The Nigeria National Petroleum Corporation (NNPC) did not remit $12.9bn to the federation account between 2005 and 2013, an audit report of the Nigeria Extractive Industries Transparency Initiative (NEITI) has alleged.

According to the report which was unveiled on Monday in Abuja by Kayode Fayemi, minister solid minerals and chairman of NEITI board, the unremitted funds were the sum of dividends, interest and loan repayment from the Nigeria Liquefied Natural Gas (NLNG).

“The audit revealed that NLNG paid the sum of $1.289bn as dividend, interest and loan repayment for 2013. NNPC acknowledged receipt of this amount, but did not remit it to either the federal government or the federation. However, it is important to also note that the 2013 figure brings to $12.9 bn the total NLNG payments received by the NNPC between 2005 and 2013, but not remitted by the NNPC to the federal government or the federation,” the report presented by the minister read.

The report also revealed that Nigeria lost $518m to offshore processing arrangement and crude for product swap arrangement in 2013.

Advertisement

NEITI recommended that “the NNPC and its sub units refund outstanding payments to the federation.”

“Government should investigate the status of NLNG dividends; NNPC should discontinue alternative importation arrangements and limit itself to export of crude and import of refined products; NNPC should abide by the federal government financial regulations, and always comply with the 90-day credit period,” it added.

Responding to a question on whether the NNPC had returned some of the unremittted funds, Fayemi said: “It is possible that certain refunds have been made, but that will not detract from the veracity of the report.”

Advertisement

The 2013 report

In 2013 alone, NNPC did not remit up to $5bn to the federation account in 2013, the audit alleged.

NEITI said the outstanding revenue for the year stood at $3.79bn and N358.27bn ($1.81bn at current CBN rate).

Of significance is the allegation that the sum of $1.29bn dividend from the NLNG due the federation account was not remitted by the corporation in 2013.

Advertisement

Giving the breakdown, NEITI said the Nigeria Petroleum Development Company (NPDC), the exploration arm of NNPC, did not remit outstanding payments of $1.7bn on the eight oil mining licences (OMLs) from the NNPC/SPDC joint venture.

NPDC also withheld $414,000 and N249.2 million refunds on OML 26 in the NNPC/SPDC divested asset, the audit report said, adding that there was an outstanding N2.17bn cash call refund on OML 42 from the same asset.

The company also did not remit $763.41 million from its liftings in its JV with National Agip Oil Company (NAOC), and another $33.21 million from the SPDC JV, NEITI said.

There were unpaid debts of N351.87bn going by the subsidy approved by the Petroleum Product Pricing and Regulatory Authority (PPPRA), and an over recovery of N3.98bn under the petroleum support fund.

Advertisement

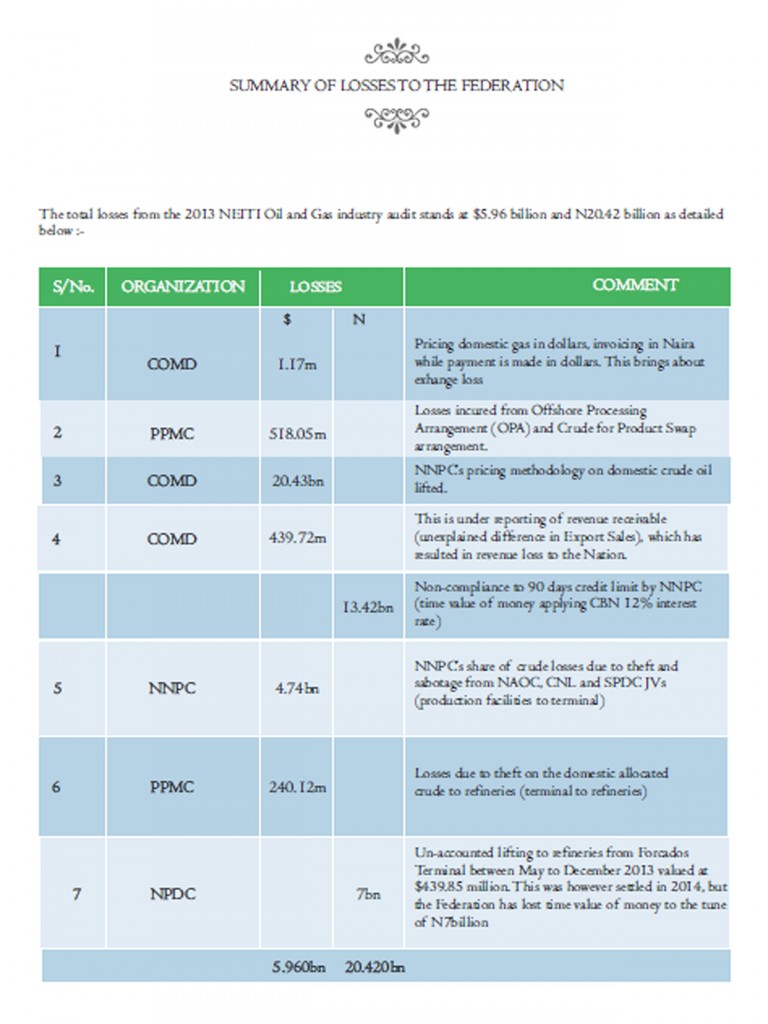

NEITI further said the total losses to the federation account in 2013 were $5.96bn and N20.42bn, including a stagerring $4.74bn in crude oil theft alone.

Under-payment or under-assessment of petroleum profit tax and royalty for 2013 was estimated at nearly $600 million by NEITI.

Advertisement

Queries and recommendations

The audit raised a number of queries and made recommendations to the government on the operations of the oil and gas industry, which is the biggest source of public revenue in the country.

Advertisement

On the strategic alliance agreements (SAA) entered into with private companies by the NPDC, the audit said the transfer of federation equity by NNPC to NPDC should be further investigated.

It said: “The consideration computed by DPR with respect to the eight OMLs assigned to NPDC from SHELL JV between 2010 and 2011 was $1.8 billion and of this amount, no consideration was paid from the dates of transfer up till April 2014 when the sum of $100 million was paid, leaving an outstanding balance of $1.7 billion as at the time of reporting.

Advertisement

“The assignments of the OMLs were not arm’s length transactions and were also adjudged to be undervalued. For instance, the 2014 PWC forensic audit report on NNPC estimated the value of NNPC’s 55% equity assigned to NPDC to be about $3.4 Billion based on commercial value paid by third parties on the sale of SHELL’s 45% equity in the same OMLs.”

“Lifting of 950,135 barrels in September from MPN JV (Qua-Iboe Crude Type) valued at $105,735,773.48 was also traced to NPDC account, which was later refunded to the Federation Account in November as follows: 853,000 bbls from NPDC Shoreline JV (OML 30) and 96,052 bbls from Seplat JV valued at $103,992,372.90, leaving a value difference of $1,743,400.58. Shortfall in Federation Account remittance to the tune of $1,743,400.58,” the report said.

NEITI asked that NNPC ought to remit the sum of $2.2bn after the reconciliation of crude oil sales.

The NNPC is expected to prepare a response to the audit.

Add a comment