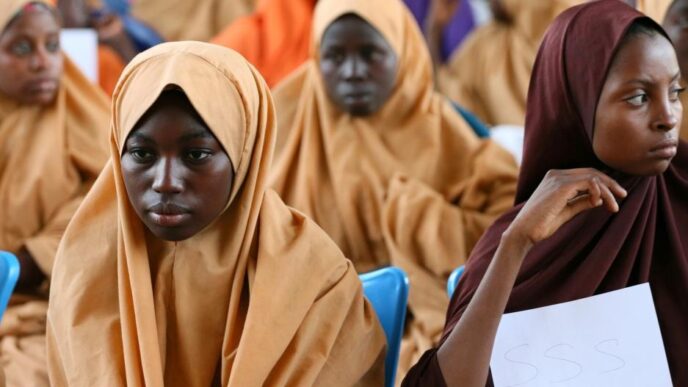

Ondo college students protesting lack of water, electricity on campus on April 21, 2023.

Academic staff in colleges of education say they fear Nigeria’s proposed tax reforms may disrupt infrastructure financing in public tertiary institutions.

Smart Olugbeko, president of the Colleges of Education Academic Staff Union (COEASU), says some aspects of the reform have the potential to stifle what has become a major source of infrastructure financing for struggling public tertiary institutions.

In a communiqué obtained by TheCable and dated December 3, Olugbeko said COEASU acknowledges the potential strengths of the proposed law in expanding Nigeria’s tax base and enforcing compliance.

He said associated disruptions to education tax could, however, undermine the development of public tertiary education in Nigeria.

Advertisement

ON THE TAX BILLS

On October 3, President Bola Tinubu asked the national assembly to consider and pass four tax reform bills.

They include the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service Establishment Bill, and the Joint Revenue Board Establishment Bill.

Advertisement

The bills have since been a subject of controversy and heated media debates.

The Northern States Governors Forum (NSGF) opposed the bills while the national economic council (NEC) sought its withdrawal.

The Nigeria Tax Administration Bill 2024 proposes a new VAT sharing model as follows: 10 percent for the federal government, 55 percent for states, and 35 percent for local governments (as opposed to the current 15:50:35 arrangement respectively).

Under this proposal, states will use the sharing ratio of 20:20:60 across the equality, population size, and tax derivation criteria respectively for its cut of 50 percent (instead of the current 50:30:20 arrangement).

Advertisement

The observed increase in derivation sharing to 60 percent from 20 (sold as intending to ensure more tax revenue goes back to states that generate the most) has been criticised as having the potential to impoverish states that generate less.

The remaining bills seek to unify Nigeria’s tax laws, create a more efficient legal framework for tax administration, and replace the Federal Inland Revenue Service (FIRS) with a refined NRS.

INFRASTRUCTURE FUND FOR TERTIARY SCHOOLS

The proposed tax reforms, stakeholders argue, are expected to have a ripple effect on institutions that rely on tax revenue.

Advertisement

Subject matter experts in Nigeria’s education sector say the bills aim to modernise and streamline tax administration, but they could also disrupt the revenue streams of agencies like the Tertiary Education Trust Fund (TETFund).

TETFund, established in 2011, monitors the disbursement of education tax to public tertiary institutions in Nigeria.

Advertisement

It provides supplementary funding to these institutions for infrastructure, staff training, and research among others.

For many federal tertiary institutions, the fund became a primary source of finance for critical infrastructure projects.

Advertisement

The fund’s main revenue source is the three percent education tax paid from the assessable profit of companies registered in Nigeria.

In 2024, the federal government opted to cut 30 percent of TETFund’s annual revenue and funnel it into student loans despite criticism.

Advertisement

There are fears that the reforms, including the consolidation of tax laws and the restructuring of tax administration through the establishment of an NRS, could alter how this tax is collected and allocated.

One significant concern is the potential reduction or redistribution of TETFund’s dedicated education tax to pave the way for broader government initiatives like the proposed development levy for education and infrastructure.

Additionally, some fear easing corporate tax burdens and offering exemptions to small businesses could shrink the overall tax pool and affect allocations to agencies like TETFund with public tertiary institutions at the receiving end.

PROPOSED REFORMS MAY SCUTTLE TETFUND, SAYS COEASU

Smart Olugbeko, in his communiqué, said COEASU as a union noted “the inimical effect” of the proposed tax reforms.

He said TETFund has become the lifeblood of public universities, polytechnics, and colleges of education that “would have gone comatose” without the trust fund’s intervention.

“Before the establishment of TETFund, infrastructure in tertiary institutions was in shambles. The government became clueless about the way forward until the academic staff unions came up with the brilliant idea of a trust fund for the education sector,” he said.

“Nigeria’s government has not shown serious concern for education and has willfully destroyed public institutions through its policy somersault and lack of commitment to education.

“It is shocking to note that no Nigerian government in the last two decades or more has committed up to 9% of the annual budget to education despite the UNESCO recommendation that 26% of the annual budget be dedicated to education.

“The aspect of the tax reform that allowed TETFund to be stifled of its source of funds will gradually drag tertiary institutions into the stock market, making them become capitalistic ventures for the highest bidders.”

Olugbeko, while calling on education stakeholders to reject the reforms, said the fund’s revenue sources should instead be strengthened.