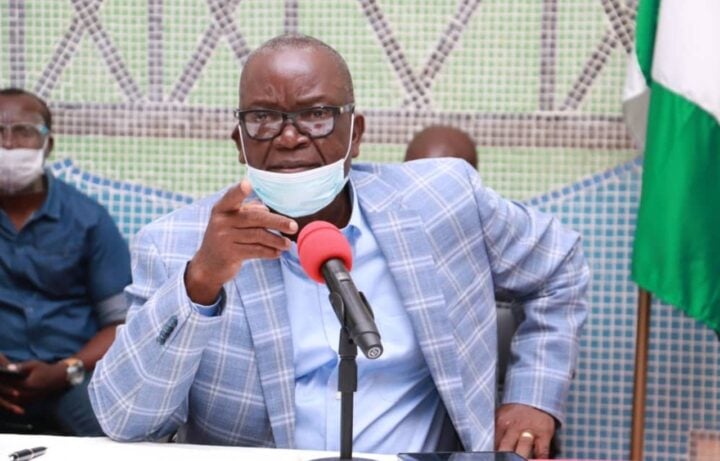

AbdulRahman AbdulRazaq, governor of Kwara, says his administration will not overtax residents of the state.

AbdulRazaq gave the assurance at the investiture of Biola Adimula as the 4th national chairperson of the Society of Women in Taxation (SWIT) on Saturday.

AbdulRazaq, represented by Susan Oluwole, Kwara head of service (HoS), said the state government was mindful of the effect of over-taxation and would ensure residents pay only exact dues.

“This is ensuring everything is balanced and will not cause undue hardship,” the governor said.

Advertisement

“But we are conscious of the fact that everybody should be made to pay what they are supposed to pay to the government.”

AbdulRazaq added that Kwara will not joke with the issue of taxation as it is important to the development of Nigeria.

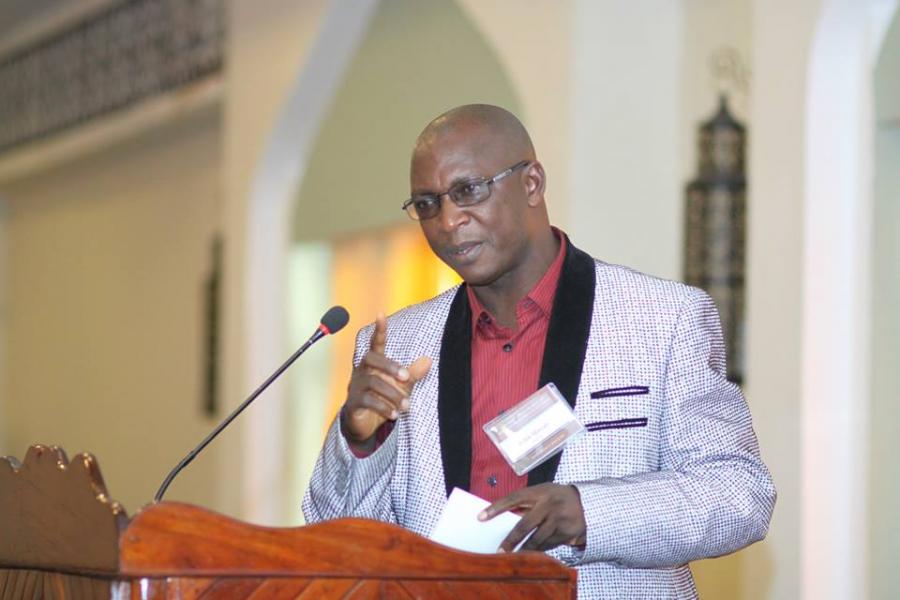

Isola Akingbade, who represented Muhammad Nami, Federal Inland Revenue (FIRS) executive chairman, said the tax agency was implementing several initiatives to mitigate the impact of aggressive tax avoidance and tax evasion in Nigeria.

Advertisement

“The authority will ensure deployment of Tax-pro Max, a fully integrated tax solution and amendment of tax laws through the annual Finance Act to block leakages,” he said.

He added that there would be cultural and structural realignment towards global tax practices to address peculiar economic dynamics, among others.

Speaking at the event, the new president said development in the global space has shown across the world that taxation is now the big elephant in the room which governments around the globe collect from their respective jurisdictions.

She said the recent decision by G7 countries to impose global minimum tax on multinationals that operate across their jurisdictions had also shown clearly that taxation had become a main source of revenue generation globally.

Advertisement

The SWIT chairperson also said that the global tax environment was blocking tax leakages from their jurisdiction, adding that Nigeria’s tax system was undergoing significant improvement to achieve the same objective.

Add a comment