On Thursday, the national assembly approved the request of President Muhammadu Buhari to earmark N4 trillion for petrol subsidy in 2022.

Subsidy or under-recovery is the underpriced sales of premium motor spirit (PMS), better known as petrol.

The lower and upper legislative chambers approved the president’s request after they considered reports of the finance committees.

The committees also revised the 2022 medium-term expenditure framework (MTEF) and fiscal strategy paper (FSP) to accommodate the president’s request.

Advertisement

The national assembly raised the oil benchmark to $73 per barrel and reduced production output to 1.6 million barrels per day.

The federal government had postponed the planned petrol subsidy removal, citing “high inflation and economic hardship”.

SUBSIDY PAYMENTS IMPACTED NNPC REVENUE

Advertisement

According to an analysis by TheCable Index, the Nigeria National Petroleum Corporation (NNPC) had been deducting from oil revenue to fund the unpriced sales of petrol to Nigerians, affecting revenue projects for the three tiers of government and developmental projects.

In 2021, petrol subsidy payments gulped N1.43 trillion, shrinking revenue accrued to the federation account to N542 billion — a shortfall from the projected N2.51 trillion.

For instance, the current subsidy provision is more than the fund budgeted for education in the last five years.

Between 2018 and 2022, the federal government budgeted N3.75 trillion, according to details from the Budget Office.

Advertisement

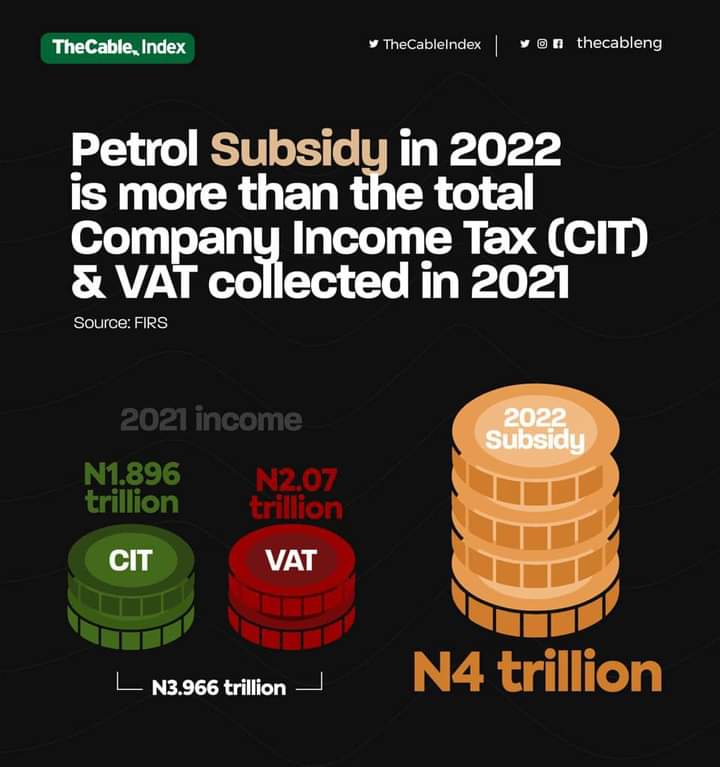

2022 FUEL SUBSIDY PROVISION MORE THAN TOTAL CIT, VAT REVENUE COLLECTED IN 2021

Data from the Federal Inland Revenue Service (FIRS) obtained by TheCable Index painted a gloomy picture of Nigeria’s revenue push and spending on subsiding petrol.

According to the data, the federation collected an estimated N3.9 trillion in 2021 from value-added tax (VAT) and company income tax (CIT).

Advertisement

The proceeds from VAT totalled N2.07 trillion, while CIT collections accounted for N1.896 trillion.

RISING PETROL SUBSIDIES POSE DEBT SUSTAINABILITY CONCERNS FOR NIGERIA

Advertisement

Shubham Chaudhuri, World Bank country director, explained that the choice of removing subsidies is Nigeria’s decision to make.

In its latest Africa’s Pulse report, World Bank said Nigeria’s increasing fuel subsidy could pose debt sustainability concerns for the country.

Advertisement

According to the bank, the rising cost of subsidies could also weaken the country’s public finance.

The bank also added that the country’s soaring military spending and debt servicing costs could prey on the country’s debt sustainability level.

Advertisement

Add a comment