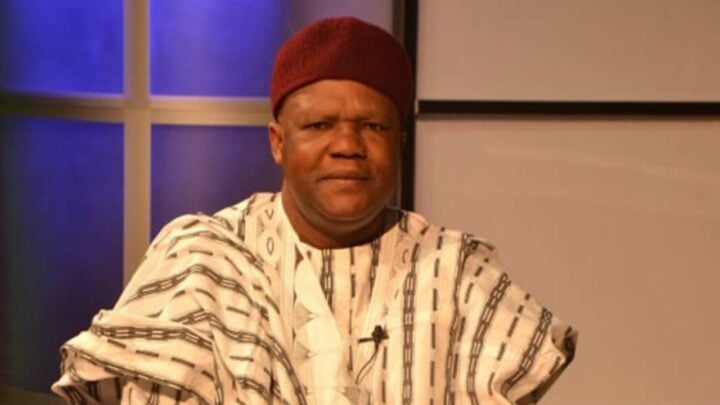

Longe Yesufu Alonge, a director with Qua Iboe Power Plant (QIPP), gives a broad insight into the 540MW power project in Akwa Ibom state. According to him, QIPP is unique in the sense that the power purchase agreement factors in when the transmission and distribution networks will be expanded to evacuate the power to be generated. In this interview with TAIWO ADEBULU, Alonge says QIPP and the federal government have focused on how to align the timing of the project with President Muhammadu Buhari’s presidential power initiative (PPI).

TheCable: Where does the QIPP project currently stand?

Alonge: Qua Iboe Power Plant (QIPP) is a 540MW combined cycle gas-fired plant that will be constructed at Ibeno local government area in Akwa Ibom state. It will be situated very close to the gas supply from Mobil Producing Nigeria (MPN) joint venture. The power purchase agreement (PPA) and put call option agreement (PCOA) were initialed in October 2017 between Nigerian Bulk Electricity Trading Plc (NBET) — who is the offtaker — and QIPP project sponsors. Before and after the initialing of documents, both parties have been working together to look for ways to provide comfort that will make it a sustainable project that is aligned with the government’s long-term objectives for the power sector. The project sponsor has done a lot that includes resettlement action plan, design work, soil and geotechnical on the site. Others works include EPC bidding, licensing among many others. Through negotiations with FGN, the project sponsors have agreed to lower their tariff to ensure QIPP is the lowest cost new greenfield project in Nigeria.

TheCable: With the myriad of challenges troubling the power sector, some observers feel the coming of QIPP won’t make a difference as we already have high generation capacity that is largely unutilised. What do you think about this?

Advertisement

Alonge: Nigeria’s greatest challenge as a country of over 200 million people and growing is to provide economic growth through job creation. To achieve this, Nigeria will require a sustainable power sector to enable industrial and agricultural segments to grow. Today, Nigeria’s power sector does face a myriad of challenges across the value chain — generation, transmission and distribution. However, President Muhammadu Buhari has set out specific objectives and plans to address this such as the presidential power initiative (PPI) and the relaunch of the power sector recovery plan (PSRP). To be honest, there are probably no investors that will invest to build new power plants against the state of today’s power sector in Nigeria; however, no one wants Nigeria to stand still and to that end, QIPP is planning for its power plant to be completely constructed on a timeline that is based on the PPI and PSRP long term objectives.

As one is aware, these large projects take significant time to develop and construct; therefore, it is necessary for us to be executing a PPA and PCOA today in order to have the power plant that will come online in 2025. It is true that there exists some 13GW of installed generation capacity, but only about 5GW is currently in use due to constraints on the grid. However, when you look at the PPI programme of the present government, it is projecting to increase the generation capacity from its present delivered 5GW to 7GW in 2021 (first phase), 11GW in 2023 (second phase) and 25GW in 2025 (third phase). FGN plans to achieve these improvements on the grid through the partnership with Siemens and its proven solution for transmission, and distribution under the PPI programme. As QIPP is only planning to come online in the third phase of the PPI, QIPP and the Federal Government of Nigeria have negotiated certain provisions in the PPA to ensure a sustainable win-win solution for both parties. These provisions will provide certain controls for the FGN that has insisted on certain conditions to the PPA’s effectiveness that ensure the timing of QIPP is beneficial to Nigeria and not a liability. QIPP’s current schedule would see it starting construction in July 2022 and only starting commercial operations in July 2025, in line with the PPI and PSRP programs.

It is important to also note that though we have up to 13GW of installed generation, most of the thermal plants are facing gas supply challenges and this is greatly affecting their operations, in addition to other challenges. QIPP has an almost dedicated gas supply with no gas challenge as witnessed with most of the existing thermal plants.

Advertisement

TheCable: As the federal government is already battling with similar agreements that are hurting the country’s finances, isn’t this project coming to worsen the situation on ground?

Alonge: Nigeria’s success in generating economic development will be highly dependent on international investments. As previously stated, QIPP is entering into a win-win partnership with the federal government to appropriately share the risks and manage the timing of QIPP’s construction. However, QIPP recognises that the contract must present sufficient protections to justify investing about $1 billion in Nigeria. The PPA ensures that both parties are obligated to undertake their responsibilities to make the contract work. The challenge in the power sector today does not necessarily have to do with the IPP agreements but rather with the timing of those projects. Prior to its operation readiness, QIPP recognizes that the transmission and distribution networks must be ready to deliver the electrons of the power plant to paying customers. It is for this reason that QIPP and FGN have focused on how to align the timing of the QIPP project and how to work together to address any gaps in the transmission network that would prevent QIPP’s electrons from reaching the customer.

QIPP has been around for a long time, but its investors have not looked to rush the project in a manner that would put an unsustainable strain on the country’s finances. QIPP now believes there is alignment on timing with the implementation of the PPI and PSRP. Therefore, QIPP is seeking to finalize its development work in order for it to start construction on a program by 2022. Part of that development work includes playing a role in the construction of a transmission line (from Ikot Abasi to Ikot Ekpene) prior to QIPP starting its construction to make sure major risks to the project are mitigated.

TheCable: The Ikot Abasi-Ikot Ekpene transmission line is facing huge challenges at present. This is the major concern. If the PCOA is executed and the construction is completed in due time, how do you intend to reconcile the TCN obstacle and deliver power?

Advertisement

Alonge: QIPP recognises this risk. Part of the reasons why it is necessary to execute the PPA and PCOA today, is that the PPA will set out a roadmap for the completion of the Ikot Abasi to Ikot Ekpene Transmission Line prior to QIPP starting construction on its power plant . Under the PPA,QIPP is committing financial resources to partner with Siemens to make sure the Ikot Abasi to Ikot Ekpene T-Line is complete. This is expected to take about 18 months. It is important to note that as part of the QIPP discussions with government, three of the Discos in close proximity to the QIPP generated power at the Ikot Ekpene switching station were invited to tell government what their future power demand will be by 2025 when QIPP will be ready. To achieve this, the Discos provided some projects within their networks that will be included as part of the PPI program. This was done to make sure there is a proper plan to ensure the end-users get the power that QIPP will bring on board. The PPI transmission and distribution works will greatly help TCN be in a better position than what it presently faces in managing the national grid.

TheCable: The PCOA is believed to be risky clause for Nigeria, given the fragility of our electricity industry. Isn’t this deal going to put the power sector into more financial mess as pundits predict?

Alonge: The PCOA, as the name implies, is a put call option agreement that works in conjunction with the PPA, to help protect and ensures that parties meet their obligations within the PPA. There have been severe misunderstandings by the public as to what this agreement is all about. Most people have the erroneous belief that it is a document meant to defraud the government. This is completely wrong interpretation and not representative of the intention of the document. To provide a simple example, the PCOA sets out what happens if either party defaults on their obligations of the PPA. In the extreme, the investor could lose the power plant (call by FGN) or the government could have to pay the investor for the power plant (put by the investor). But the put or call is only triggered if the counterparty does not fulfill their obligations. Furthermore, the PPA has many ways to remedy a default prior to the PCOA taking effect. The industry norm across the globe requires that the buyer of power must pay for the power and if there is a default compensate the investor.

The PCOA was created to go a step further by ensuring that if the government has to pay the investor for a default, that the government then owns the asset (historically a government could compensate the investor, but the investor would still own the asset). In the case of QIPP, it intends to invest $1 billion in Nigeria. To that end, it must know that if it does everything that it is obligated to do, it should be compensated independent of the actions of other parties’ performance across the power sector value chain. This is why QIPP and FGN have focused on timing. QIPP recognises that it will only add value — and therefore not be a burden on FGN’s finances — if the power sector is ready to receive its power; therefore, the negotiations with FGN have been about alignment of timing and risk, but still require that the foundation of the relationship be a bankable agreement. Ultimately, the PCOA can be viewed as an investment insurance that is very fair as it ensures an exchange of assets and money between parties involved in the transaction. The good thing with the PCOA is that some countries in Africa have keyed into its use because of the fairness it brings on board.

Advertisement

TheCable: Do you project an event where there will be pressure on the government to cancel the deal?

Alonge: We’ve been having good discussions with government over the years and have seen ourselves as partners that have keyed into the government programme of turning around the power sector. It is important to note that the present project sponsors took over the project from Mobil Producing Nigeria (MPN) in 2015 and now developing the project in partnership with the Nigeria National Petroleum Corporation (NNPC) as a co-shareholder in QIPP. QIPP has a dedicated gas supply from the MPN JV gas field. MPN will bring the gas onshore through a new submarine pipeline. This pipeline will also play a major role to ensure gas supply for the AKK pipeline for power plants along the pipeline axis, namely the planned 4 Gigawatts of new power plants in Abuja, Kaduna and Kano. These AKK power plants are also being timed like QIPP to ensure that the third phase of the PPI can deliver part of the 25Gigawatts from year 2025.

Advertisement

Since information is key to providing public awareness, we strongly believe that this interview will go a long way in creating that awareness to make people understand that QIPP is indeed a template on how sustainable power projects should be done in Nigeria going forward and that the government has been very straight forward in discussion with QIPP to look for ways of encouraging investment into the Nigeria economy that will not cause hardship to Nigerians and drain its purse. With this understanding, we don’t think that the government will be put under any pressure to cancel the deal as it creates a solution for future growth of the power sector.

Advertisement

1 comments

Such a cool guy. https://www.thecable.ng/interview-qua-iboe-power-project-fits-perfectly-into-buharis-initiative-says-director