It is important that public officeholders clarify the issues that citizens are distraught about and a key element has been the case of rising public debt. Kemi’s Adeosun piece comes in the context of the well-rehashed situation that the current administration met the country. With its hail of campaign promises without counting the cost, the Buhari-led government pushed itself into a tyranny of expectations. I guess Nigerian politicians will be more mindful when they make promises as the campaign pamphlets had programmes with at least N19tn yearly to fulfill.

We must also understand that issue of debt is not treated with consternation as Kemi Adeosun wrote. It is a right argument that requires our interest in inter-generational equity. If are amassing the debt that will be a burden on future revenues, it is important to demand more transparency on what exactly we are bequeathing the future and the economic viability of it. Nigeria paid $13bn to settle the Paris Club of creditors mostly tied to frivolous infrastructure that had no economic impact on the current generation.

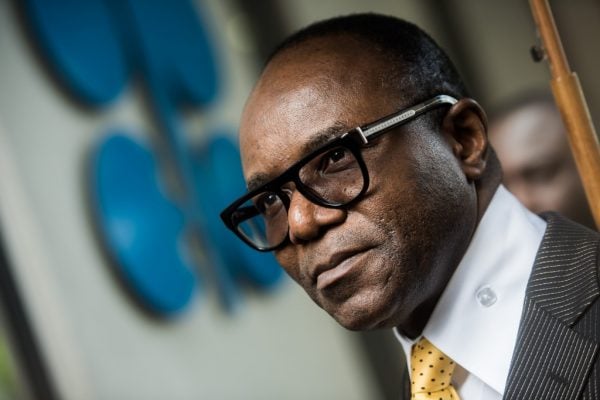

It must also be said that this administration has not been more transparent than previous government as regards debt numbers. I reckon that DMO has to be one of the best-managed government institutions with how it maintains an updated register of the national debt. Several officers who worked at state governments where it is nearly impossible to get fiscal numbers and currently at the federal level are surprised at this level of transparency, but we must be vigilant that this not rolled back in a bid to silence varied discussions. Despite the anti-corruption crusade, it has become impossible to get a detailed breakdown of the N1.2tn capital releases as claimed for 2016 budget cycle. Except for NNPC that started its monthly operations and financial reports, this administration has not been more transparent than previous governments, and it needs to sincerely improve this. The Buhari-led government has not provided details of capital releases on the project basis, no bold attempts on open contracting, never applied punitive sanctions to those indicted in Auditor-General reports or any tangible thought on campaign financing, a drain on public resources at all levels. So which improved transparency are we talking about?

Diving into the numbers, the unfortunate thing about the current fiscal management is how it has not shown any belt-tightening approach in the way public officers parade themselves. We don’t know any radical approach to reduce aides of public officers nor has there been any interactive party-level discussions on the National Assembly to rein its cost. In a budget approved during the recession, it is still littered with purchase of cars at N25bn, computer software acquisition at N9bn etc. One would have expected that beyond the serial removal of ghost workers that has not lead to a single prosecution and has always been a public relations stunt for successive governments, the entire Nigerian budgets will solely prioritize not a cluster of administrative capital projects but developmental capital projects with direct impact on the people. The ballpark figure of N1.2tn thrown around has no public details. How can such amount be spent with serial commissioning of projects since the Kaduna-Abuja rail? This means Nigerians are probably not seeing it or certain persons are economical with the truth. Well, I can easily be proven wrong with clear definition of capital projects funded. We continuously hear of the Efficiency Unit as a “placeholder point” but no real understanding of its operations and savings that helped government fulfill regarding bureaucracy.

Advertisement

I am happy that with Kemi Adeosun’s argument, Federal Government clearly sees where the Nigeria’s fiscal problem lies. The critical challenge has always been the size of public revenues, too low for a country of our population and economic size. This is why we must not fetishize our debt-to-GDP numbers currently at 17.1%. That Nigeria have a huge GDP and has not been able to maximise public revenues from it attest to the poor appraisal of the current GDP structure or the approach we have taken that poorly discourage tax payments. From 29% debt-to Revenue ratio in 2014, the Federal Government has moved to 44.7% in 2016. This means that from every 100 Naira that FG receives, it spends 44 Naira on servicing debts. In recent Pew Research, it was stated that as at 2015, Brazil spent 42% of its revenue to service debts, being the highest in the world. This shows that while Nigerian debt size might be low, the cost of servicing debt is high among its peers. We must not fall for low debt-to-GDP figures; it is the single incomplete story. Bond interests have not toppled 16% in past year, and the badge that the Nigerian government flashes is that portfolio investors now savour our sweet debt. Who would not with cool interest rates and guaranteed exchange rate exits? The Nigerian government is running a cool social security for the Nigerians who can afford its debt, distorting incentives for the growth of private capital.

It is also unfortunate that FG is also crowding the banks of retail savers launching bond issuance capped at 12-13%. This excludes its Federal Government debt to CBN that has risen from N866bn in February 2015 to N5.189tn as at July 2017. Imagine a scenario at when there are multiple options of bonds and treasury bills at tax and risk-free rates, which bank would borrow to the private sector? In the 2016 Budget Implementation Report by the Budget office, it was stated that “Credit to government grew by 27.44% when compared with the end September 2016 figure of N3.66 trillion….Credit to the private sector (Cp) slumped by 2.93% to ₦21.98 trillion at end-December 2016 from ₦22.65 trillion at end-September 2016 indicating crowding out .”

Think of a country with the debt to the government at a faster pace than credit to the private sector that also needs private capital to reach growth rates of 7% in 2020 as stated in its Economic Recovery and Growth Capital (ERGP). It is also important that government rates have been private lending benchmark in Nigeria now around 25%. With this administration, the only business in town as been government. This administration made a chore out of commissioning private plants but underneath the numbers is a frustrated Nigerian who can’t get capital from the bank because fiscal management have disincentivized this. This is why conversations of debt should not be in size. It is how does FG reduce the cost of borrowing and most especially the domestic offerings that now touches every upper and middle class bracket of the society.

Advertisement

Nigeria’s debt service costs will reach N1.6tn in 2017, closing on its personnel costs of N1.8tn, this is the worry that should be triggering debates on well-structured quantitative easing not government out-borrowing everyone in the space. The current approach of substituting local debt with dollar-denominated debt is also faulty. What should be the purpose of raising external debt? With oil being our main foreign earner at 95% of receipts, is Nigeria not supposed to be borrowing for infrastructure or making investments to correct this imbalance that puts Nigerian currency on a wrong footing every time that oil markets go into a dip?

As stated in the Economic Growth Recovery Plan “Nigeria’s peers raise an average 16 per cent of GDP from non-resource taxes; Nigeria raises just 3 per cent (2015)” The plan also states a target to “increase tax to GDP ratio from the current 6 per cent to 15 per cent during the period.” With a targeted GDP of N137.331tn in 2020, we are talking about tax revenues of N20tn, which is nearly eight times the current total non-oil revenue taxes. This means Nigeria needs to at least multiply its taxes eight times to meet the 2020 target. Despite the efforts shown by Kemi Adeosun in the piece, it shows that it will always be inadequate without a proper reflection on why do we have a huge GDP but little taxes? What is the structure of the GDP that makes it impossible to collect taxes? Has the Nigerian government shown enough faith in the management of public taxes that make it more deserving? These are the conversations that need to be honked because the current approach is a reflection of growth rates in the past and shows that without robust thinking our public revenues will not rise.

I believe the debt debate is rooted in the fact that Nigerian government is taking the escapist approach, raking up debt in quick numbers, rapidly forgetting where before exit of creditors. This escapist approach of taking gradual steps on revenue, but giant footprints on debt is what is being questioned. Nigerian leaders in 18 months have shopped everywhere – AfDB, World Bank, Retail savers, bondholders, Eurobond, portfolio investors, Sukuk bonds, treasury bills to pay its own cost. A dive into its Budget Implementation reports shows that its numbers doesn’t add up such as how did Nigeria finance actual deficit of N1.02tn for 2016 after counting at bond receipts. How is FG also entitled to Paris Club refund and what is the source of the N1.64tn extra-statutory fund provided to states?

In fact, most of the projects tied to these debts especially rail do not have any known economic importance and are not fastened to the idea that such projects should be self-liquidating. They are mainly for political expediency, and this is why this debate is necessary. That Nigerian government should provide effective plumbing in raising revenues, rein on debt service costs with favor for long-term bonds as well as rates that consider private sector lending, evidently reduce overheads and administrative capital items and overall unleash transparency on every issue. Here we see monetary authorities (CBN) limiting liquidity in a bid to keep Naira at a preferred value by mopping up funds in circulation through borrowing, the fiscal authorities (government) keeps feasting on expensive debt while everyone except their bondholders leans through. The Nigerian government needs a lot of rigorous thinking as well as caution.

Advertisement

Onigbinde is co-founder of BudgIT

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment