Investors fell over one another to lend to the government at a rate that was materially lower than inflation — which would leave them with 10 percent less of their money in real terms at the time of maturity.

This is further worsened by the country’s low yield environment which means even though the return on the one-year treasury bill tenor is below inflation, it is about the highest yielding risk-free asset for that duration, leaving investors with negative returns.

A real return refers to what the investor has earned after adjusting for inflation. The inflation-adjusted return accounts for the effect of inflation on an investment’s performance over time.

At the last Nigerian treasury bills (NTB) auction conducted by the Central Bank of Nigeria (CBN) on behalf of the Federal Government of Nigeria (FGN) last week, more than N45 billion worth of unsuccessful transactions were recorded as excess liquidity chased after a limited investment instrument.

Advertisement

Average interest rates on short-term T-bills have tanked to 1.3 percent from the high of 14 percent some two years ago, while data from securities trading platform, FMDQ, shows the yield on bonds are sitting as low as 7 percent.

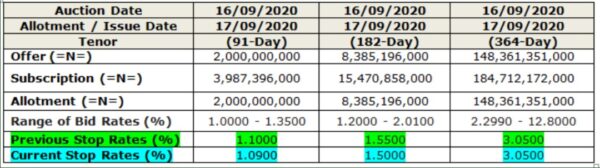

At the last auction, investors bid at rates as low as 1 percent, 2 percent, and 12.80 percent on the 91-day, 182-day, and 364-day tenors, respectively, while the apex bank settled its stop rates at 1.09 percent, 1.50percent and 3.05 percent on the 91-day and 182-day, 364-day maturities respectively, a further drop from the previous stop rates of 1.10 percent and 1.55 percent recorded in the previous auction.

Advertisement

Source: CBN auction result

This implies that with Nigeria’s 29 month-high inflation rate at 13.22 percent in August, return on investment for T-bills plunged to -10.17 for the 364-day instrument and -12.13 percent and -11.72 percent for the 91-day and 182-day maturities, respectively.

While the low-interest-rate environment has become a major win for both the Federal Government and large corporates, providing them with a haven to borrow at a low cost.

As at August 29, a total of N559.77 billion had been raised by large corporates from commercial papers, which is about 103 percent higher than the N275.37 billion raised in March, according to data from the FMDQ.

Advertisement

And between April and July this year, the Federal Government raised N7.74 billion in bonds, down by 3 percent from the N7.94 billion raised in the first three months of the year.

According to fixed income analysts, opportunities to put money into the right investments now are limited, leading to more money being parked in treasury bills.

At the last auction, while investors were willing to subscribe to the 91-day instrument with N3.98 billion, the CBN only allotted N2 billion, meaning N1.89 billion was recorded as unsuccessful bids.

Further analysis of auction results revealed that the 182-day medium-term paper was oversubscribed by N7.08 billion. While the CBN raised N8.39 billion, investors were ready to put in N15.47 billion in the instrument. Also, the apex bank sold N148.36 billion worth of bills for the 364-day paper, but investors jostled with a subscription worth N184.71 billion and thus, recorded N36.35 unsuccessful bids.

Advertisement

A collapse in yields on Nigerian assets is also leaving pension fund administrators (PFAs) with no choice but to reinvest pensioners’ funds into assets offering rates below inflation, following CBN’s policy that restricted them alongside other local investors from investing in high yielding short-term OMO bill instrument.

Pension funds invest in a variety of assets, but most, including defined benefit plans, use low-risk assets such as government bonds as the benchmark discount rate. While that means they have profited from the fixed-income rally, falling yields have also driven up future liabilities — in turn threatening their ability to meet oncoming obligations.

Advertisement

In nominal terms, pensioners may have seen assets under management hit over N11 trillion. However, such growth has been wiped out in real terms due to the successive devaluation of the naira.

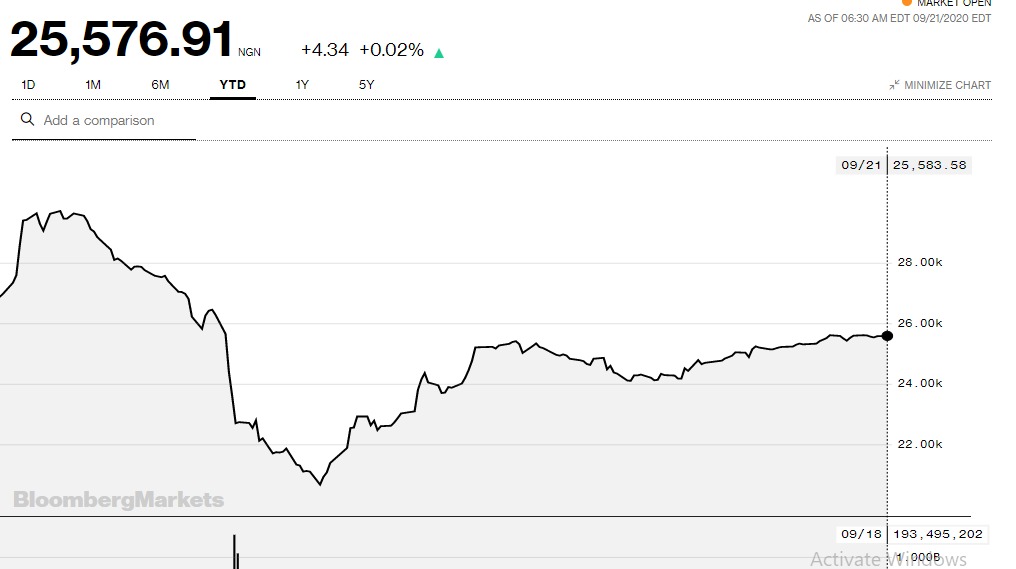

Expectedly, domestic participation in the Lagos bourse has seen an uptick from 40 percent to 61 percent, Oscar Onyema, chief executive officer, Nigerian Stock Exchange, said in one of his presentations to clients.

Advertisement

Source: Bloomberg

Advertisement

“The increased participation of local investors in equities is due to the low-interest-rate environment, which has positioned the exchange as a haven and viable market for the destination of private capital,” Onyema said.

Add a comment