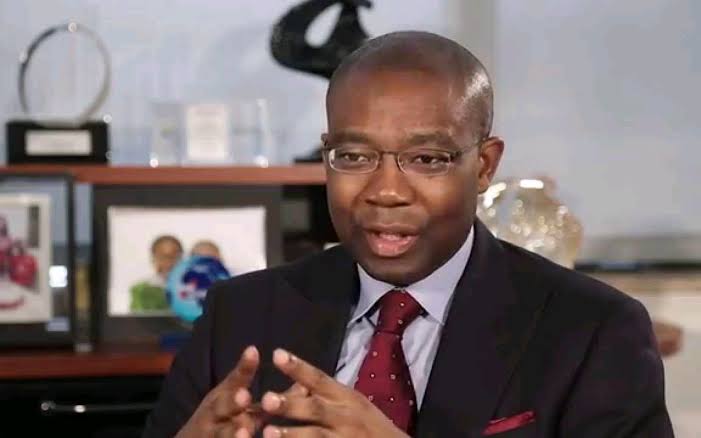

Ayodele Subair, executive chairman of LIRS

Lagos State Internal Revenue Service (LIRS) says the deadline for filing annual tax returns will not be extended.

Speaking on Arise TV on Wednesday, Ayodele Subair, executive chairman of LIRS, said there is no room for flexibility on the deadline for the tax returns filing, insisting it is firm and must be complied with.

According to the chairman, individuals who fail to file their tax returns by the stipulated date will be penalised.

“The deadline is there. It is sacrosanct. You are not supposed to vary that, you are supposed to comply and apply,” the chairman said.

Advertisement

“Now, if the revenue gives an extension, that is a different thing, but really, by law, we are not even supposed to give that extension we must have real fundamental reasons for us to give an extension because it is a federal law, not a state law.

“If you fail to file, we will take you to court and upon conviction, you pay a fine of 50,000 naira. Also, we can go the other route and do a best of judgment, assessment on you.

“Usually, the best of judgment is based on probably what you filed the previous year and when we issue that assessment notice against you, you have 30 days to respond, to pay and if you don’t pay, we can go to law court.

Advertisement

“We don’t need to go into an open court. All we need to do is go into the chambers of the judge and once we lay all the records before him, we are likely to get that judgment against you. So, it’s not a good thing to be on the wrong side of the law.”

Subair said all types of individual income must be reported — including income from employment, trade, vocation or profession, as well as global income from sources both within and outside the country.

“Well, all residents of Lagos are supposed to report all income, whether it is local income earned or foreign income earned,” he said.

“You are supposed to report your global income. So basically, whether you are in employment or you are in trade or vocation or some profession, you are expected to aggregate all the incomes from all the sources and report it truthfully.”

Advertisement

He said LIRS understands the importance of maintaining taxpayers’ confidentiality, affirming tax agency adhere strictly to the Nigeria Data Protection Regulation (NDPR) privacy act to ensure all data within its possession is treated as highly confidential.

On March 3, LIRS announced all individual taxpayers in the state must file their annual tax returns on or before March 31, to avoid penalties for non-compliance.

The agency said the directive includes self-employed individuals and employees under the pay-as-you-earn (PAYE) scheme.

Advertisement

Add a comment