The Lagos state government has announced the use of Electronic Revenue Assurance (ERA) invoicing system to enhance transparency and accountability in the remittance and collection of consumption tax by businesses.

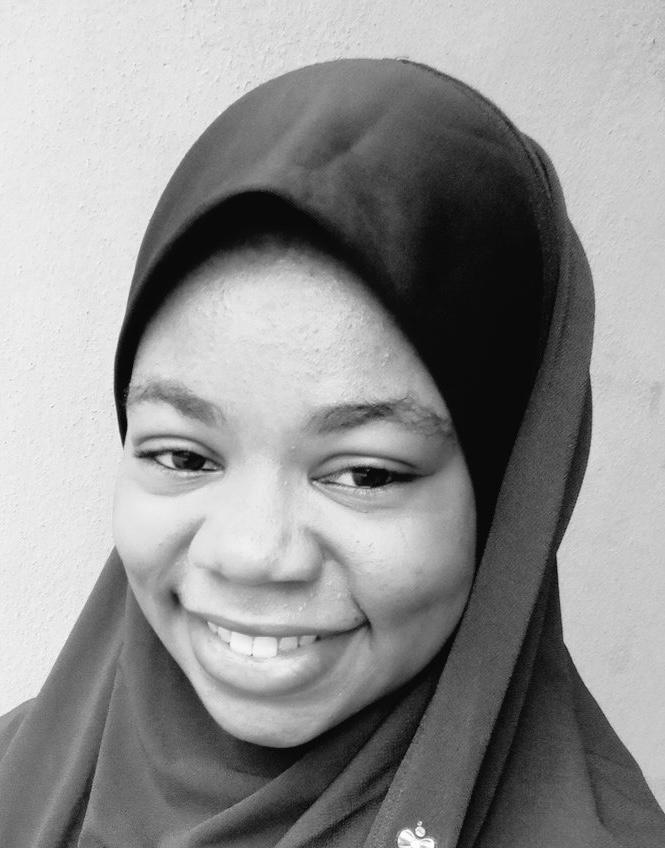

Speaking at a stakeholders meeting at the state house on Thursday, Ayodele Subair, chairman, Lagos Inland Revenue Service (LIRS), said the introduction of the device is part of the government’s effort to ensure the provisions of the 2017 consumption tax regulations.

Subair said the ERA will provide empirical evidence of sales.

He explained that members of the public were the bearers of the tax, adding that business owners only act as collecting agents.

Advertisement

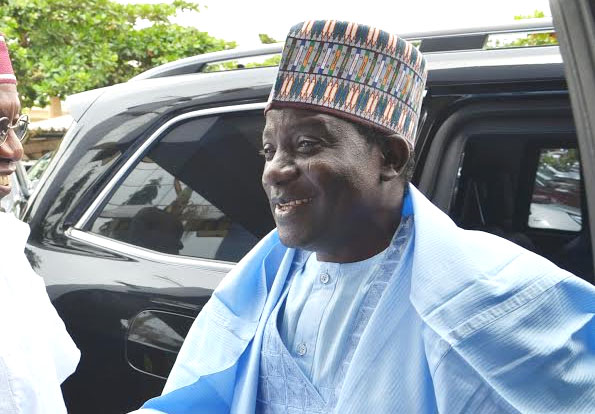

Akinyemi Asade, the state commissioner for finance, who was also present, said though Nigeria has moved up 24 points on the ease of doing business ranking, paying taxes only increased 11 points.

He added that the use of ERA will end the era of an unending tax audit of businesses and prevent outright evasion of tax.

Olusegun Banjo, the state commissioner for economic planning and budget, said the government has monitored the spending lifestyle of Lagosians, which he said does not correlate with the income declared by businesses.

Advertisement

He said owing to the persistently growing population of the state, the government needed to generate more revenue to provide infrastructure.

Adeniji Kazeem, attorney-general and commissioner for justice, represented Adesola Odunlami, solicitor-general and permanent secretary, said business owners found guilty of tax evasion stand a fine of N500,000 or six months imprisonment or both.

In December 2017, LIRS shut 11 hotels, restaurants and event centres over alleged failures to remit their taxes under the hotel occupancy and restaurant consumption laws of Lagos state 2009.

An operative from AV Imperial Technologies Limited said collecting agents have three options to key into the ERA system; use of android phones, use of point of sale (POS) device and sales data recorder (SDR) hardware.

Advertisement

Add a comment