Within the first seven days of March, the power sector lost about N6.8 billion to challenges related to insufficient gas supply to electricity generation companies (GenCos) and other constraints. But this is not a new thing in the sector. In 2020, the sector lost N1.71 billion in just one day over these constraints, and the losses keep mounting daily.

While the federal government is currently pushing for full implementation of its autogas initiative to make Nigerians use gas for their cars, the country is producing less than 5,500 megawatts (MW) of electricity for its teeming population owing to limitations from low gas supply to power plants. Misplaced priority, some would say. For over 200 million people, 5,500MW electricity supply — out of over 13,000MW generation capacity — implies erratic power supply and lack of energy access in some parts of the country.

In 2020, the Transmission Company of Nigeria (TCN) attributed the country’s epileptic power system to gas constraints, hampering the production capacities of generating companies (GenCos).

Some of the affected thermal power stations were Sapele NIPP, Olorunsogo NIPP, Ihovbor NIPP and Azura Edo, Egbin, Sapele, Delta, Geregu, Omotosho, Olorunsogo, Geregu NIPP, Alaoji NIPP, Omotosho NIPP, Odukpani NIPP, Okpai and Omoku power generating plants. In fact, four of them generated zero megawatts.

Advertisement

Out of the 28 electricity generation companies (GenCos), only three are hydro — Shiroro, Kainji and Jebba — while others are gas-fired plants. Inevitably, 25 need a constant supply of gas to produce electricity.

The latest quarterly report of the Nigerian Electricity Regulatory Commission (NERC) shows that gas supply shortage remains a troubling challenge in the sector.

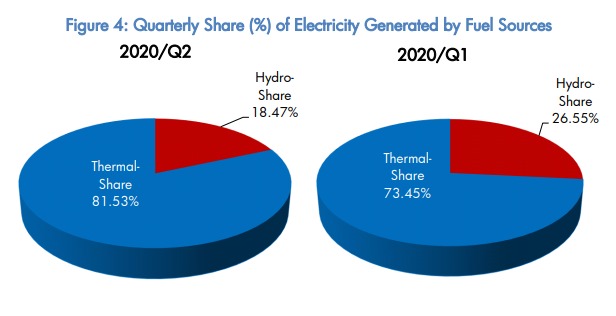

“Gas continues to dominate the electricity generation mix accounting for 81.53% of the electricity generated during the second quarter of 2020. This implies that approximately 8.15kWh of every 10kWh of electric energy generated in Nigeria in the second quarter of 2020 came from gas,” the NERC report said.

Advertisement

But why would gas be an issue for the power sector in a country that has the largest gas reserves on the continent, while the energy demands of its population are not met?

SUFFERING AMID PLENTY

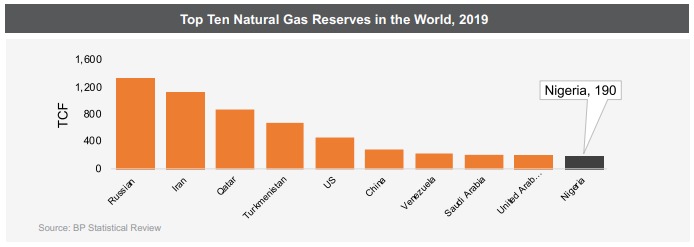

Nigeria holds the largest natural gas reserves in Africa — and the ninth largest globally — with an estimate of 200.79 trillion cubic feet (Tcf), yet only a little is tapped. The reserve is estimated to rise to 210.8 tcf by 2022. Unarguably, Nigeria’s oil and gas sector is the mainstay of the country’s economy.

Advertisement

According to Mordecai Ladan, director of the Department of Petroleum Resources (DPR), the country’s gas reserves is more than its crude oil reserves. He added that the nation’s daily gas production stood at 1.2 billion standard cubic feet (scuf) with 41 percent of the daily production exported while 48 percent went to the domestic market, and 11 percent flared.

“National gas reserves rose to 200.79 trillion cubic feet as of January 1, 2019, and that is what should be quoted going forward,” Ladan said.

“We have got greater potential if we are to increase the volume of gas reserves growth. It is very strategic to keep growing the reserves in order to boost export.

“It is also important to boost domestic gas supply to boost power supply. DPR will keep working with industry stakeholders to meet gas supply obligations and always crave for your cooperation.”

Advertisement

Meanwhile, the country is ranked also as one of the top 10 largest exporters of natural gas globally, yet there is a shortage of supply to its thermal plants, which has limited electricity production. Where does the problem lie?

Advertisement

THE PERENNIAL LIQUIDITY CHALLENGE

One of the major — possibly the biggest — challenges bedevilling the Nigerian Electricity Supply Industry (NESI) is the liquidity challenge; hence the sector is not financially viable.

Advertisement

The electricity distribution companies (DisCos) are finding it hard to collect significant revenue for energy distributed to customers. This also affects the Discos’ remittance to the Nigerian Bulk Electricity Trading Company (NBET) and market operators. Most of the DisCos do not offset up to 50 percent of the market invoice for energy received.

NBET is the body that buys power from the GenCos through power purchase agreements (PPAs) and sells to the DisCos through vesting contracts.

Advertisement

As a result of low remittances by the DisCos, NBET too has been unable to meet its obligations to GenCos. The ripple effect means GenCos too will be unable to pay gas suppliers. A key operational and financial data of the industry indicates that between January 2019 to September 2020, NBET a payment shortfall of N865 billion to GenCos.

In 2019, GenCos threatened to shut down power plants across the country if the federal government failed to intervene in the challenges troubling them.

“GenCos indebtedness to their gas suppliers is due to NBET’s indebtedness to them. No Genco has any outstanding gas payment that is more than what NBET is owing the Genco. Put differently, NBET is indirectly charging 0.75% for paying its debt to GenCos!!!” the Association of Power Generation Companies (APGC), the umbrella body for GenCos, said.

To resolve this, the federal government came up with the Power Assurance Guarantee (PAG), like the N701 billion released in 2017, for NBET to guarantee payment for the evacuation of electricity produced by the GenCos, so that they can pay gas suppliers. Another N600 billion was later approved. With the expiration of the payment assurance scheme, GenCos raised the alarm over a N1.7 trillion shortfall.

ISSUES WITH GAS SUPPLY AGREEMENTS

Over time, gas producers have been cautious of investing in gas infrastructure in the country as a result of low gas prices and lack of assurance or guarantee of payment from the GenCos. Hence, the processes for gas supply agreements have been fraught with challenges.

A Gas Sale And Aggregation Agreement (GSAA), which is typically between the GenCo, gas supplier and the gas aggregation company, stipulates contractual framework, rights, obligations and risk allocation for gas supply to the GenCo.

The most prominent case was the sloppy gas supply deal between Calabar GenCo and Accugas Ltd, forcing the federal government to keep paying over $10 million monthly with or without gas supply to the plant.

Speaking on Monday at a one-day public hearing organised by the house of representatives joint committee on gas and petroleum resources, Mele Kyari, group managing director of the Nigerian National Petroleum Corporation (NNPC), said investors need clarity on fiscal terms before they can invest in gas development projects across the country.

“The PSC simply says the parties can sit down and agree on a framework for monetising the gas on terms that are mutually acceptable,” the NNPC GMD said.

However, the NERC said it will rally around stakeholders to ensure a lasting solution to the gas shortage challenge in the power sector.

“The Commission continued consultations with relevant stakeholders to develop lasting solutions to the gas impasse in the power industry,” the regulator recently said.

It must, however, be noted that a final solution to the low gas supply to GenCos may not break the electricity jinx in Nigeria. If the GenCos operate half of their full capacity of 13,000MW, they will be compelled to shut down some thermal plants because the transmission infrastructure cannot wheel beyond 6,000MW; while the DisCos, which are known for load rejection, cannot successfully distribute 5,000MW to Nigerian homes as a result of poor distribution network.

Support for this report was provided by the Premium Times Centre for Investigative Journalism (PTCIJ) through its Natural Resource and Extractive Programme

Add a comment