Various players from the nation’s insurance sector have called on the government to support the industry’s growth and development by collaborating with stakeholders to work out ways of streamlining the taxation applicable to the sector.

This was the major view that ran through submissions of the panelists and participants at the one-day seminar organized by Leadway Assurance in conjunction with Price waterhouseCoopers (PwC) in Lagos last week.

Adetola Adegbayi, executive director, general insurance, Leadway Assurance, who was one of the panelists, argued that the insurance industry currently suffers from a complex tax structure that has always resulted in multiple taxation without understanding the complexity of insurance placements.

She cited the example of deducting withholding tax from “re-insurance commission” as a fundamental problem because the practice did not recognise the fact that such “commissions”are not earnings but “a reserve against reinsurance credit risk” for premium liabilities passed through the books of the insurer”.

Advertisement

“Brokers, agents, insurers and re-insurers pay different taxes, all of which principally come from the premium paid by one entity – the insured – due to the nature of the insurance value chain”, she said.

Adegbayi, therefore,cautioned that unless all stakeholders came together “to collate the entire structure of the tax burden along the insurance value chain”, multiple taxation would continue to pose a threat to the well-being of the industry.

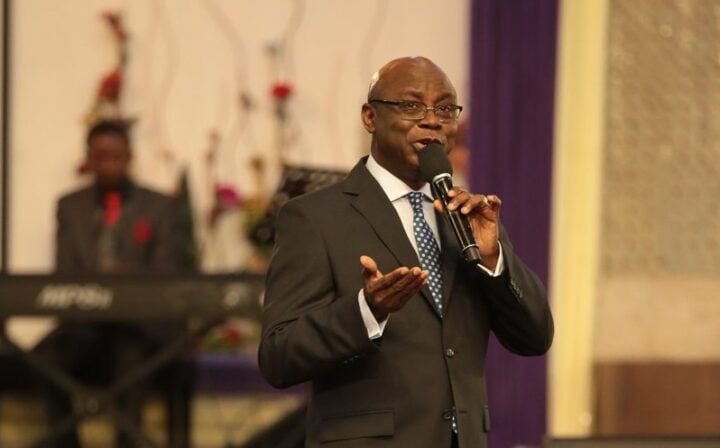

Taiwo Oyedele, of PricewaterhouseCoopers, urged the government to support the insurance industry through a review of the specific tax regime that concerns the sector, adding that as the industry was saddled with bearing the nation’s risks, it should not also be burdened with taxes.

Advertisement

According to him, Nigeria’s poor social infrastructure continues to create multiple incidence of socio-economic dislocations that impact heavily on the survival of the insurance sector.

In his words, “the growing rate of crimes in the society increases claims settlement, just as bad roads often lead to accidents, whichincrease claims. In the same way, poor health care brings about high death rate, thereby pushing claims up”.

Babatunde Fowler, executive chairman of FIRS, represented at the event by Toluwalase Akpomedaye, regional coordinator FIRS, said such sessions have helped foster understanding with other sectors of the economy.

He assured stakeholders that the FIRS was willing to work with the insurance industry to ensure growth and development, stressing that all the tax concerns expressed by operators in the industry were presently being looked into.

Advertisement

Fowler also charged operators in the industry to support the government by paying all necessary taxes, adding that the economy needed taxes to thrive.

Add a comment