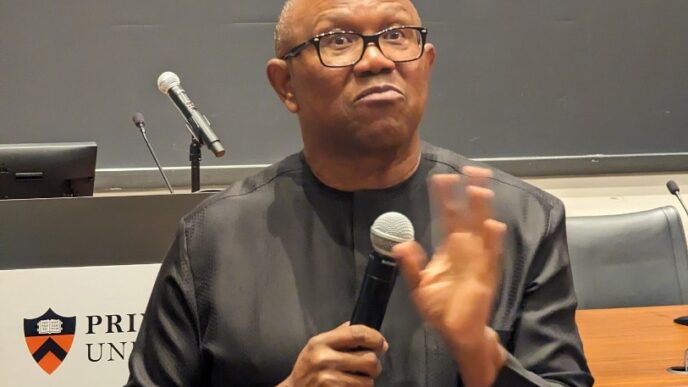

Bayo Onanuga

The presidency says there is no provision in the tax reform bills before the national assembly that will impoverish the northern region of the country.

In a statement on Monday, Bayo Onanuga, the presidential spokesperson, said the bills will not make Lagos or Rivers states more affluent than other parts of the country.

BACKGROUND

In October, Tinubu asked the national assembly to consider and pass four tax reform bills.

Advertisement

The four bills are the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service Establishment Bill and the Joint Revenue Board Establishment Bill.

The Northern States Governors Forum (NSGF) opposed the bills, while the national economic council (NEC) asked Tinubu to withdraw them for further consultation.

In the Nigeria Tax Administration Bill, 2024, the legislation proposes a new value-added tax (VAT) sharing model as follows: 10 percent for the federal government, 55 percent for states, and 35 percent for LGAs.

Advertisement

Under this proposal, states will use the sharing ratio of 20:20:60—equality, population, and derivation.

In the current VAT-sharing formula, the federal government takes 15 percent, states take 50 percent, while 35 percent goes to the LGAs.

States usually use the 50:30:20 sharing ratio—50 percent for equality, 30 percent for population and 20 percent for derivation.

The proposed increase in VAT derivation from 20 percent to 60 percent has elicited criticisms, especially from northern stakeholders.

Advertisement

Section 77 of the Nigeria Tax Administration Bill, 2024 states that: “Notwithstanding any formula that may be prescribed by any other law, the net revenue accruing by virtue of the operation of chapter six of the Nigeria Tax Act shall be distributed as follows: (a) 10% to the Federal Government; (b) 55% to the State Governments and the Federal Capital Territory; and (c) 35% to the Local Governments. Provided that 60% of the amount standing to the credit of states and local governments shall be distributed among them on the basis of derivation.”

On Sunday, Babagana Zulum, governor of Borno, said a study of the tax administration bill by the northern stakeholders shows that only Lagos and Rivers will benefit from the proposed VAT-sharing model.

‘NASENI, TETFUND, AND NITDA NOT AFFECTED BY THE TAX REFORM BILLS’

Onanuga said the reactions trailing the tax reform bills are “not grounded in facts, reality, or sufficient knowledge” of the legislation.

Advertisement

The presidential spokesperson said bills will not destroy the economy of any part of the country.

He added that the legislation was designed to “enhance the quality of life for Nigerians, especially the disadvantaged, who are trying to make a living”.

Advertisement

Onanuga said the bills did not stipulate scrapping of the Tertiary Education Trust Fund (TETFund), National Agency for Science and Engineering Infrastructure (NASENI), and National Information Technology Development Agency (NITDA).

“Since the public debate around the transformative tax bills before the National Assembly began in the last few weeks, various political actors and commentators have tried to obfuscate the facts, deliberately misinforming and misleading the public,” the statement reads.

Advertisement

“Unfortunately, most reactions are not grounded in facts, reality, or sufficient knowledge of the bills.

“While some commentators have attempted to incite the people against lawmakers, others have polarized one section of the country against another.

Advertisement

“The tax reform bills will not make Lagos or Rivers more affluent and other parts of the country, as recklessly canvassed, poorer.

“The bills will not destroy the economy of any section of the country. Instead, they aim to enhance the quality of life for Nigerians, especially the disadvantaged, who are trying to make a living.

“Contrary to the lies being peddled, the bills do not suggest that NASENI, TETFUND, and NITDA will cease to exist in 2029 after the passage of the bills.

“Government agencies, such as NASENI, TETFUND, and NITDA, are funded through budgetary provisions with company income tax and other taxes paid by the same businesses that are being overburdened with the special taxes.

“One reason President Bola Tinubu embarked on the tax and fiscal policy reforms is the need to streamline tax administration in Nigeria and make the operating environment conducive for businesses.”

Add a comment