The Lagos Inland Revenue Service (LIRS) has directed employers to deduct capital gains tax (CGT) from any sum paid to employees on termination of their services.

According to a notice released by the tax agency, such compensations are subject to taxation in section 6(a) of the Capital Gains Tax Act although it is exempted from taxation in paragraph 26 of schedule three of Personal Income Tax Act.

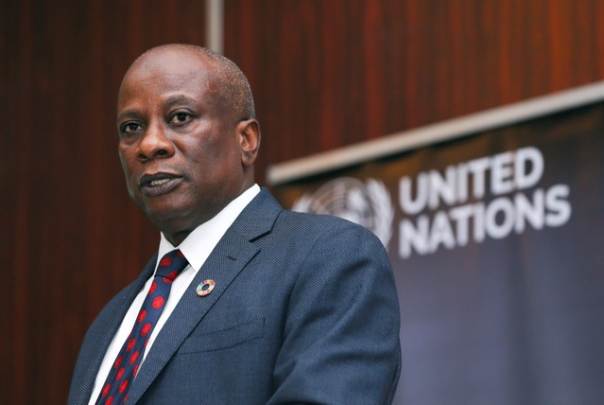

According to the notice, which was signed by Ayodele Subair, LIRS chairman, the compensation will be exempted from pay as you earn (PAYE) if the sum was not agreed on before the disengagement process began.

However, the same will be subject to capital gain tax, which is 10% of the amount.

Advertisement

“Pre-agreed amounts are generated from employment and subject to PAYE,” the notice read.

“Gratuity payments are tax deductible for PAYE purposes if they are paid under an approved pension scheme in line with Section 5 of the Pension Reform Act (PRA) 2014.

“If paid outside the PRA, the gratuity payments would be taxable if the conditions under Paragraph 18 of the 3rd Schedule is triggered, i.e.

Advertisement

- The service period is not up to 10 years;

- Any amount in excess of N100,000; and

- Where the service period is not up to five years (or an aggregate of 63 consecutive months in the case of a service that is not continuous), the exemption allowed is N1,000 per annum for such period or aggregate period of employment. Any excess calculated does not qualify for the exemption.”

Subair said employers should, henceforth, notify the LIRS of payments for compensation for loss of employment.

“It is no longer acceptable to lump terminal benefits under the heading of compensation for loss of employment. Employers are required to show each pay component and the corresponding payments in their tax returns to enable the LIRS determine the correct tax treatment.”

Add a comment