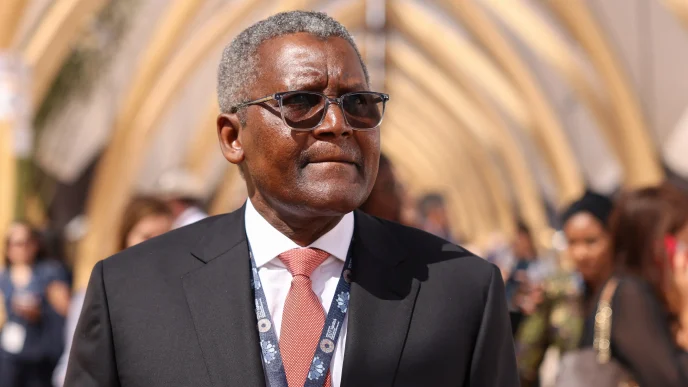

Gabriel Idahosa, LCCI’s president

The Lagos Chamber of Commerce and Industry (LCCI) says recent interest rate hikes are hampering the expansion and sustainability of businesses.

Speaking at its quarterly “State of the Economy’ news conference on Thursday in Lagos, Gabriel Idahosa, LCCI’s president, warned that rate hikes alone are insufficient to curb inflation without addressing the fundamental challenges in Nigeria’s real sector.

Idahosa said the real sector has shown the ability to generate more jobs, produce goods for both domestic consumption and export, and serve as the foundation of the nation’s industrial economy.

He said although high interest rates draw in foreign portfolio investments and local investors to treasury bills and bonds, this shift is diverting funds away from the private sector and into government treasuries.

Advertisement

The LCCI president said the private sector, which drives growth and job creation in Nigeria, is currently facing challenges such as higher borrowing costs and diminished investment incentives, among other issues.

“Recent hikes in monetary policy rate have directly translated to higher interest rates, making it more expensive for businesses to access credit for working capital, expansion, and sustainability,” Idahosa said.

“The latest uptick in inflation may sustain an upward trend in the coming months due to the current crises with petroleum pricing and an attendant burden that is unprecedented in Nigeria’s economic history.

Advertisement

“Government must remain focused on boosting food production through ongoing policy reforms, targeted fiscal interventions, and better management of Nigeria’s floating exchange rate regime.

“If government harmonises its fiscal and monetary instruments to tackle cost of agricultural production, enhance food processing, and sustain the fight against insecurity, inflationary pressures may soon begin to abate.”

On September 24, the monetary policy committee (MPC) of the Central Bank of Nigeria (CBN) raised the monetary policy rate (MPR), which benchmarks interest rates, from 26.75 percent to 27.25 percent.

Since the resumption of the MPC meeting this year, interest rates have increased from 22.75 percent in February to 27.25 percent.

Advertisement

Olayemi Cardoso, governor of the CBN, had said the multiple hikes in interest rates have helped to moderate inflation.

‘INTENSIFY EFFORTS ON CURRENT INITIATIVES’

Idahosa called on the government to intensify its efforts on current initiatives, including reducing certain taxes, transitioning to compressed natural gas (CNG) mobility, implementing the crude for naira scheme, and suspending some import duties.

The LCCI boss, however, warned against disregarding the agreements leading to the approval and implementation of the new N70,000 minimum wage.

Advertisement

He said although recent cost assessments have diminished the value of a N70,000 monthly wage, the government must stay committed to providing all promised benefits to its workers.

Advertisement

Add a comment