2020 Paying Taxes report, which measures the ease of paying taxes across 190 countries of the world, puts Nigeria at 159th place, and one of the worst performers across the globe.

According to the report Zambia, Seychelles, Rwanda, South Africa are the top performers in Africa. The index, which measures the time it takes to pay taxes, the number of taxes paid, the existence of VAT refund, among others, show that it takes a company 343 hours to pay all its taxes in Nigeria. In Seychelles, it takes only 85 hours — four times less time than Nigeria.

As far as VAT refund goes, the report shows it exists in Nigeria, but the process for retrieving the refund is unknown to the public and does not exist in practice.

Juxtaposing the PwC report with the OECD revenue statistics for 2019, TheCable found that countries with less time for tax fillings and greater ease of payment methods have higher tax-to-GDP ratios. Simply put, the easier it is to pay taxes, the easier it is for countries to raise their tax-to-GDP ratio.

Clearly showing that one sure way for Nigeria to increase the tax-to-GDP ratio is by making it easier to pay taxes in the country, especially by taking advantage of technology solutions. The Muhammadu Buhari administration and the leadership of Babatunde Fowler as the chairman of FIRS has actually improved taxation in Nigeria.

The World Bank-PwC paying taxes report showed that it took 908 hours for a company to file its taxes in Nigeria five years ago. But that number has been cut down to 343 hours and Nigeria has jumped 20 places on the paying taxes ranking. But more needs to be done.

POSSIBLE SOLUTIONS

After speaking to over 100 Nigerians from vendors to tax experts, to taxpayers, to regulators, and exploring available data and tax reports, TheCable understands that the biggest challenge is tax education, efficient tax systems, and accountability on the part of the government. All these reflect the poor job done by the tax master and the non-compliance on the part of the taxpayers.

Taiwo Oyedele, head of tax and regulatory services at PwC, who was one of the drafters of the Finance Act 2020 said in a recent media interview that a good number of people do not want to pay taxes because they do not get direct benefits from the taxes they pay.

Oyedele said a huge chunk of taxes paid in the country goes to recurrent expenditure, which is difficult for Nigerians to see in terms of tangible infrastructure. He, therefore, suggested that some taxes should only go to capital projects, which could transform the nation — without hurting human capital development.

“One of the things I am hoping we get into the process is for government to say we have certain taxes that the money cannot be used for recurrent expenditure. So, these taxes can only fund capital projects,” he said.

While he suggested that oil taxes should go to capital projects and human development, some of the low and middle-income earners who spoke to TheCable want their taxes funneled directly to capital projects that they can see.

“As a group, each and every one of us pays the sum of N200 every end of month, and our taxes are collated and sent to the government,” Bashir Sani Mohammed, a middle-aged technician at Mando Mechanic Village, Kaduna, told TheCable.

Mohammed believes his taxes were used in fixing the recently-commissioned Kaduna-Sokoto road.

“To convince me or any Nigerian to pay taxes, the means is as simple as simplifying the payment process and making the administration of tax proceeds transparent; I want to see the road my tax built, the hospital my tax fixed, the child my tax educated,” Adewale said.

“Is that too much to ask?”

With assistance from Bulus Blessing.

This is a special piece of solutions journalism by Cable Newspaper Journalism Foundation (CNJF) in partnership with TheCable. It was part-funded by MacArthur Foundation and a third party.

Add a comment