The rising prospects of more US interest rate increases in 2017 has encouraged Dollar bullish investors to ruthlessly attack global stocks, emerging markets and commodities during trading this week.

Asian shares were noticeable tepid on Friday as participants re-evaluated the likely impacts of higher rates to emerging market economies. With the holiday mood slowly kicking in after the Fed surprise, European markets and Wall Street may cruise in today’s session. When king Dollar enters the scene, no prisoners are taken and such could translate to further losses in emerging markets and Gold as the year comes to an end.

Speaking of Gold, the metal sunk to fresh 10 month lows below $1140 on Thursday as markets digested the possibility of more US interest rate hikes in 2017. With the metal historically known for its zero-yielding status, rising rates in the world’s largest economy could grant bearish investors the permission to attack prices to levels not seen since 2015.

The strengthening Dollar may become a key theme for the early parts of 2017 consequently capping any extreme upside gains on Gold. From a technical standpoint, the breakdown below $1140 could encourage a further decline towards $1150.

Advertisement

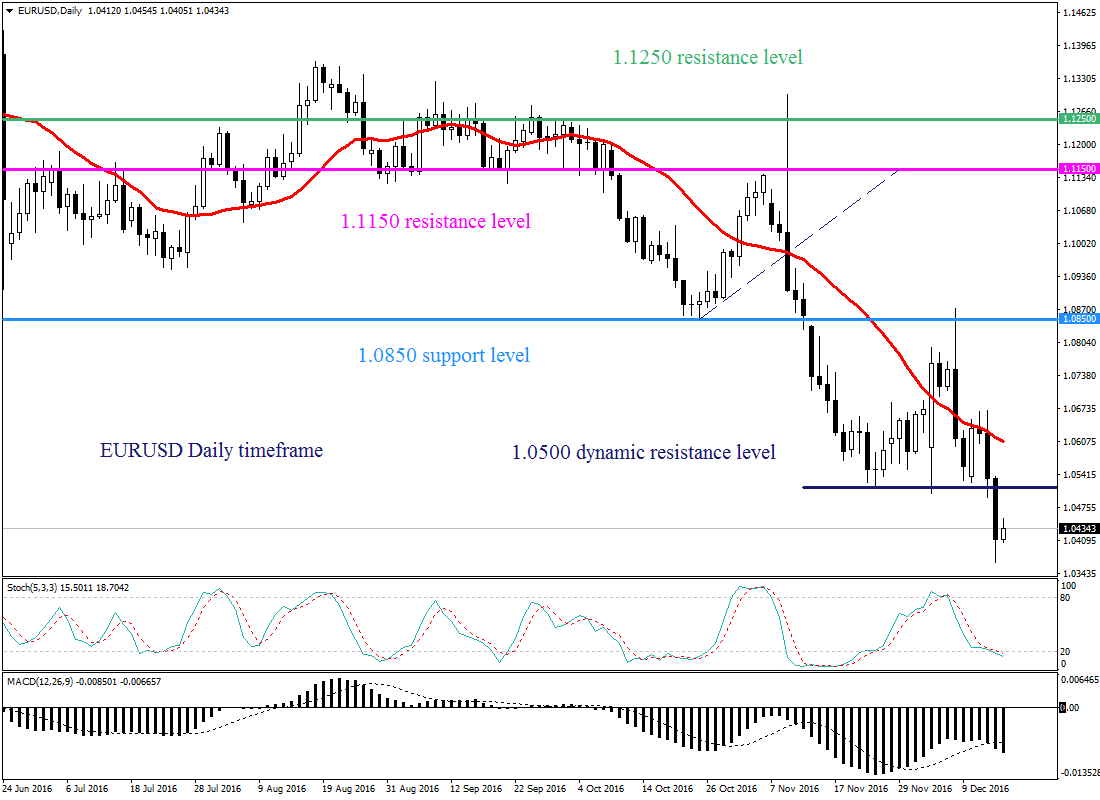

The main discussion which seized the headlines during late trading on Thursday was how a resurgent Dollar could revive the EURUSD parity dream. With the European Central Bank extending its QE and the Fed on route to raising US interest rates next year, the explosive divergence in monetary policy between these two major central banks could ensure the EURUSD remains depressed for prolonged periods.

The Euro may be pressured as uncertainty intensifies ahead of the French and German elections while Dollar revival should effectively make the EURUSD a sellers dream. As of writing the pair currently hovers around 14 year lows at 1.040 with steeper declines expected in the future when bearish investors exploit the 1.050 dynamic resistances.

Advertisement

Focusing on today, it’s all about the Dollar with the improving sentiment towards the US economy and heightened rate hike expectations providing a firm foundation for bulls to install heavy rounds of buying on the Dollar Index. Repeatedly positive US data and rising optimism over fiscal stimulus measures boosting US growth have been the drivers behind the Greenbacks awe inspiring rebound in Q4.

Dollar bulls are back in town and this could provide enough inspiration for buyers to send the Dollar Index to fresh 14 highs as the year comes to an end. From a technical standpoint, the Dollar Index exploded above 103.00 on Thursday and such could pave a path towards 105.00.

Focusing back on commodities, WTI crude is clearly gasping for air as the combination of concerns over the OPEC and Non-OPEC cut agreement and a strengthening Dollar encourages sellers to pounce. The explosive impacts of lasts weeks’ unexpected corporation with OPEC and Non-OPEC could be fading away as fears heighten over the cartel members going against the settlement.

Advertisement

Concerns over the oversupply and effectiveness of the proposed deal could be revived in the New Yea if reports of OPEC pumping at record highs persist. As of now, the driver behind WTI’s decline is a resurgent Dollar which could pull the commodity back below $50 by year end.

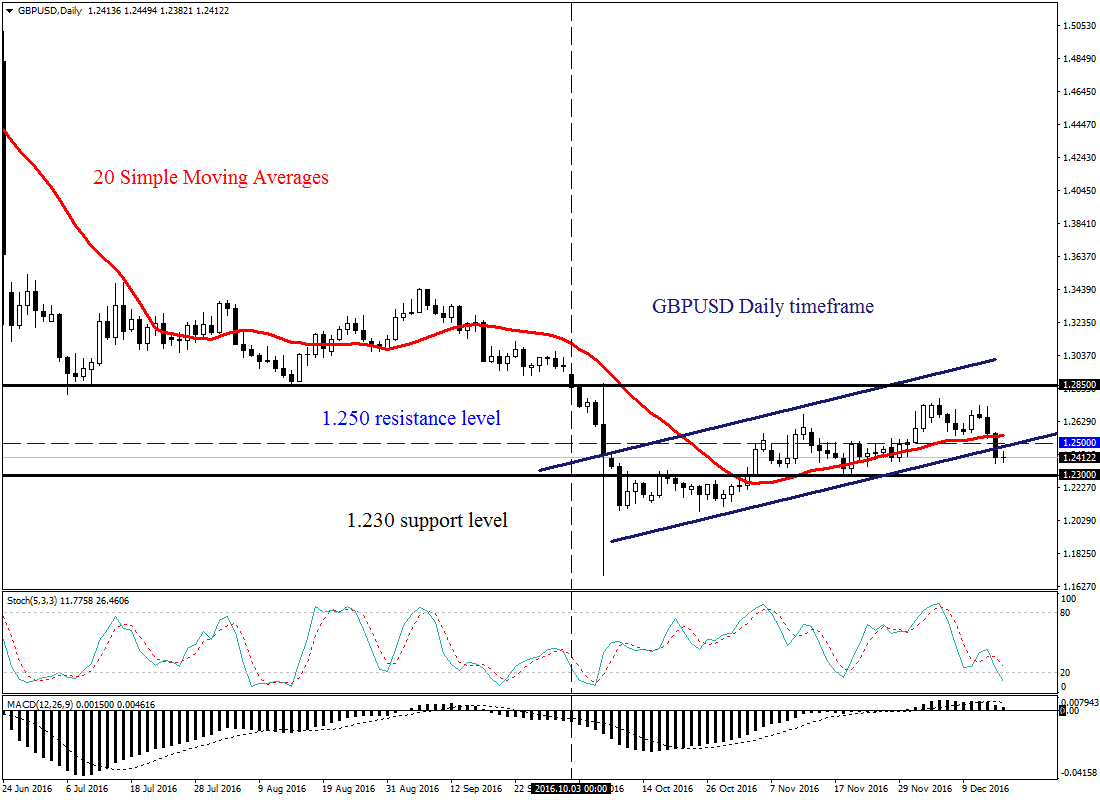

Currency spotlight – GBPUSD

The Brutal Sterling selloff post vote to leaving the European Union has been one of the key highlights of 2016. Sterling has been exposed to extreme losses with any appreciation in prices seen as a technical bounce for sellers to install repeated rounds of selling. With concerns still elevated over the Brexit woes impacting UK economic growth, buying sentiment towards the currency remains remarkably low.

Dollars upsurge from the renewed US rate hike expectations has left the GBPUSD vulnerable to further losses with the pair hovering above 1.2400 as of writing. Previous support around 1.2500 could transform into a dynamic resistance that encourages a further selloff towards 1.2300.

Advertisement

Advertisement