The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) says international oil companies (IOCs) have proposed transferring 26 oil blocks to local firms.

NUPRC said it has engaged the services of two top international oil and gas decommissioning experts to conduct thorough evaluations on the 26 oil blocks slated for divestment.

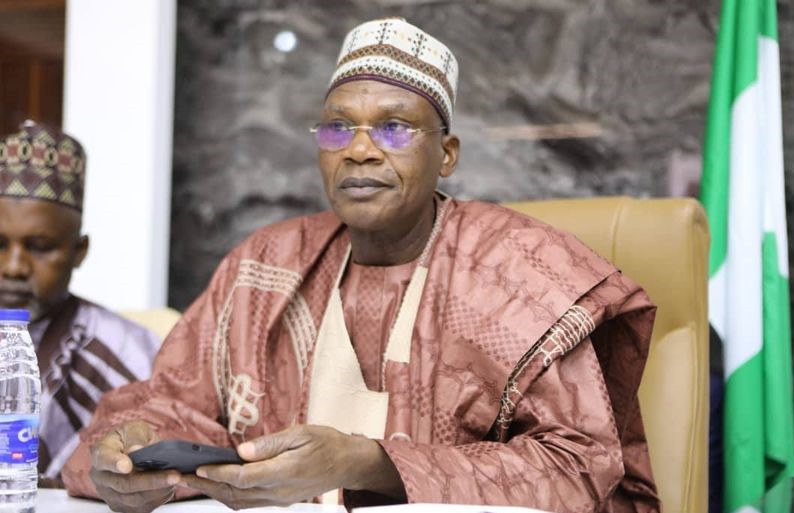

Gbenga Komolafe, NUPRC’s chief executive officer (CEO), spoke on Friday at the industry dialogue on IOCs’ divestment of oil and gas assets in Abuja.

The workshop was organised to provide direction and assess the thoroughness and scrutiny regarding adherence to the laws and procedures governing the planned divestment of oil and gas assets.

Advertisement

In his remarks, Komolafe said the blocks have an approximate total reserve of 8.211 million barrels of oil, 2,699 million barrels of condensate, 44,110 billion cubic feet of associated gas and 46,604 billion cubic feet of non-associated gas.

He said this constituted a substantial addition to the country’s hydrocarbon reserves.

“Additionally, these blocks contain P3 reserves estimated at 5,557 million barrels of oil, 1,221 million barrels of condensate, 14,296 billion cubic feet of associated gas and 13,518 billion cubic feet of non-associated gas,” Komolafe said.

Advertisement

“It is worth noting that a substantial part of the P3 reserves is located in or near producing assets. This means that a competent successor can easily mature them to 2P reserves.

“Additionally, the current average production from these blocks is 346,290 barrels per day (bpod) (NAOC-28,018 bopd, MPNU-159,378 bopd, EQUINOR-36,155 bopd and SPDC-122,739 bopd).

“But the technical production potential is much higher – standing at 643,054 barrels (NAOC-147,481 bopd, MPNU-244,268 bopd, EQUINOR-39,203 and SPDC-212,102 bopd).

“These blocks have the potential to significantly boost our national production, which will benefit all stakeholders.”

Advertisement

He listed S&P Global Commodity Insights (SPGCI) and Boston Consulting Group (BCG) as leading international consultants in oil and gas decommissioning.

Komolafe said the consultants would collaborate with NUPRC as independent consultants to delineate all liabilities related to end-of-field life and abandonment legacies in accordance with divestment protocols.

“They will also manage the operational risk across the entire asset portfolio, create a workflow for estimating total onshore decommissioning capital expenditure (CAPEX) liabilities,” he said.

“They will determine the host community’s obligations based on three per cent operating expenses (OPEX) stipulated in the Petroleum Industry Act (PIA), benchmark best practices on asset sales, and provide case study reports that draw lessons based on best practices.”

Advertisement

He said the commission’s regulatory objective is to guarantee that all parties involved in the divestment process adhere to the authorised divestment guidelines.

NUPRC PROVIDES DIVESTMENT OPTIONS TO IOCS

Advertisement

Speaking on an overview of the divestments, Enorense Amadasu, the executive commissioner, development and production at NUPRC, outlined the divestment framework.

Outlining the divestment options, and the objectives, Olayemi Anyanechi, the commission’s secretary and legal adviser at NUPRC, said the first option is obtaining ministerial approval for the divestments with the stipulation that entities would retain liabilities.

Advertisement

Anyanechi explained that this arrangement would remain in place until NUPRC completes its investigation and assigns liabilities to the appropriate party.

The second option, according to Anyanechi, is that ministerial approval would not be given until the commission had identified or allocated all liabilities to the responsible parties.

Advertisement

“The divesting entities will be required to issue a waiver, waiving their rights to deemed consent as provider in section 95 (7) (B) of the PIA,” she said.

Osagie Okunbor, chairman, Oil Producers Trade Section (OPTS), and Abdulrazaq Isa, chairman, Independent Petroleum Producers Group (IPPG), commended NUPRC for its transparency and the clear options outlined in the divestment process.

Representatives from other parties, such as Equinor, Seplat, and Agip, among others, also commended NUPRC for its efforts and transparency, pledging to provide feedback to the commission.

Add a comment