The Lagos Chamber of Commerce and Industry (LCCI) has urged the federal government to sustain ongoing tax reforms to increase revenue.

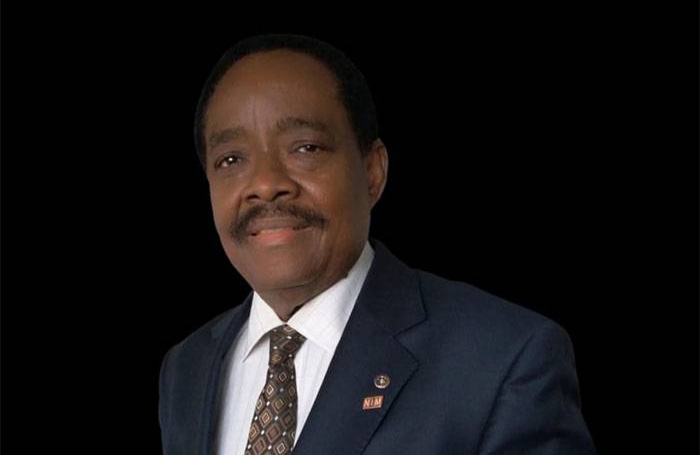

Speaking on Tuesday in Lagos, Michael Olawale-Cole, LCCI president, said the chamber acknowledged the revenue challenges currently facing the government and would support economically viable initiatives to resolve them.

“Beyond the technicalities around the assessment, rates, and computation of taxes, we urge the government at all levels to ensure the creation of an enabling tax environment where the tax system is fair, equitable, and efficient to make tax payment easy,” he said.

“At different media opportunities, the chamber has advocated for the widening of the tax net to capture more qualified taxpayers who hitherto are not paying their taxes.

Advertisement

“In addition, the World Bank’s recently published Nigeria Development Update recommended that we impose higher taxes on ‘sin’ products or luxury patronised by the rich.

“We have always made a case against the imposition of more taxes on private sector operators who pool resources together to provide almost all their infrastructural needs ranging from water, electricity, technology, etc.

“However, since taxes are the main sources of government revenue, we would ask that ongoing tax reforms be sustained to create an efficient tax system that simplifies tax payment and is accepted by all parties as being a fair system.”

Advertisement

On the provision of 5 percent capital gains in the new finance law, Olawale-Cole described it as an additional cost burden to investors in the capital market.

He said it would amount to double taxation as individual income earners and companies who have paid income taxes would be subjected to second-level taxation.

“Capital market investors have typically surrendered their funds and made them available for investment. They should not be deterred by a reduction in their expected capital gains,” he said.

“With the All-Share Index (ASI) at 42,318 in December, capital market deals are just recovering from a very low level of 37,658 as of June 2021.

Advertisement

“While we are not against the re-introduction of the capital gains tax, there is a need for better timing to allow the market to recover fully before any consideration of taxes.”

The LCCI boss also expressed concern over the protracted insecurity crisis that had hampered production in certain parts of the country.

Add a comment