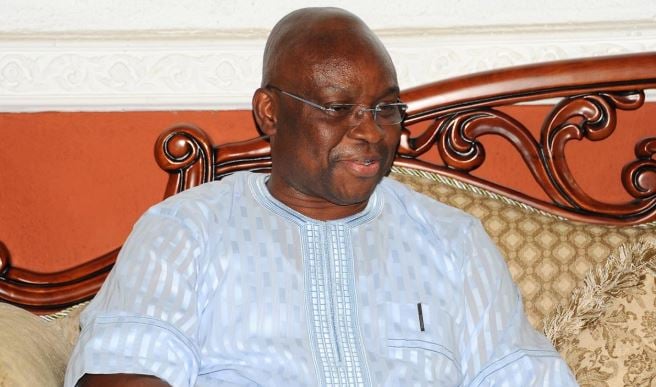

Benedict Oramah

Benedict Oramah, president of African Export-Import Bank (Afreximbank), has addressed the oil-for-cash loan agreement with the Nigerian National Petroleum Company (NNPC) Limited.

In an interview with Arise News posted on Sunday on X, Oramah said the $3.3 billion crude oil pre-payment loan obtained by NNPC has a 6 percent margin.

According to Oramah, who doubles as Afreximbank board chairman, the facility is a 5-year loan and the interest rate might still drop when inflation rate declines.

“We’re not talking about three years ago, four years ago. We’re talking of today where interest rates have gone up, and we’re just hoping that inflation will go down globally so that rates can start going down,” Oramah said.

Advertisement

“And in fact, if those rates start going down, the interest rate of this loan will start also going down. So that’s what I thought about it, about the pricing of the loan.”

He also said the interest rate on the loan is the base rate which governs the cost of funds.

Afreximbank president said anybody who wants to “compare it can compare it against the yields on the Nigerian bonds trading today”.

Advertisement

“What are the yields for a seven-year Nigerian bond? Most likely to be about 15 percent if not more. That is where the treasure is at,” Oramah said.

He also said the $3.3 billion loan will not be repaid with $12 billion.

Oramah said the facility is transparent, adding that there is nothing to hide.

TRANSACTION DETAILS SAY OTHERWISE

Advertisement

Details of the transaction reported by TheCable on January 4, 2024, showed Nigeria is expected to pay an interest of 11.85 percent per annum on the $3.3 billion “pre-export finance facility” (PxF).

A total of 164.25 million barrels of crude oil was pledged by Nigeria — which is 90,000 barrels per day — starting from 2024, to repay the loan through Project Gazelle Funding Ltd, an “orphan” special purpose vehicle (SPV) incorporated in Bahamas for the PxF.

According to data obtained from the Central Bank of Nigeria (CBN), at the beginning of 2024, a barrel of Nigerian oil was sold at the international market for $77.93 per barrel.

When pegged to the 164.25 million barrels of oil pledged by Nigeria, it equals $12.8 billion — which is about three times more than the loan taken.

Advertisement

LOAN HELPS ACUTE FX SHORTAGE

Oramah said the loan is effective, as it helps with the acute foreign exchange shortage in the country and stabilises the financial system.

Advertisement

“And you know there are things people do not know, maybe government will not be saying it, but I’m at liberty because we have a justification for doing what we did. It actually helps us stabilise the financial system,” he said.

“It’s the job of government to do what they know is right actually. Of course, it’s good for the people to criticise, ask questions and all that.

Advertisement

“But I just think that sometimes, people who are criticizing also have to be reasonable.”

Oramah added that the international institution is not the only lender of the $3.3 billion facility.

Advertisement

According to the details of the transaction, Nigeria will pay an interest of 11.85 percent per annum on the “pre-export finance facility” (PxF).

The NNPC has received the initial disbursement of $2.25 billion of the agreed $3 billion under the crude oil prepayment facility.

Add a comment