Oil marketers under the aegis of the Depot and Petroleum Products Marketers Association of Nigeria (DAPPMAN) have raised alarm about potential risks linked to the naira-for-crude oil policy.

On March 10, TheCable reported that the Nigerian National Petroleum Company (NNPC) Limited had reportedly suspended the naira-for-crude deal until 2030, as the government-owned company has forward-sold all its crude oil.

However, following the report, NNPC said negotiations are ongoing for a new naira-for-crude deal with Dangote Petroleum Refinery, as the current agreement will expire at the end of March.

On March 19, the Dangote refinery said it temporarily halted the sale of petroleum products in naira.

Advertisement

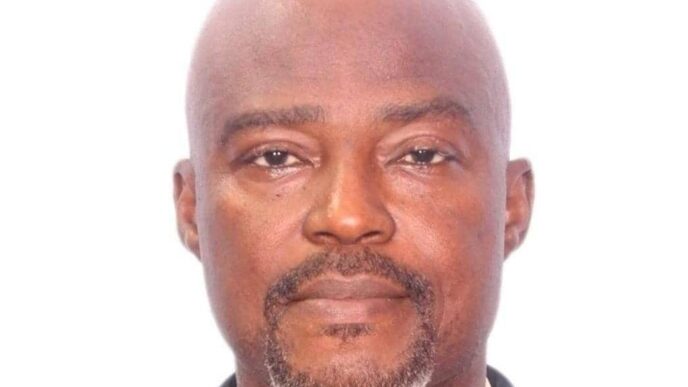

In a statement on Monday, Olufemi Adewole, executive secretary of DAPPMAN, said the policy might disrupt Nigeria’s role in the global oil market, which is traditionally driven by transactions in dollars.

Adewole warned that the policy could jeopardise Nigeria’s foreign exchange stability and discourage foreign direct investment (FDI) inflows.

He stressed that oil trade relies on dollars due to the currency’s stability and global acceptance, which provides predictability to international partners and investors.

Advertisement

Adewole cautioned that failing to align with the standard may isolate Nigeria from global markets, hinder trade, and discourage investment.

“The global oil market depends on the U.S. dollar’s stability. Shifting from this norm could alienate our trade partners and investors,” he said.

Adewole further highlighted broader economic risks, noting that reactive policies often yield uneven benefits, favouring a few rather than the wider economy.

‘LINKING CRUDE OIL TRANSACTIONS TO NAIRA COULD WORSEN FX RATE INSTABILITY’

Advertisement

He warned that linking crude oil transactions to the naira could worsen inflation and cause foreign exchange (FX) rate instability.

“The naira has been historically unstable. Tying oil deals to it could trigger capital flight and scare off foreign investors,” he added.

He also warned that the naira-for-crude framework might place heavy pressure on Nigeria’s foreign exchange reserves.

“The policy could deplete reserves, leaving the CBN unable to stabilise the Naira. Oil sales are a major source of foreign exchange,” he said.

Advertisement

“DAPPMAN supports efforts to strengthen the Naira, but reforms must address the root causes of its weakness.”

He referenced Venezuela’s failed attempt to replace the dollar with its local currency for oil trade in the 2000s, which caused severe economic turmoil.

Advertisement

Adewole urged Nigeria to learn from Venezuela’s experience, warning that abrupt policy shifts without safeguards can lead to unintended consequences.

“Disrupting international trade norms can backfire. Policies should maximise benefits for all Nigerians,” he said.

Advertisement

Adewole stressed the importance of aligning with global market practices to ensure long-term economic stability.

“The oil sector’s future relies on investment-friendly policies that protect reserves and foster competitiveness,” he added.

Advertisement

“With the right environment, Nigeria can build a sustainable energy future.”

Despite concerns, DAPPMAN said it remains committed to working with regulators and stakeholders to improve Nigeria’s downstream oil sector.

Add a comment