Lafarge Africa, a cement maker, has posted a 37 percent surge in net profit year-on-year at N28.19 billion in its third quarter results for the period ended September 30.

The cement maker’s revenue increased 10 percent from N163 billion in third quarter in 2019 to N171 billion in same period in 2020.

Operating profit grew by 15.7 percent from N35.5 billion in 2019 to N41 billion in 2020. Profit before tax (PBT) from continuing operations grew by 70.34 percent from N20.1 billion in 2019 to N34.2 billion in 2020.

On a quarterly basis, revenue also increased 31.34 percent from N45.1 billion in 2019 to N59.3 billion in 2020, however, the bottomline was flat at N4 billion, on the back of mounting cost of sales and admin expenses.

Advertisement

Operating profit rose by 7.2 percent from N7.7 billion in 2019 to N8.3 billion in 2020. Profit after tax (from continuing operations) rose marginally from N7.7 billion in 2019 to N7.8 billion in 2020.

Lafarge’s earnings have continued to receive a boost from significantly lower finance cost due to the improved leverage position of the company (Debt/equity ratio moderated to 0.19x in full-year 2019 compared with 2.25x in full-year 2018 and 1.83x in 2017), following the disposal of its debt-laden Lafarge South Africa Holdco (LSAH) operations, that has been the major drag to the group’s business over the last few years.

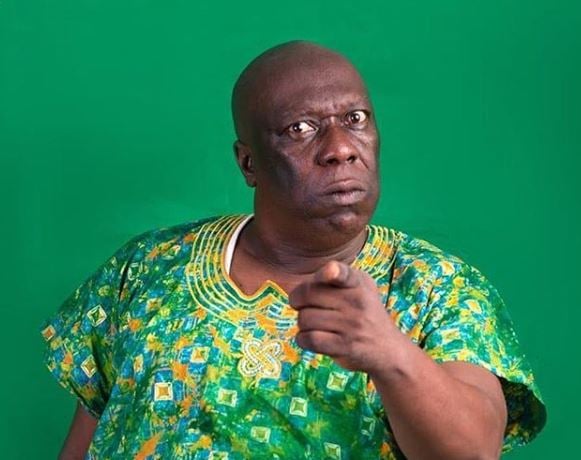

Khaled El Dokani, chief executive officer, Lafarge Africa said “Our robust results for the first 9 months reflect the strong recovery of the demand in Q3 and the successful implementation of our “Health, Cost & Cash” initiatives. Both have delivered considerable improvement in recurring EBIT, net income and free cash flow, despite the impact of the COVID-19 pandemic and Naira devaluation, particularly in Q3.”

Advertisement

Shares of Lafarge have gained 16.99 percent in value this year, trading at N18.85 on October 16 — the highest year to date.

Add a comment