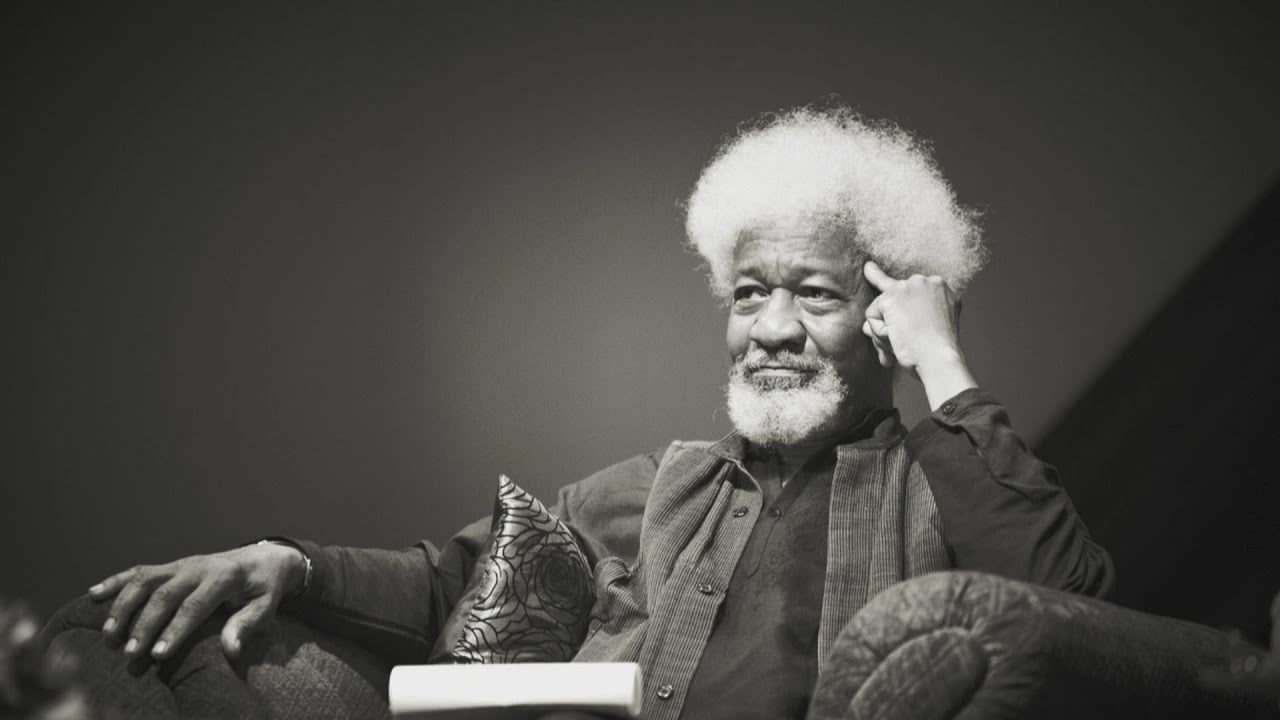

Peter Obi, presidential candidate of the Labour Party (LP) in the 2023 elections.

Peter Obi, former Anambra state governor, says the hike in interest rate by the Central Bank of Nigeria (CBN) will worsen the country’s economic situation.

In a statement on his X account on Thursday, Obi expressed concern that raising the monetary policy rate (MPR) and cash reserve ratio (CRR) will adversely affect the economy.

On February 27, 2024, the monetary policy committee of the CBN raised the MPR, which benchmarks interest rates, from 18.75 percent to 22.75 percent.

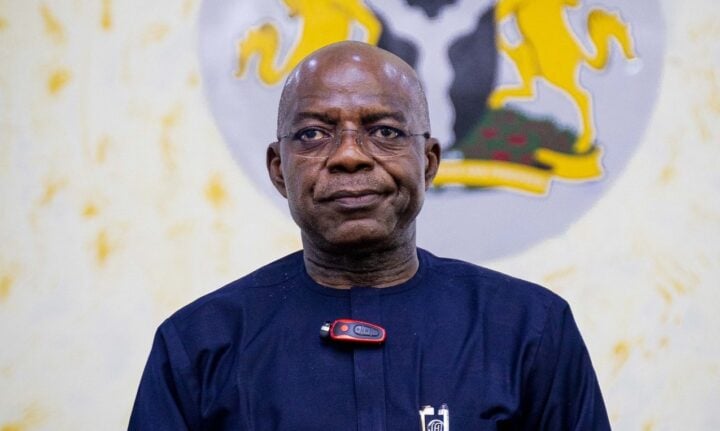

Olayemi Cardoso, CBN’s governor said the committee also adjusted the asymmetric corridor at +100 and -700 basis points from +100 basis points and -300 basis points around the MPR.

Advertisement

Cardoso said the committee also increased the CRR from 32.5 percent to 45 percent, while retaining the liquidity rate at 30 percent.

However, according to Obi, the sharp increase in MPR and CRR will result in job loss in the productive sector, especially manufacturing and other sectors that rely on bank loans and credit facilities for their funding needs.

Obi, the presidential candidate for the Labour Party in the 2023 election, said the rate increase is counterproductive, adding that the policy will not address money supply challenges in the country.

Advertisement

“I am of the strong opinion that the recent decision of the Monetary Policy Committee to increase the onetary policy rate (MPR) to 22.5% and the cash reserve ratio (CRR) to 45% will further worsen the economic situation of most Nigerian households as it is bound to cause more job losses in the productive sector, especially manufacturing and other sectors that rely on bank loans and credit facilities for their funding needs,” he said.

“Tightening liquidity in the financial system does not improve productivity, ie food production, which is the major cause of inflation in Nigeria.

“Moreover, only about 12% of N3.6 trillion of the total money in circulation is in the banking system which means that 88%, about N3.2 trillion is outside the banking system.

“So, this measure would rather be counterproductive as it would not address the intended purpose of managing the money supply.

Advertisement

“These new measures will worsen the fragile economy as the supply of funds would dry up for the real sector, and the new MPR rate hike will push the interest rate on loans to above 30%, which would be very difficult for the real sector operators especially manufacturers and SMEs to repay; resulting, obviously, in increased bad loans, and worsening the nation’s economic situation.”

To manage the high rate of inflation and decline in production, Obi said the government must address the issue of insecurity in the country.

“The most critical way to manage our high rate of inflation and decline in production is for the government to address the issue of insecurity in the country, which will allow for increased food, and crude oil production, and an overall increase in production, which will make products, especially food, cheaper,” he said.

Obi said the government should provide “overall” security in the country, to increase production and foreign portfolio investments (FPIs) in Nigeria.

Advertisement

Add a comment