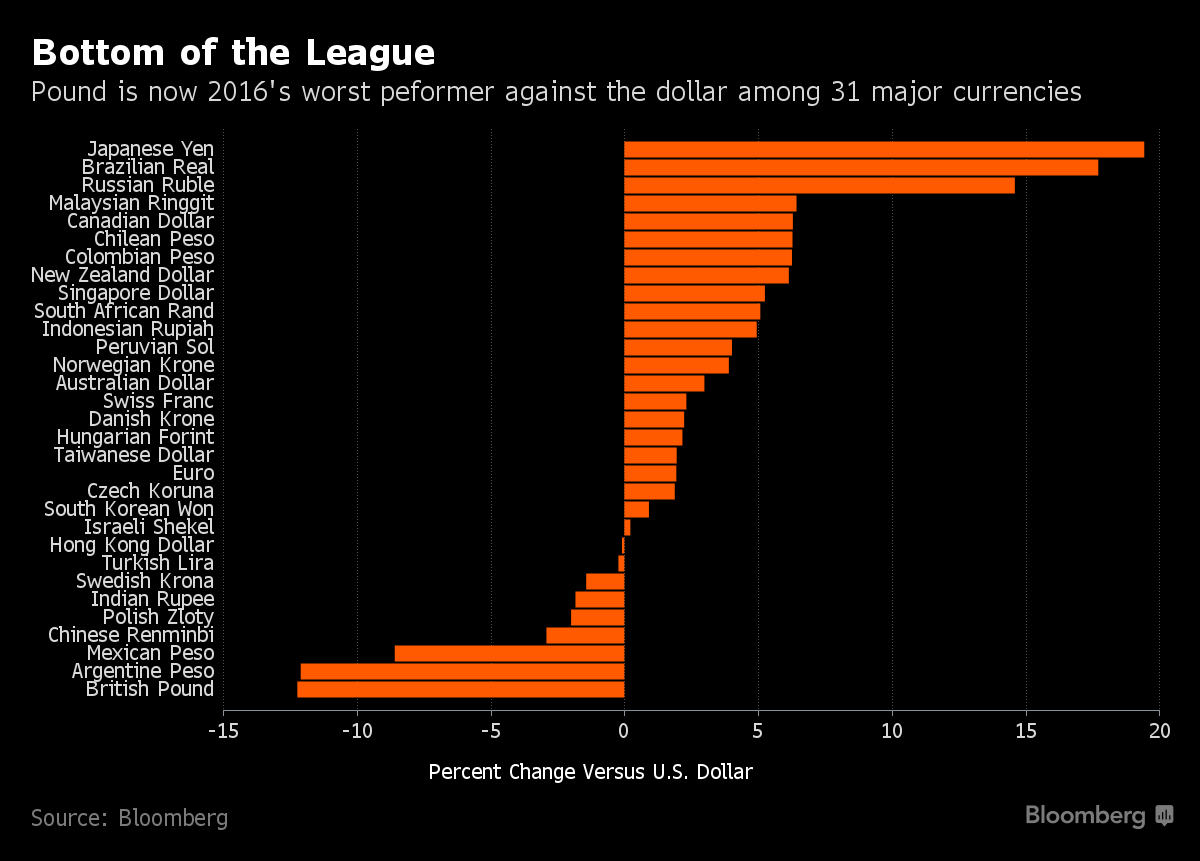

The British pound has become the worst performing major currency of 2016, sinking to a 31-year low after Brexit vote.

On June 23, the UK voted to exit the European Union, causing the pound to plunge to a 31-year low of £1/$1.36.

According Bloomberg, the currency has remained on a free fall since the vote, falling for a third consecutive week to win itself the title of 2016’s worst performer among major currencies.

The Nigerian naira was not listed as one of the major currencies, having lost over 29 percent in 2016.

Advertisement

This week, the UK currency overtook the Argentine peso as the biggest loser versus the dollar among 31 major peers in 2016 as investors continued to digest the fallout from the June 23 referendum decision to leave the European Union.

“Sterling’s going to fall considerably further as the effects of that uncertainty on investment and growth emerge from the gloom,” Kit Juckes, a macro-strategist at Societe Generale SA in London, wrote in a note to clients.

The pound rose 0.3 percent to $1.2941 at 4:55pm in London, leaving it down 2.5 percent this week and more than 12 percent this year.

Advertisement

It briefly erased its daily gain after a US Labour Department report showed a bigger-than-estimated jump in June payrolls.

Sterling advanced 0.5 percent to 85.30 pence per euro, for a 1.7 percent weekly slide.

On Wednesday, Britain’s currency touched a 31-year low of $1.2798 after the closure of a number of property funds echoed the real-estate tremors at the start of the financial crisis in 2007.

Advertisement

UK consumer confidence plunged the most in 21 years in a special post-referendum survey conducted from June 30 to July 5, data showed on Friday.

That the pound surpassed the Argentine peso as the world’s worst performer is all the more remarkable given that the South American nation’s economy shrank in 2014 and that President Mauricio Macri has removed most of the currency controls that had been propping up the exchange rate.

Add a comment