BY ZUHUMNAN DAPEL

Nigeria churns out roughly two million barrels of crude oil a day, making it Africa’s top producer and the world’s 13th. But still, because of its feeble domestic refineries, Nigeria imports about 80 percent of the gasoline it consumes at home, selling it at a government-fixed rate (US$0.43) that is below the international average price (US$0.97) and the landing cost determined by world oil price and cost of freight.

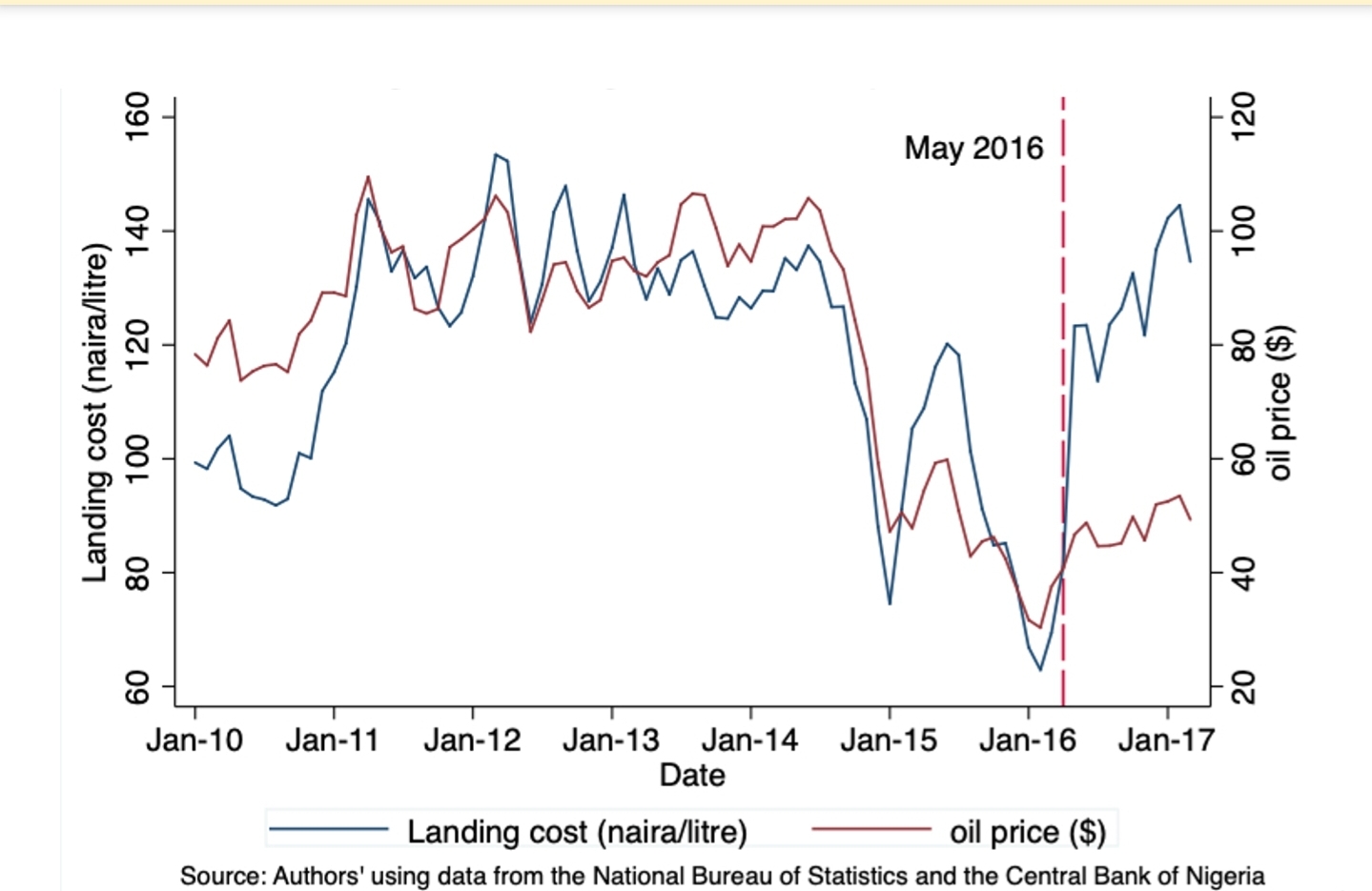

The difference is finance in subsidy. For instance, in 2011 alone, the total subsidy amount was over $13 billion—about three percent of Nigeria’s GDP that year; and N4.39 trillion in 2022. The subsidy is expected to shield local pump prices from rising international oil prices. Tellingly, subsidy expenses should rise with and fall with world oil prices while keeping domestic retail prices relatively constant. However, the reality on the ground is a far cry from this in that Nigerian pump prices, global prices and the subsidy bill change in the same direction (see the chart below). This situation motivates sceptics of the subsidy claims to ask a probing question: since local buyers are not utterly being shielded by the subsidy from rising global oil prices, then who are those being shielded or protected by subsidy expenses?

Advertisement

To reduce this huge financial (or fiscal) burden, Nigeria’s government in January 2012 attempted to free up the gasoline price by ending the subsidy regime and allowing demand and supply to determine the price. (The subsidy programme was also considered rife with double-dealing—about US$6 billion in fraudulent claims were made in 2012.) Although praised by the IMF, the move was met with a storm of protests at home, forcing the government to rescind its decision. Within two weeks, the price reverted from N141 to N97 per litre.

But the price deregulation move was not permanently shelved. The government that came to power in May 2015 revisited the idea, and after one year in office raised the official price by 67 percent, to 145 (N95.18 if adjusted for inflation) naira per litre (US$ 0.43 at black-market rates). This remains the official price today. But as the global crude oil price heads to triple digits, there are concerns that what the government spends on subsidies may rise, potentially pushing up the official price. However, there is no clear claim by the government, despite the price rise, that the subsidy regime has ended. But do local consumers (e.g., motorists) still pay this price for the product?

The answer is not straightforward. These are the facts.

Advertisement

The domestic supply of and demand for gasoline in Nigeria have not always been matched. The excess demand has always been preceded by truckloads of products smuggled abroad. Higher pump prices relative to Nigeria’s (US$0.43) in neighbouring countries are argued to have fuelled the racketeering: Benin (US$0.72); Niger (US$0.88); Cameroon (US$1.03) Chad (US$0.78); Togo (US$0.71); and Ghana (US$0.92).

The fiscal dent (or ‘under–recovery’) of this, according to estimates by the NNPC, is US$2.3 million daily. This is a benefit that goes to the sellers and consumers of the products in the neighbouring countries rather than the consumers in Nigeria. This often creates scarcity, which drives up the black-market premium (BMP)—the difference between the unofficial (true) price and the official price.

It should be noted that if the BMP is zero, then there is perfect compliance by the distributors/retailers of the product: they are selling at exactly the official price. If, on the other hand, the BMP is greater than zero, then there is some non-compliance. Therefore the closer the BMP is to zero, the higher the level of compliance with the official price.

A caveat: theoretically, the BMP can be less than zero, but this is practically impossible because all distributors/sellers are expected to be rational, meaning they will never want to sell the product below its official price.

Advertisement

However, strong enforcement of the price control law does not necessarily guarantee a high level of compliance as there could be stiff resistance to the enforcement. But weak enforcement does not mean there has been more noncompliance—sellers’ fear of state authorities may compel their compliance. However, strong enforcement can lead to high levels of compliance.

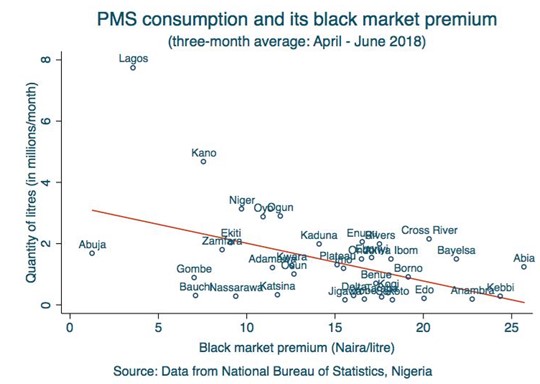

- Evidence from the graph shows that all the states, on average, sell the product above the official price; no state is exactly on the y (or the vertical) axis. There is no perfect compliance in any of the states.

- Abuja’s BMP (N1.27/litre), relative to other states, is the closest to zero, making it the most officially price-compliant part of the country. Abuja is the seat of power, where we expect institutions to be more effective in enforcing compliance.

- Abia is the state with the highest BMP: N25.71/litre, making it the least compliant state. Other least compliant states can be found on the bottom right and top right of the graph. This simply means big state-level consumers tend to comply, more than other states, with the official price.

But what could account for the variation in prices across states?

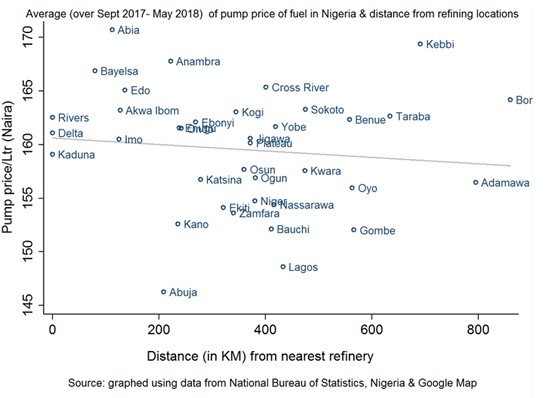

If the distance from the refinery (Nigeria has four functional refineries, although not operating at full capacity at the moment) and the cost of transporting the product significantly determines the variations, then the graph will be a straight 45-degree line and all the dots (or the state labels) will cluster around the line.

Advertisement

But what we see is partially the opposite: states that are closer to their nearest refineries tend to pay higher prices than other states. For example, Abia state is closer to its closest refinery (Warri refinery, Ekpan in Delta state) and still pays the highest pump price.

The correlation between the pump price and distance is negative at 11 percent. The farther the state is from the refinery, the lower the pump price it pays, at least relative to other states.

Advertisement

On the graph, Delta, Kaduna and Rivers (the locations of three refineries) appear in the same area. The reason is simple: the distance from Delta to Delta is zero; the distance from Kaduna to Kaduna is also zero and so on.

But then, about 80 percent of Nigerian petrol is imported. In this case, how is this brought into the country/distributed across the states? Answering these questions may shed some light on unravelling the source of variations.

Advertisement

The undersupply of gasoline has been the main justification for the fuel subsidy, and consequently the official pricing of the product. And as noted by Moss et al., “This has discouraged investment in domestic refining capacity. Of the 20 refinery licences issued since 2000, none have been used because the current market structure does not allow investors to fully cover their operational costs.”

Since Nigeria imports over 80 percent of its petroleum products, local pump prices must be divorced from changes in international oil prices if they are to be kept stable. One way to do this is for the country to refine its fuel needs locally. This brings to the fore the forthcoming Dangote refinery, which is expected to be the largest in the world. If it succeeds, it will play a key role in revamping Africa’s largest economy. It will raise Nigeria’s external reserves by replacing imports of refined petroleum products that cost about $7-$10 billion annually.

Advertisement

However, there are two vital questions that Dangote, the federal government of Nigeria and their deal makers must answer. First, the refinery is expected to pump and refine 650,000 barrels of crude oil per day. Will it pay for the oil in dollars? Otherwise, the refinery will cut Nigeria’s flow of foreign exchange by over $60 billion annually. This is based on my estimate using data on oil prices and oil production.

Second, how will the pump price be set? If the government steps back from its refining business and therefore stops setting the pump price as it is currently doing, Mr Dangote could rule the Nigerian oil market.

Dapel can be contacted via [email protected] and on Twitter @dapelzg

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment